Capital One 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

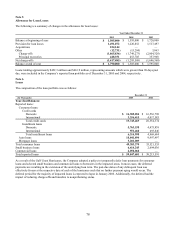

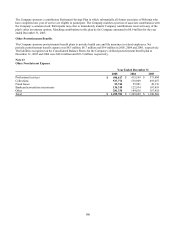

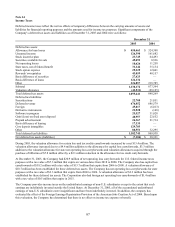

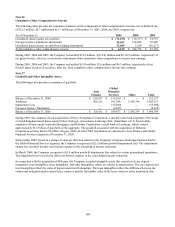

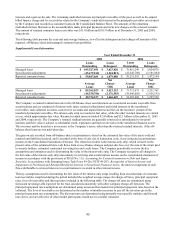

Significant components of the provision for income taxes attributable to continuing operations were as follows:

Year Ended December 31

2005 2004 2003

Federal taxes $ 899,646 $ 749,800 $ 614,730

State taxes 30,180 33,849 8,346

International taxes (19,558) 35,107 5,914

Deferred income taxes 109,587 (2,174) 38,092

Income taxes $ 1,019,855 $ 816,582 $ 667,082

The reconciliation of income tax attributable to continuing operations computed at the U.S. federal statutory tax rate to

come tax expense was: in

Year Ended December 31

2005 2004 2003

Income tax at statutory federal tax rate 35.00% 35.00% 35.00%

Other, including state taxes 1.05 (0.40) 2.00

Income taxes 36.05% 34.60% 37.00%

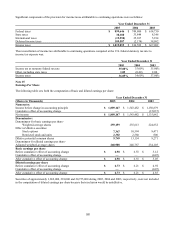

Note 15

E

arnings Per Share

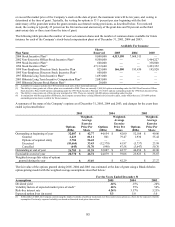

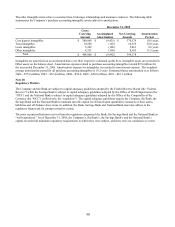

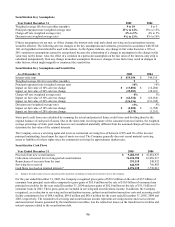

The following table sets forth the computation of basic and diluted earnings per share:

Year Ended December 31

(Shares in Thousands) 2005 2004 2003

Numerator:

Income before change in accounting principle $ 1,809,147 $ 1,543,482 $ 1,150,879

Cumulative effect of accounting change —

— (15,037)

Net income $ 1,809,147 $ 1,543,482 $ 1,135,842

Denominator:

Denominator for basic earnings per share-

Weighted-average shares 259,159

235,613 224,832

Effect of dilutive securities:

Stock options 7,367

10,594 8,471

Restricted stock and units 2,382

2,560 800

Dilutive potential common shares 9,749

13,154 9,271

Denominator for diluted earnings per share-

Adjusted weighted-average shares 268,908

248,767 234,103

Basic earnings per share

Before cumulative effect of accounting change $ 6.98

$ 6.55 $ 5.12

Cumulative effect of accounting change —

— (0.07)

After cumulative effect of accounting change $ 6.98

$ 6.55 $ 5.05

Diluted earnings per share

Before cumulative effect of accounting change $ 6.73

$ 6.21 $ 4.92

Cumulative effect of accounting change —

— (0.07)

After cumulative effect of accounting change $ 6.73

$ 6.21 $ 4.85

Securities of approximately 1,862,000, 218,000 and 20,755,000 during 2005, 2004 and 2003, respectively, were not included

the computation of diluted earnings per share because their inclusion would be antidilutive. in

88