Capital One 2005 Annual Report Download - page 76

Download and view the complete annual report

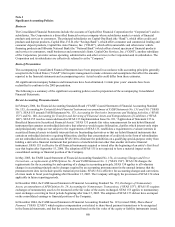

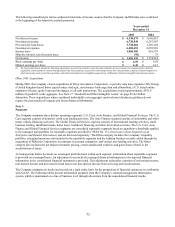

Please find page 76 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Securities and Exchange Commission (“SEC”) issued an amendment in April 2005 deferring the effective date of SFAS

123 (R) to begin with the first interim or annual reporting period of the Company’ s fiscal year which would be after

December 15, 2005 for the Company. In December 2003, the Company adopted the expense recognition provisions of

Statement of Financial Accounting Standard No. 123, Accounting for Stock Based Compensation, (“SFAS 123”), under the

prospective method allowed by Statement of Financial Accounting Standard No. 148, Accounting for Stock-Based

Compensation—Transition and Disclosure—an amendment of FASB Statement No. 123, (“SFAS 148”), to all awards

granted, modified, or settled after January 1, 2003. The provisions of SFAS 123(R) must be applied using the modified

prospective method which requires the Company to recognize compensation expense for the unvested portion of all awards

granted prior to January 1, 2003. The adoption of SFAS 123(R) will not have a material impact on the consolidated earnings

r financial position of the Company. o

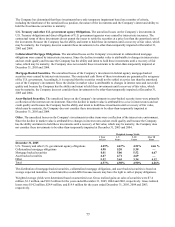

In December 2003, the Accounting Standards Executive Committee (“AcSEC”) issued Statement of Position 03-3,

Accounting for Certain Loans or Debt Securities Acquired in a Transfer, (“SOP 03-3”). SOP 03-3 addresses accounting for

differences between contractual cash flows and cash flows expected to be collected from an initial investment in loans

acquired in a transfer if those differences are attributable, at least in part, to credit quality. It applies to individual loan

purchases, portfolio purchases, and loans acquired in a purchase business combination. It does not apply to loans to

borrowers in good standing under revolving credit agreements (which include credit cards and home equity loans), mortgage

ans held for sale, and loans originated by the Company. lo

The Company’ s acquired loans, subject to SOP 03-3, are recorded at fair value and no separate valuation allowance is

recorded at the date of acquisition. The Company reviews each loan at acquisition to determine if it should be accounted for

under SOP 03-3 and if so, determines whether each such loan is to be accounted for individually or whether such loans will

be aggregated into pools of loans based on common risk characteristics. The Company makes an estimate of the total cash

flows it expects to collect from the loans (or pools of loans), which includes undiscounted expected principal and interest.

The excess of that amount over the fair value of the loans is referred to as accretable yield. Accretable yield is recognized as

interest income on a constant yield basis over the life of the loans. Any adjustments to the acquisition date fair value of the

acquired loans made during the refinement of the allocation of purchase price will impact accretable yield. The Company also

determines the loans’ contractual principal and contractual interest payments. The excess of that amount over the total cash

flows it expects to collect from the loans is referred to as nonaccretable difference, which is not accreted into income. The

Company continues to estimate cash flows expected to be collected over the life of the loans. Subsequent increases in total

cash flows it expects to collect are recognized as an adjustment to the accretable yield with the amount of periodic accretion

adjusted over the remaining life of the loans. Subsequent decreases in cash flows expected to be collected over the life of the

loans are recognized as impairment in the current period through a valuation allowance. SOP 03-3 is effective for loans

acquired in fiscal years beginning after December 15, 2004. See Note 7 for further discussion of SOP 03-3.

In January 2003, the FASB issued FASB Interpretation No. 46, Consolidation of Variable Interest Entities, an Interpretation

of ARB No. 51 (“FIN 46”). In December 2003, the FASB issued FASB Interpretation 46 (Revised December 2003),

Consolidation of Variable Interest Entities, and Interpretation of ARB No. 51 (“FIN 46(R)”) to provide clarification of

certain provisions of FIN 46 as originally issued, and to defer the effective dates for certain entities. These interpretations

address consolidation of business enterprises of variable interest entities (“VIEs”), which have certain characteristics. These

characteristics include either that the equity investment at risk is not sufficient to permit the entity to finance its activities

without additional subordinated financial support from other parties; or that the equity investors in the entity lack one or more

of the essential characteristics of a controlling financial interest. The Company elected to early adopt the provisions of FIN

46 for the interim period ended September 30, 2003. The Company has consolidated all material VIEs for which the

Company is the primary beneficiary, as defined under FIN 46, effective July 1, 2003. The Company recorded premises and

equipment of $139.8 million, other borrowings of $178.3 million and recognized a charge of $15.0 million, net of tax, for a

cumulative effect of a change in accounting principle for the year ended December 31, 2003.

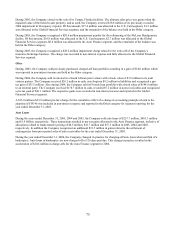

C

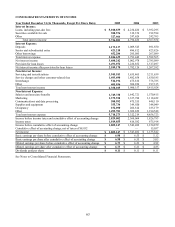

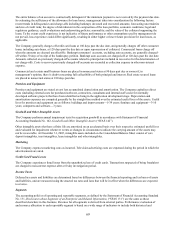

ash and Cash Equivalents

Cash and cash equivalents includes cash and due from banks, federal funds sold and resale agreements and interest-bearing

deposits at other banks. Cash paid for interest for the years ended December 31, 2005, 2004 and 2003 was $1.9 billion, $1.8

billion and $1.6 billion, respectively. Cash paid for income taxes for the years ended December 31, 2005, 2004 and 2003 was

$654.8 million, $705.1 million and $571.2 million, respectively.

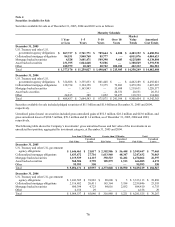

Securities Available for Sale

The Company classifies all debt securities as securities available for sale. These securities are stated at fair value, with the

unrealized gains and losses, net of tax, reported as a component of cumulative other comprehensive income. The amortized

cost of debt securities is adjusted for amortization of premiums and accretion of discounts to maturity. Such amortization or

accretion is included in interest income. Realized gains and losses on sales of securities are determined using the specific

67