Capital One 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.required capital levels. In addition, the U.K. Bank is limited by the U.K. Companies Act—1985 in its distribution of

ividends to the Bank in that such dividends may only be paid out of the U.K. Bank’ s “distributable profits.” d

As in the U.S., in non-U.S. jurisdictions where we operate, we face a risk that the laws and regulations that are applicable to

us (or the interpretations of existing laws by relevant regulators) may change in ways that adversely impact our business. In

the United Kingdom, in connection with the December 2003 Government report, “Fair, Clear and Competitive: The

Consumer Credit Market in the 21st Century”, the introduction of the Consumer Credit (Amendment) Bill in Parliament was

confirmed on November 23, 2004. The Bill is likely to come into force in April 2006 and is expected to cover the following

areas: the creation of an “unfair relationship” test for credit agreements, the creation of alternative dispute resolution options

for credit agreements, a requirement on lenders to provide annual statements to borrowers outlining the full amount owed and

warnings about making only minimum repayments, and a stricter licensing regime that would give the OFT new powers to

fine lenders for their behavior. At this time, we cannot predict the extent to which the provisions of the draft bill will remain

in the final statute, or, if implemented, how such changes would impact us. In addition, there is a current examination by the

OFT of whether the levels of interchange paid by retailers in respect of MasterCard credit and charge cards in the U.K. are

too high. The OFT has also launched a similar investigation into Visa interchange fees. The preliminary conclusion of the

MasterCard examination is that the levels of interchange are too high which could, if not changed or if agreement is reached

on a lower level of interchange, adversely affect the yield on U.K. credit card portfolios, including ours, and could therefore

adversely impact our earnings. Other U.K. legal developments include communications with the OFT as to its interpretation

of consumer credit law which could lead to changes in the lending agreements from time to time. The OFT is carrying out an

industry wide investigation into alleged unfair contract terms in lending agreements and questioning how credit card

companies calculate default charges, such as late, overlimit and returned check fees, in the U.K. The OFT asserts that the

Unfair Terms in Consumer Contracts Regulations 1999 render unenforceable consumer lending agreement terms relating to

default charges to the extent that the charge is disproportionately high in relation to the actual cost of the default to the

companies. The OFT may seek an agreement with the companies to change their practices or, if this is not possible, may

obtain a court injunction to prevent the continued use of the alleged unfair term. In July 2005, the Company received a letter

from the OFT indicating the OFT had reached a provisional conclusion that the levels of default charges the credit card

companies impose are excessive. The OFT also issued a press release the following day indicating that it had written to eight

major credit card companies to consult on its provisional conclusion. The OFT had at that time, given the credit card

companies three months in which to provide suitable undertakings or otherwise to address the concerns it has raised.

Discussions between the OFT and the Company continue to be ongoing and the OFT has now indicated it may instead issue a

statement of principles; it is unclear at this time in what the principles might state or in what way the principles might impact

the Company. In the event the OFT’ s view prevails, the Company’ s default charges in the U.K. could be significantly

reduced. In addition, should the OFT prevail in its challenge, the Company may also be subject to claims from customers

seeking reimbursement of default charges. The Company is assessing the OFT challenge and cannot state what its eventual

outcome will be. Any potential impact could vary based on business strategies or other actions the Company takes to attempt

limit the impact.

to

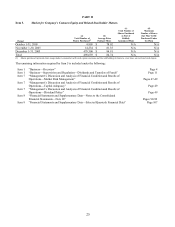

S

tatistical Information

The statistical information required by Item 1 can be found in Item 6 “Selected Financial Data”, Item 7 “Management

Discussion and Analysis of Financial Condition and Results of Operations” and in Item 8, “Financial Statements and

Supplementary Data”, as follows:

I. Distribution of Assets, Liabilities and Stockholders’ Equity;

Interest Rates and Interest Differential .............................................

pages 52–53

II. Investment Portfolio ......................................................................... page 76

III. Loan Portfolio................................................................................... pages 50–60; 68; 78-79

IV. Summary of Loan Loss Experience.................................................. pages 57-60; 78

V. Deposits............................................................................................ pages 44–45; 80; 82

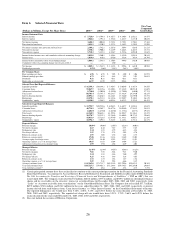

VI. Return on Equity and Assets ............................................................ page 26

VII. Other Borrowings ............................................................................. pages 43–45; 80–82

I em 1A. Risk Factors. t

This Annual Report on Form 10-K contains forward-looking statements. We also may make written or oral forward-looking

statements in our periodic reports to the Securities and Exchange Commission on Forms 10-Q and 8-K, in our annual report

16