Capital One 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

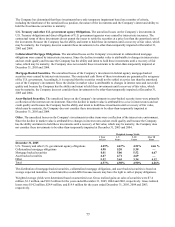

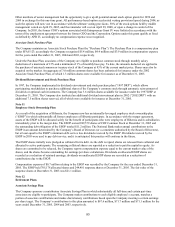

The Company sponsors a contributory Retirement Savings Plan in which substantially all former associates of Hibernia who

have completed one year of service are eligible to participate. The Company matches a portion of associate contributions with

the Company’ s common stock. Participants may elect to immediately transfer Company contributions received to any of the

plan’ s other investment options. Matching contributions to this plan by the Company amounted to $0.9 million for the year

nded December 31, 2005. e

O

ther Postretirement Benefits

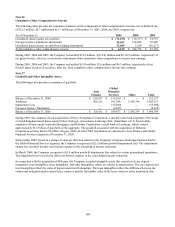

The Company sponsors postretirement benefit plans to provide health care and life insurance to retired employees. Net

periodic postretirement benefit expense was $8.5 million, $6.7 million and $9.4 million in 2005, 2004 and 2003, respectively.

The liabilities recognized on the Consolidated Balance Sheets for the Company’ s defined postretirement benefit plan at

ecember 31, 2005 and 2004 were $42.0 million and $33.5 million, respectively. D

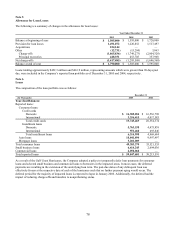

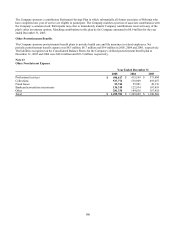

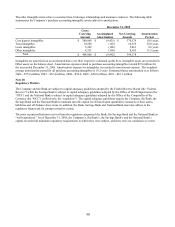

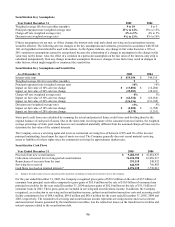

Note 13

Other Non-Interest Expense

Year Ended December 31

2005 2004 2003

Professional services $ 490,617

$ 415,169 $ 373,404

Collections 537,772

530,909 493,057

Fraud losses 53,744

55,981 49,176

Bankcard association assessments 136,318

122,934 107,493

Other 281,330

184,836 167,418

Total $ 1,499,781 $ 1,309,829 $ 1,190,548

86