Capital One 2005 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

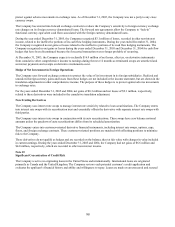

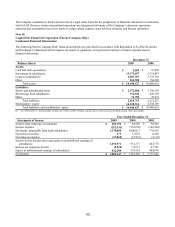

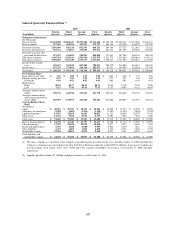

Year Ended December 31

Statements of Cash Flows 2005 2004 2003

Operating Activities:

Net income $ 1,809,147

$ 1,543,482 $ 1,135,842

Adjustments to reconcile net income to net cash provided by operating

activities:

Equity in undistributed earnings of subsidiaries (622,208) (574,134) (404,878)

Loss on repurchase of senior notes 12,444

— —

Amortization of discount of senior notes 2,818

12,671 12,518

Stock plan compensation expense 149,496

127,174 49,449

Decrease in other assets 212,019

77,122 53,197

Increase (decrease) in other liabilities 43,452

(7,088) 4,135

Net cash provided by operating activities 1,607,168

1,179,227 850,263

Investing Activities:

Increase in investment in subsidiaries (911,348) (80,379) (350,000)

Decrease (increase) in loans to subsidiaries 115,952

(1,975,131) (643,603)

Net cash used for acquisitions (2,261,757) — —

Net cash used in investing activities (3,057,153) (2,055,510) (993,603)

Financing Activities:

(81,463)

(Decrease) increase in borrowings from subsidiaries 381,205 (117,698)

Issuance of senior notes 1,262,035

— 298,581

Maturities of senior notes (162,500) — —

Repurchases of senior notes (597,196) — (125,000)

Dividends paid (27,504) (25,618) (24,282)

Purchases of treasury stock (40,049) (17,232) (4,069)

Net proceeds from issuances of common stock 770,311

23,910 25,147

Proceeds from exercise of stock options 312,176

497,003 118,149

Net cash provided by financing activities 1,435,810

859,268 170,828

(Decrease) increase in cash and cash equivalents (14,175) (17,015) 27,488

Cash and cash equivalents at beginning of year 16,858

33,873 6,385

Cash and cash equivalents at end of year $ 2,683

$ 16,858 $ 33,873

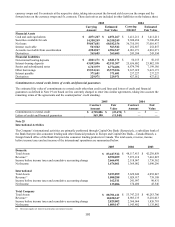

Note 27

Subsequent Events

On February 27, 2006, the Company sold a combination of Company originated charged-off loans and purchased charged-off

loan portfolios. The sale resulted in the acceleration of future portfolio returns of approximately $84.0 million, subject to

finalization. The pre-tax income will be reflected in the following 2006 statement of income line items: a reduction in the

provision for loan losses through an increase in recoveries for the portion of charged-off loans originated by the company and

not securitized; an increase to servicing and securitizations income for the portion of charged-off loans originated by the

company and securitized; and an increase to other non-interest income for the purchased charged-off loan portfolios.

103