Capital One 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.commitments generally require customers to maintain certain credit standards. Collateral requirements and loan-to-value

ratios are the same as those for funded transactions and are established based on management’ s credit assessment of the

customer. Commitments may expire without being drawn upon. Therefore, the total commitment amount does not necessarily

represent future requirements. The outstanding unfunded commitments to extend credit other than credit card lines were

approximately $4.7 billion as of December 31, 2005.

Funding Commitments Related to Synthetic Fuel Tax Credit Transactions

In June of 2004 and July of 2005, the Company, through two separate transactions and two consolidated special purpose

entities (SPVs), purchased minority ownership interests in two entities established to operate facilities which produce a coal-

based synthetic fuel that qualifies for tax credits pursuant to Section 29 of the Internal Revenue Code. The SPVs purchased

their minority interests from third parties paying $2.6 million in cash and agreeing to pay an estimated $159.1 million

comprised of fixed note payments, variable payments and the funding of their share of operating losses sufficient to maintain

their minority ownership percentages. Actual total payments will be based on the amount of tax credits generated through the

end of 2007. In exchange, the SPVs will receive an estimated $192.0 million in tax benefits resulting from a combination of

deductions, allocated operating losses, and tax credits. The Corporation has guaranteed the SPVs commitments under the

purchase agreements. As of December 31, 2005, the Company has recorded $66.2 million in tax benefits and had an

estimated remaining commitment for fixed note payments, variable payments and the funding of their proportionate share of

the operating losses totaling $104.6 million.

G

uarantees

esidual Value Guarantees R

In December 2000, the Company entered into a 10-year agreement for the lease of the headquarters building being

constructed in McLean, Virginia. The agreement called for monthly rent to commence upon completion, which occurred in

the first quarter of 2003, and is based on LIBOR rates applied to the cost of the building funded. If, at the end of the lease

term, the Company does not purchase the property, the Company guarantees a maximum residual value of up to $114.8

million representing approximately 72% of the $159.5 million cost of the building. This agreement, made with a multi-

purpose entity that is a wholly-owned subsidiary of one of the Company’ s lenders, provides that in the event of a sale of the

property, the Company’ s obligation would be equal to the sum of all amounts owed by the Company under a note issuance

made in connection with the lease inception. As of December 31, 2005, the value of the building was estimated to be above

the maximum residual value that the Company guarantees; thus, no deficiency existed and no liability was recorded relative

to this property. During 2005, the Company notified the lender of its intention to purchase the property in 2006 and as such

curred a $20.6 million prepayment penalty related to the refinancing of the McLean headquarters facility. in

ther Guarantees O

In connection with certain installment loan securitization transactions, the transferee (off-balance sheet special purpose entity

receiving the installment loans) entered into interest rate hedge agreements (the “swaps”) with a counterparty to reduce

interest rate risk associated with the transactions. In connection with the swaps, the Corporation entered into letter

agreements guaranteeing the performance of the transferee under the swaps. If at anytime the Class A invested amount equals

zero and the notional amount of the swap is greater than zero resulting in an “Early Termination Date” (as defined in the

securitization transaction’ s Master Agreement), then (a) to the extent that, in connection with the occurrence of such Early

Termination Date, the transferee is obligated to make any payments to the counterparty pursuant to the Master Agreement,

the Corporation shall reimburse the transferee for the full amount of such payment and (b) to the extent that, in connection

with the occurrence of an Early Termination Date, the transferee is entitled to receive any payment from the counterparty

pursuant to the Master Agreement, the transferee will pay to the Corporation the amount of such payment. At December 31,

005, the maximum exposure to the Corporation under the letter agreements was approximately $18.2 million. 2

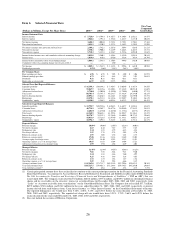

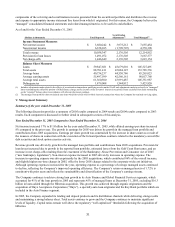

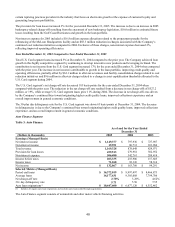

IV. Reconciliation to GAAP Financial Measures

The Company’ s consolidated financial statements prepared in accordance with GAAP are referred to as its “reported”

financial statements. Loans included in securitization transactions which qualify as sales under GAAP have been removed

from the Company’ s “reported” balance sheet. However, servicing fees, finance charges, and other fees, net of charge-offs,

and interest paid to investors of securitizations are recognized as servicing and securitizations income on the “reported”

income statement.

The Company’ s “managed” consolidated financial statements reflect adjustments made related to effects of securitization

transactions qualifying as sales under GAAP. The Company generates earnings from its “managed” loan portfolio which

includes both the on-balance sheet loans and off-balance sheet loans. The Company’ s “managed” income statement takes the

30