Capital One 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

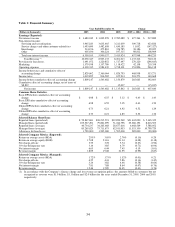

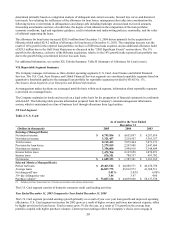

The 30-plus day delinquency rate for the reported and managed consumer loan portfolio decreased 71 and 58 basis points,

respectively, at December 31, 2005. The reduction in the reported and managed consumer loan 30-plus day delinquency rates

reflect a higher concentration of lower loss assets in the respective loan portfolios (including $16.3 billion loans added

through the acquisition of Hibernia), the clearing out of delinquencies related to recent bankruptcy related charge-offs and

verall improved collections experience. o

The 30-plus day delinquency rate for the reported consumer loan portfolio decreased 94 basis points at December 31, 2004

compared to December 31, 2003. The 30-plus day delinquency rate for the managed consumer loan portfolio at December 31,

2004 was down 64 basis points compared to December 31, 2003. Both reported and managed consumer loan delinquency rate

decreases principally reflect the Company’ s continued asset diversification beyond U.S. consumer credit cards, a continued

bias toward originating higher credit quality loans, improved collections experience and an overall improvement in general

economic conditions.

F

or additional information, see section XII, Tabular Summary, Table E (Delinquencies).

Net Charge-Offs

Net charge-offs include the principal amount of losses (excluding accrued and unpaid finance charges and fees and fraud

losses) less current period principal recoveries. The Company charges off credit card loans at 180 days past the due date and

generally charges off other consumer loans at 120 days past the due date or upon repossession of collateral. Costs to recover

previously charged-off accounts are recorded as collection expenses in other non-interest expense. Non-collateralized

ankruptcies are typically charged-off within 2-7 days upon notification and in any event within 30 days. b

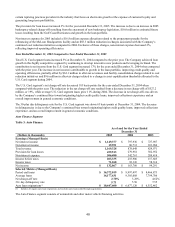

The reported and managed net charge-off rates decreased 23 and 16 basis points, respectively, while net charge-off dollars

increased 12% and 11% on a reported and managed basis, respectively, for the year ended December 31, 2005 compared to

the prior year. The decrease in net charge-off rates principally relates to the Company’ s continued asset diversification within

and beyond U.S. consumer credit cards. The increase in the net charge-off dollars was driven by growth in the reported and

managed loan portfolios combined with the incremental increase of bankruptcy charge-offs resulting from the enactment of

the new bankruptcy legislation as discussed in the “2005 Significant Events” section above. Reported and managed

bankruptcy charge-offs increased $146.8 million and $394.8 million, respectively, for the year ended December 31, 2005

when compared to the prior year.

For the year ended December 31, 2004, the reported and managed net charge-off rates decreased 196 and 145 basis points,

respectively when compared with the prior year. The decrease in net charge-off rates principally relates to the Company’ s

continued asset diversification beyond U.S. consumer credit cards, a continued bias toward originating higher credit quality

loans, improved collections experience and an overall improvement in general economic conditions.

For additional information, see section XII, Tabular Summary, Table F (Net Charge-offs).

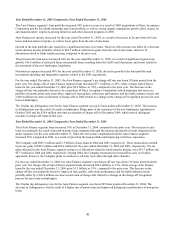

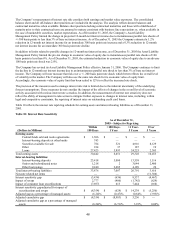

Nonperforming Assets

The Company assumed nonperforming assets in connection with the acquisition of Hibernia.

Nonperforming loans consist of nonaccrual loans (loans on which interest income is not currently recognized) and

restructured loans (loans with below-market interest rates or other concessions due to the deteriorated financial condition of

the borrower). Commercial and small business loans are placed in nonaccrual status at 90 days past due or sooner if, in

management’ s opinion, there is doubt concerning the ability to fully collect both principal and interest. Real estate secured

consumer loans are placed in nonaccrual status at 180 days past due.

F

or additional information, see section XII, Tabular Summary, Table G (Nonperforming Assets).

Allowance for loan losses

The allowance for loan losses is maintained at an amount estimated to be sufficient to absorb probable losses, net of principal

recoveries (including recovery of collateral), inherent in the existing reported loan portfolio. The provision for loan losses is

the periodic cost of maintaining an adequate allowance. Management believes that, for all relevant periods, the allowance for

loan losses was adequate to cover anticipated losses in the total reported consumer loan portfolio under then current

conditions, met applicable legal and regulatory guidance and was consistent with GAAP. There can be no assurance as to

future credit losses that may be incurred in connection with the Company’ s loan portfolio, nor can there be any assurance that

the loan loss allowance that has been established by the Company will be sufficient to absorb such future credit losses. The

allowance is a general allowance applicable to the reported consumer loan portfolio. The amount of allowance necessary is

38