Capital One 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

determined primarily based on a migration analysis of delinquent and current accounts, forward loss curves and historical

loss trends. In evaluating the sufficiency of the allowance for loan losses, management also takes into consideration the

following factors: recent trends in delinquencies and charge-offs including bankrupt, deceased and recovered amounts;

forecasting uncertainties and size of credit risks; the degree of risk inherent in the composition of the loan portfolio;

economic conditions; legal and regulatory guidance; credit evaluations and underwriting policies; seasonality; and the value

of collateral supporting the loans.

The allowance for loan losses increased $285.0 million from December 31, 2004 driven primarily by the acquisition of

Hibernia which added $214.2 million of allowance for loan losses at December 31, 2005. The remaining increase was the

result of 14% growth in the reported loan portfolio, exclusive of Hibernia loans acquired, and an additional allowance build

of $28.5 million due to the Gulf Coast Hurricanes as discussed in the “2005 Significant Events” section above. The 5%

growth in the allowance, exclusive of the Hibernia acquisition, relative to the 14% growth in the reported loan portfolio was

due to the growth being concentrated in lower loss auto loans.

For additional information, see section XII, Tabular Summary, Table H (Summary of Allowance for Loan Losses).

V

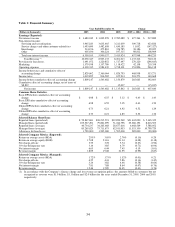

II. Reportable Segment Summary

The Company manages its business as three distinct operating segments: U.S. Card, Auto Finance and Global Financial

Services. The U.S. Card, Auto Finance and Global Financial Services segments are considered reportable segments based on

quantitative thresholds applied to the managed loan portfolio for reportable segments provided by SFAS No. 131,

Disclosures about Segments of an Enterprise and Related Information.

As management makes decisions on a managed portfolio basis within each segment, information about reportable segments

provided on a managed basis. is

The Company maintains its books and records on a legal entity basis for the preparation of financial statements in conformity

with GAAP. The following table presents information prepared from the Company’ s internal management information

stem, which is maintained on a line of business level through allocations from legal entities. sy

US Card Segment

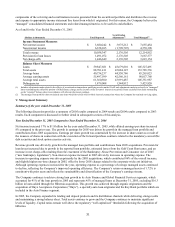

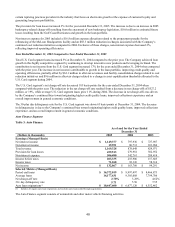

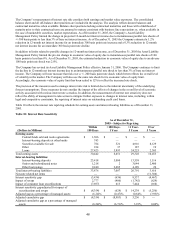

Table 2: U.S. Card

As of and for the Year Ended

December 31

(Dollars in thousands) 2005 2004 2003

Earnings (Managed Basis)

Net interest income $ 4,793,956 $ 4,655,897 $ 4,287,814

Non-interest income 3,321,457 3,219,567 3,583,357

Total revenue 8,115,413 7,875,464 7,871,171

Provision for loan losses 2,279,109 2,207,888 2,647,406

Non-interest expense 3,356,600 3,499,918 3,348,894

Income before taxes 2,479,704 2,167,658 1,874,871

Income taxes 870,351 780,357 693,702

Net income $ 1,609,353 $ 1,387,301 $ 1,181,169

Selected Metrics (Managed Basis)

Period end loans $ 49,463,522 $ 48,609,571 $ 46,278,750

Average loans 46,827,775 45,812,973 41,308,511

Net charge-off rate 5.01% 5.05% 6.88%

30+ day delinquency rate 3.44 3.97 4.60

Purchase volume(1) $ 73,687,136 $ 64,039,668 $ 58,137,538

) Includes purchase transactions net of returns and excludes cash advance transactions. (1

The U.S. Card segment consists of domestic consumer credit card lending activities.

Year Ended December 31, 2005 Compared to Year Ended December 31, 2004

The U.S. Card segment provided earnings growth primarily as a result of year over year loan growth and improved operating

efficiencies. U.S. Card segment net income for 2005 grew as a result of higher revenue and lower non-interest expense, offset

by higher provision for loan losses. Total revenues grew 3% for the year, as a result of 2% growth in the average loan

portfolio coupled with higher purchase volumes. Current period earnings reflect the Company’ s choice not to engage in

39