Capital One 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

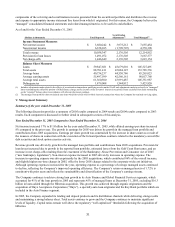

million of goodwill. In addition in the second quarter of 2005, the Company purchased a $635.3 million non-prime auto loan

ortfolio from Key Bank. p

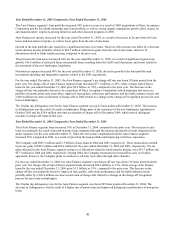

Gulf Coast Hurricanes

The 2005 Gulf Coast Hurricanes resulted in an estimated $44.1 million of loan losses expected to be realized in the future,

which excludes the impact on Hibernia of $175.0 million that was reflected in Hibernia’ s results prior to the acquisition. Of

the total estimated impact, $28.5 million was reflected in the provision for loan losses through an increase in the allowance

for loan losses and $15.6 million was reflected as a reduction of servicing and securitizations income through a write-down of

tained interests related to the Company’ s loan securitization programs. re

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (“new bankruptcy legislation”) became effective in

October 2005. As a result, prior to the enactment of the new bankruptcy legislation, the Company experienced a significant

increase in bankruptcy related charge-offs during 2005 which is reflected through an increase of provision for loan losses for

the reported loan portfolio and through a reduction of servicing and securitizations income for the off-balance sheet loan

portfolio. Reported and managed charge-offs for bankruptcies increased $146.8 million and $394.8 million, respectively, in

005 when compared to the prior year. 2

Cost Reduction Initiatives and Other One-Time Items

During 2005, the Company incurred $76.3 million in employee termination and facility consolidation charges related to

continued corporate-wide cost reduction initiatives. The Company also incurred a $20.6 million pre-payment penalty related

to the refinancing of the McLean headquarters facility and a $28.2 million impairment charge related to its Global Financial

Services segment insurance brokerage business. All these charges were recorded in non interest expense. As an offset, the

Company recognized in non-interest income a $34.0 million gain on the sale of previously purchased charged-off loan

portfolios.

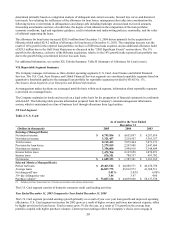

Mandatory Convertible Securities

Pursuant to the original terms of the mandatory convertible securities (“Upper DECs”) issued in April of 2002, the Company

completed a remarketing of $704.5 million principal amount of senior notes in February 2005. Following the remarketing, the

Company extinguished $585.0 million principal amount of the remarketed senior notes using the proceeds from the issuance

of $300.0 million of seven year 4.80% fixed rate senior notes and $300.0 million of twelve year 5.25% fixed rate senior

notes. The Company recognized a $12.4 million loss on the extinguishment of the remarketed notes. In May 2005, the

Company issued 10.4 million shares of common stock in accordance with the settlement provisions of the forward purchase

ontracts related to the Upper DECs. The issuance provided $747.5 million in cash proceeds. c

V

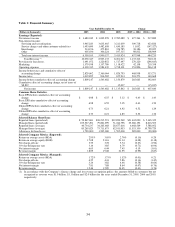

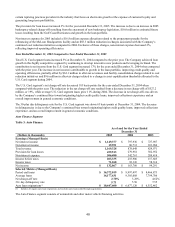

I. Financial Summary

A

doption of Accounting Pronouncements and Accounting Changes

In December 2003, the Company adopted the expense recognition provisions of Statement of Financial Accounting Standard

No. 123 Accounting for Stock Based Compensation (“SFAS 123”), prospectively to all awards granted, modified or settled

after January 1, 2003. The adoption of SFAS 123 resulted in the recognition of compensation expense of $5.0 million for the

year ended December 31, 2003. Compensation expense resulted from the discounts provided under the Associate Stock

Purchase Plan and the amortization of the estimated fair value of stock options granted during 2003.

In July 2003, the Company adopted the provisions of FASB interpretation No. 46(R), Consolidation of Variable Interest

Entities, an Interpretation of ARB No. 51, Revised (“FIN 46(R)”). The Company has consolidated all material variable

interest entities (“VIEs”) for which the Company is the primary beneficiary, as defined by FIN 46(R). The consolidation of

the VIEs resulted in a $15.0 million ($23.9 pre-tax) charge for the cumulative effect of a change in accounting principle for

the year ended December 31, 2003.

Additional information about the adoption of accounting pronouncements and accounting changes can be found in Item 8

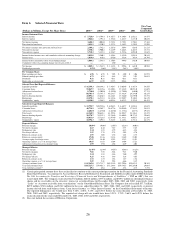

Table 1 provides a summary view of the consolidated income statement and selected metrics at and for the years ended

December 31, 2005, 2004 and 2003.

33

“Financial Statements and Supplementary Data—Notes to the Consolidated Financial Statements—Note 1” on page 66.