Capital One 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

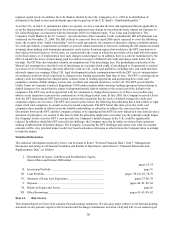

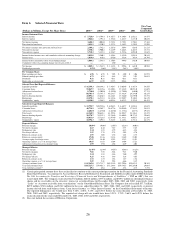

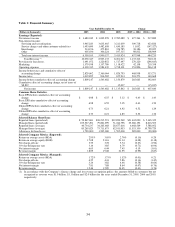

Item 6. Selected Financial Data

(Dollars in Millions, Except Per Share Data) 2005(1) 2004(1) 2003(1) 2002(1) 2001

Five Year

Compound

Growth Rate

Income Statement Data:

Interest income $ 5,726.9 $ 4,794.4 $ 4,367.7 $ 4,180.8 $ 2,921.1 18.47%

Interest expense 2,046.6 1,791.4 1,582.6 1,461.7 1,171.0 20.64%

Net interest income 3,680.3 3,003.0 2,785.1 2,719.1 1,750.1 17.36%

Provision for loan losses 1,491.1 1,220.9 1,517.5 2,149.3 1,120.5 12.90%

Net interest income after provision for loan losses 2,189.2 1,782.1 1,267.6 569.8 629.6 21.12%

Non-interest income 6,358.1 5,900.2 5,415.9 5,466.8 4,463.8 15.71%

Non-interest expense 5,718.3 5,322.2 4,856.7 4,585.6 4,058.0 12.68%

Income before income taxes and cumulative effect of accounting change 2,829.0 2,360.1 1,826.8 1,451.0 1,035.4 30.16%

Income taxes 1,019.9 816.6 676.0 551.4 393.4 28.79%

Income before cumulative effect of accounting change 1,809.1 1,543.5 1,150.8 899.6 642.0 30.96%

Cumulative effect of accounting change, net of taxes of $8.8 —— 15.0 — —

Net income $ 1,809.1 $ 1,543.5 $ 1,135.8 $ 899.6 $ 642.0 30.96%

Dividend payout ratio 1.52% 1.66% 2.14% 2.61% 3.48%

Per Common Share:

Basic earnings per share $6.98$ 6.55 $ 5.05 $ 4.09 $ 3.06 23.91%

Diluted earnings per share 6.73 6.21 4.85 3.93 2.91 24.61%

Dividends 0.11 0.11 0.11 0.11 0.11

Book value as of year-end 46.97 33.99 25.75 20.44 15.33

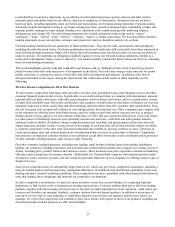

Selected Year-End Reported Balances:

Liquidity portfolio $ 16,399.3 $10,384.1 $ 7,464.7 $ 5,064.9 $ 3,467.4 54.56%

Consumer loans 59,847.7 38,215.6 32,850.3 27,343.9 20,921.0 31.69%

Allowance for loan losses (1,790.0) (1,505.0) (1,595.0) (1,720.0) (840.0) 27.71%

Total assets 88,701.4 53,747.3 46,283.7 37,382.4 28,184.0 36.25%

Interest-bearing deposits 43,092.1 25,636.8 22,416.3 17,326.0 12,839.0 38.75%

Borrowings 22,278.1 16,511.8 14,812.6 11,930.7 9,330.8 26.14%

Stockholders’ equity 14,128.9 8,388.2 6,051.8 4,623.2 3.323.5 48.41%

Selected Average Reported Balances:

Liquidity portfolio $ 12,792.7 $10,528.6 $ 6,961.2 $ 4,467.7 $ 3,038.4 48.62%

Consumer loans 40,734.2 34,265.7 28,677.6 25,036.0 17,284.3 28.81%

Allowance for loan losses (1,482.9) (1,473.0) (1,627.0) (1,178.2) (637.8) 29.82%

Total assets 61,360.5 50,648.1 41,195.4 34,201.7 23,346.3 32.18%

Interest-bearing deposits 28,370.7 24,313.3 19,768.0 15,606.9 10,373.5 39.66%

Borrowings 18,031.9 15,723.6 12,978.0 11,381.1 8,056.7 21.29%

Stockholders’ equity 10,594.3 7,295.5 5,323.5 4,148.2 2,781.2 44.17%

Reported Metrics:

Revenue margin 18.09% 19.08% 21.95% 26.28% 30.01%

Net interest margin 6.63 6.44 7.45 8.73 8.45

Delinquency rate 3.14 3.85 4.79 6.12 4.84

Net charge-off rate 3.55 3.78 5.74 5.03 4.76

Return on average assets 2.95 3.05 2.76 2.63 2.75

Return on average equity 17.08 21.16 21.34 21.69 23.08

Average equity to average assets 17.27 14.40 12.92 12.13 11.91

Operating expense as a % of average loans 10.65 11.63 13.04 14.04 17.21

Allowance for loan losses to consumer loans 2.99 3.94 4.86 6.29 4.02

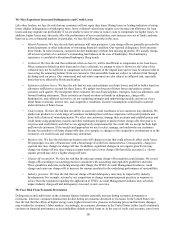

Managed Metrics:

Revenue margin 12.46% 12.89% 14.65% 16.93% 18.23%

Net interest margin 7.81 7.88 8.64 9.23 9.40

Delinquency rate 3.24 3.82 4.46 5.60 4.95

Net charge-off rate 4.25 4.41 5.86 5.24 4.65

Return on average assets 1.72 1.73 1.52 1.47 1.54

Operating expense as a % of average loans 5.09 5.41 5.94 6.66 8.35

Average consumer loans $ 85,265.0 $73,711.7 $62,911.9 $52,799.6 $35,612.3 30.38%

Year-end consumer loans $105,527.5 $79,861.3 $71,244.8 $59,746.5 $45,264.0 29.01%

Year-end total accounts(2) 49.1 48.6 47.0 47.4 43.8 7.75%

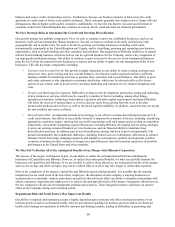

(1) Certain prior period amounts have been reclassified to conform to the current period presentation for the Financial Accounting Standards

Board Staff Position, “Accounting for Accrued Interest Receivable Related to Securitized and Sold Receivables under FASB Statement

No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities”, (“FSP on AIR”) that was

issued April 2003. The Company reclassified $427.0 million, $460.6 million, $577.0 million, and $509.7 million in subordinated finance

charge and fee receivables on the investors’ interest in securitized loans for December 2005, 2004, 2003 and 2002, respectively, from

“Loans” to “Accounts receivable from securitizations” on the Consolidated Balance Sheet. The Company also reclassified $57.7 million,

$69.2 million, $74.8 million, and $76.2 million for the years ended December 31, 2005, 2004, 2003, and 2002, respectively, in interest

income derived from such balances from “Loan interest income” to “Other Interest Income” on the Consolidated Statements of Income.

The reported delinquency rate would have been 3.26%, 4.08%, 5.13%, and 6.51% before the reclassification at December 31, 2005,

2004, 2003 and 2002, respectively. The reported net charge-off rate would have been 3.51%, 3.73%, 5.64% and 4.93% before the

reclassification for the years ended December 31, 2005, 2004, 2003 and 2002, respectively.

(2) Does not include the accounts of Hibernia Corporation.

26