Capital One 2005 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

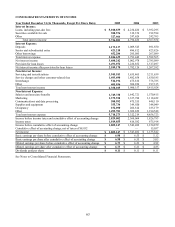

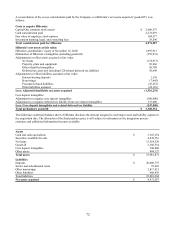

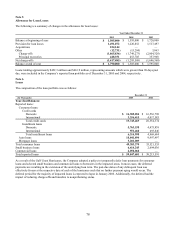

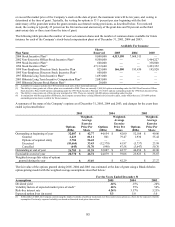

The following unaudited pro forma condensed statements of income assume that the Company and Hibernia were combined

t the beginning of the respective periods presented. a

Years ended

December 31

2005 2004

Net interest income $ 4,338,674 $ 3,696,867

Non-interest income 6,738,549 6,287,583

Provision for loan losses 1,728,864 1,269,102

Non-interest expense 6,402,653 6,030,969

Income taxes 1,060,403 929,379

Minority interest, net of income taxes (92) 76

Net income $ 1,885,395 $ 1,754,924

Basic earnings per share $ 6.55 $ 6.54

Diluted earnings per share $ 6.43 $ 6.21

(1) Pro forma adjustments include the following adjustments: accretion for loan fair value discount, reduction of interest income for amounts used to fund the

acquisition, amortization for interest-bearing deposits fair value premium, accretion for subordinated notes fair value premium, addition of interest expense for

other borrowings used to fund the acquisition, and related amortization for intangibles acquired, net of Hibernia’ s historical intangible amortization expense.

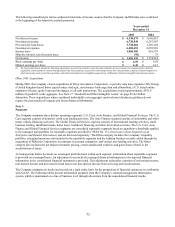

Other 2005 Acquisitions

During 2005, the Company closed acquisitions of Onyx Acceptance Corporation, a specialty auto loan originator; Hfs Group,

a United Kingdom based home equity broker; InsLogic, an insurance brokerage firm and eSmartloan, a U.S. based online

originator of home equity loans and mortgages, in all cash transactions. The acquisitions created approximately $391.4

discussion. These acquisitions when considered individually or in aggregate under relevant disclosure guidance do not

quire the presentation of separate pro forma financial information. re

Note 3

Segments

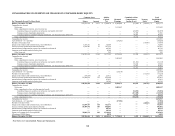

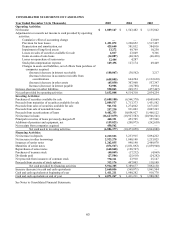

The Company maintains three distinct operating segments: U.S. Card, Auto Finance, and Global Financial Services. The U.S.

Card segment consists of domestic credit card lending activities. The Auto Finance segment consists of automobile and other

motor vehicle financing activities. The Global Financial Services segment consists of international lending activities, small

business lending, installment loans, home loans, healthcare financing and other diversified activities. The U.S. Card, Auto

Finance and Global Financial Services segments are considered reportable segments based on quantitative thresholds applied

to the managed loan portfolio for reportable segments provided by SFAS No. 131, Disclosures about Segments of an

Enterprise and Related Information, and are disclosed separately. The Other category includes the Company’ s liquidity

portfolio, emerging businesses not included in the reportable segments and the banking business recently added through the

acquisition of Hibernia Corporation, investments in external companies, and various non-lending activities. The Other

category also includes the net impact of transfer pricing, certain unallocated expenses and gains/losses related to the

curitization of assets. se

As management makes decisions on a managed portfolio basis within each segment, information about reportable segments

is provided on a managed basis. An adjustment to reconcile the managed financial information to the reported financial

information in the consolidated financial statements is provided. This adjustment reclassifies a portion of net interest income,

non-interest income and provision for loan losses into non-interest income from servicing and securitizations.

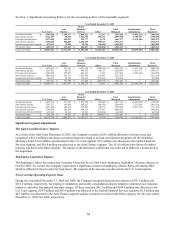

The Company maintains its books and records on a legal entity basis for the preparation of financial statements in conformity

with GAAP. The following tables present information prepared from the Company’ s internal management information

system, which is maintained on a line of business level through allocations from the consolidated financial results.

73

million of goodwill, in the aggregate. See Note 17 “Goodwill and Other Intangible Assets” on page 89 for further