Capital One 2005 Annual Report Download - page 84

Download and view the complete annual report

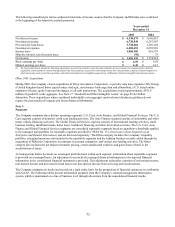

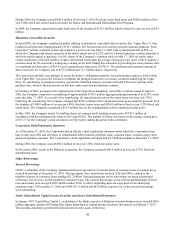

Please find page 84 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During 2005, the Company closed on the sale of its Tampa, Florida facilities. The ultimate sales price was greater than the

impaired value of the held-for-sale property, and as such, the Company reversed $18.8 million of its previously recorded

2004 impairment in Occupancy expense. Of this amount, $17.4 million was allocated to the U.S. Card segment, $1.3 million

was allocated to the Global Financial Services segment, and the remainder of the balance was held in the Other category.

During 2005, the Company recognized a $20.6 million prepayment penalty for the refinancing of the McLean Headquarters

facility. Of this amount, $16.8 million was allocated to the U.S. Card segment, $2.7 million was allocated to the Global

Financial Services segment, $0.6 million was allocated to the Auto Finance segment, and the remainder of the balance was

eld in the Other category. h

During 2005, the Company recognized a $28.2 million impairment charge related to the write-off of the Company’ s

insurance brokerage business. The charge was recorded in non-interest expense and fully allocated to the Global Financial

Services segment.

Other

During, 2005, the Company sold previously purchased charged-off loan portfolios resulting in a gain of $34.0 million which

as reported in non-interest income and held in the Other category. w

During 2004, the Company sold its interest in a South African joint venture with a book value of $3.9 million to its joint

venture partner. The Company received $26.2 million in cash, was forgiven $9.2 million in liabilities and recognized a pre-

tax gain of $31.5 million. Also during 2004, the Company sold its French loan portfolio with a book value of $144.8 million

to an external party. The Company received $178.7 million in cash, recorded $7.2 million in notes receivables and recognized

a pre-tax gain of $41.1 million. The respective gains were recorded in non-interest income and reported in the Global

Financial Services segment.

A $15.0 million ($23.9 million pre-tax) charge for the cumulative effect of a change in accounting principle related to the

adoption of FIN 46 was included in non-interest expense and reported in the Other category for segment reporting for the

year ended December 31, 2003.

A

uto Loans

During the years ended December 31, 2005, 2004 and 2003, the Company sold auto loans of $257.7 million, $901.3 million

and $1.9 billion, respectively. These transactions resulted in pre-tax gains allocated to the Auto Finance segment, inclusive of

allocations related to funds transfer pricing of $4.5 million, $41.7 million and $57.3 million in 2005, 2004 and 2003,

respectively. In addition the Company recognized an additional $12.5 million in gains related to the settlement of

ontingencies from prior period sales of auto receivables for the year ended December 31, 2005. c

During the year ended December 31, 2004, the Company changed its practice for charging-off auto loans when notified of a

bankruptcy. Auto loans in bankruptcy are now charged-off at 120 days past due. This change in practice resulted in the

cceleration of $20.4 million in charge-offs for the Auto Finance segment in 2004. a

75