Capital One 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Also, we compete for funding with other banks, savings banks and similar companies, some of which are publicly traded.

Many of these institutions are substantially larger, may have more capital and other resources and may have better debt

ratings than we do. In addition, as some of these competitors consolidate with other financial institutions, these advantages

ay increase. Competition from these institutions may increase our cost of funds. m

As part of our capital markets financing, we actively securitize our consumer loans. The occurrence of certain events may

cause the securitization transactions to amortize earlier than scheduled, which would accelerate the need for additional

funding. This early amortization could, among other things, have a significant effect on the ability of the Bank and the

Savings Bank to meet the capital adequacy requirements as all off-balance sheet loans experiencing such early amortization

would have to be recorded on the balance sheet. See pages 46-47 in Item 7 “Management’ s Discussion and Analysis of

Financial Condition and Results of Operations—Liquidity Risk Management” contained in the Corporation’ s Annual Report

n Form 10-K for the year ended December 31, 2005. o

Finally, Hibernia has experienced a significant increase in deposits since the Gulf Coast hurricanes, most likely as a result of

customers receiving federal funds and insurance payments relating to the hurricanes. Currently, it is unclear what customers

will do with these deposits on a long-term scale. It is possible that as rebuilding and reinvesting in the Gulf Coast area begins,

the amount of these incremental deposits with Hibernia could decrease significantly.

W

e May Experience Changes in Our Debt Ratings

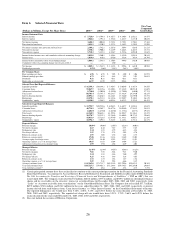

In general, ratings agencies play an important role in determining, by means of the ratings they assign to issuers and their

debt, the availability and cost of wholesale funding. We currently receive ratings from several ratings entities for our secured

and unsecured borrowings. As private entities, ratings agencies have broad discretion in the assignment of ratings. A rating

below investment grade typically reduces availability and increases the cost of market-based funding, both secured and

unsecured. A debt rating of Baa3 or higher by Moody’ s Investors Service, or BBB- or higher by Standard & Poor’ s and Fitch

Ratings, is considered investment grade. Currently, all three ratings agencies rate the unsecured senior debt of the Bank,

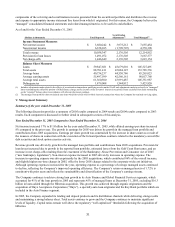

Hibernia and the Corporation as investment grade. The following chart shows ratings for Capital One Financial Corporation,

Capital One Bank and Hibernia National Bank as of December 31, 2005. As of that date, the ratings outlooks were as

f llows: o

Standard

& Poor’s Moody’s Fitch

Capital One Financial Corporation BBB- Baa1 BBB

Capital One Financial Corporation—Outlook Positive Stable Positive

Capital One Bank BBB A3 BBB

Capital One Bank—Outlook Positive Stable Positive

Hibernia National Bank BBB A3 BBB

Hibernia National Bank—Outlook Positive Stable Positive

Because we depend on the capital markets for funding and capital, we could experience reduced availability and increased

cost of funding if our debt ratings were lowered. This result could make it difficult for us to grow at or to a level we currently

anticipate. The immediate impact of a ratings downgrade on other sources of funding, however, would be limited, as our

deposit funding and pricing, as well as some of our unsecured corporate borrowing, is not generally determined by corporate

debt ratings.

We Face Market Risk of Interest Rate and Exchange Rate Fluctuations

Like other financial institutions, we borrow money from institutions and depositors, which we then lend to customers. We

earn interest on the consumer loans we make, and pay interest on the deposits and borrowings we use to fund those loans.

Changes in these two interest rates affect the value of our assets and liabilities. If the rate of interest we pay on our

borrowings increases more than the rate of interest we earn on our loans, our net interest income, and therefore our earnings,

would fall. Our earnings could also be hurt if the rates on our consumer loans fall more quickly than those on our borrowings.

We also seek to minimize market risk to a level that is immaterial to our net income. The financial instruments and

techniques we use to manage the risk of interest rate and exchange rate fluctuations, such as asset/liability matching and

interest rate and exchange rate swaps and hedges and some forward exchange contracts, may not always work successfully or

may not be available at a reasonable cost. Furthermore, if these techniques become unavailable or impractical, our earnings

ould be subject to volatility and decreases as interest rates and exchange rates change.

c

Changes in interest rates also affect the balances our customers carry on their credit cards and affect the rate of pre-payment

for installment loan products. When interest rates fall, there may be more low-rate product alternatives available to our

customers. Consequently, their credit card balances may fall and pre-payment rates for installment loan products may rise.

We can mitigate this risk by reducing the interest rates we charge or by refinancing installment loan products. However, these

21