Capital One 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129

|

|

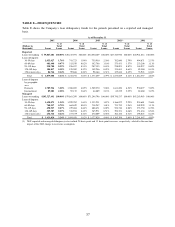

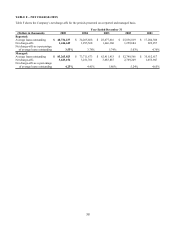

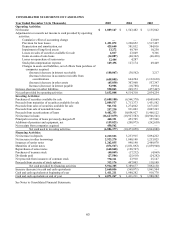

TABLE F—NET CHARGE-OFFS

Table F shows the Company’ s net charge-offs for the periods presented on a reported and managed basis.

Year Ended December 31

(Dollars in thousands) 2005 2004 2003 2002 2001

Reported:

Average loans outstanding $ 40,734,237 $ 34,265,668 $ 28,677,616 $ 25,036,019 $ 17,284,306

Net charge-offs 1,446,649 1,295,568 1,646,360 1,259,684 822,257

Net charge-offs as a percentage

of average loans outstanding 3.55% 3.78% 5.74% 5.03% 4.76%

Managed:

Average loans outstanding $ 85,265,023 $ 73,711,673 $ 62,911,953 $ 52,799,566 $ 35,612,617

Net charge-offs 3,623,154 3,251,761 3,683,887 2,769,249 1,655,947

Net charge-offs as a percentage

of average loans

outstanding 4.25% 4.41% 5.86% 5.24% 4.65%

58