Capital One 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

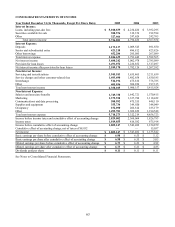

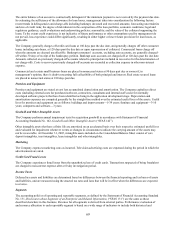

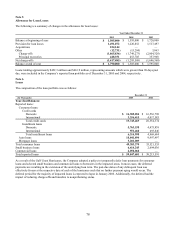

A reconciliation of the excess consideration paid by the Company over Hibernia’ s net assets acquired (“goodwill”) is as

llows: fo

Costs to acquire Hibernia:

Capital One common stock issued $ 2,606,375

Cash consideration paid 2,231,039

Fair value of employee stock options 104,577

Investment banking, legal, and consulting fees 29,596

Total consideration paid for Hibernia 4,971,587

Hibernia’s net assets at fair value:

Hibernia’ s stockholders’ equity at November 16, 2005 1,995,913

Elimination of Hibernia’ s intangibles (including goodwill) (359,951)

Adjustments to reflect assets acquired at fair value:

Net loans (174,917)

Property, plant and equipment 69,266

Other identified intangibles 20,709

Deferred tax asset (not including CDI related deferred tax liability) 58,698

Adjustments to reflect liabilities assumed at fair value:

Interest-bearing deposits 1,358

Borrowings (7,445)

Personnel related liabilities (43,252)

Other liabilities assumed (24,126)

Less: Adjusted identifiable net assets acquired (1,536,253)

Core deposit intangibles:

Adjustment to recognize core deposit intangibles (380,000)

Adjustment to recognize deferred tax liability from core deposit intangibles 133,000

Less: Core deposit intangibles and related deferred tax liability (247,000)

Total preliminary goodwill $ 3,188,334

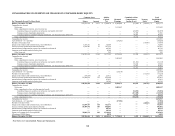

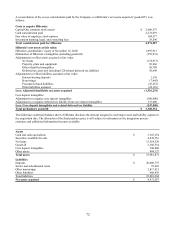

The following condensed balance sheet of Hibernia discloses the amount assigned to each major asset and liability caption at

the acquisition date. The allocation of the final purchase price is still subject to refinement as the integration process

continues and additional information becomes available.

Assets

Cash and cash equivalents $ 3,165,154

Securities available for sale 4,439,736

Net loans 15,924,520

Goodwill 3,188,334

Core deposit intangibles 380,000

Other assets 884,127

Total assets $ 27,981,871

Liabilities

Deposits $ 20,006,757

Senior and subordinated notes 97,463

Other borrowings 2,417,621

Other liabilities 488,443

Total liabilities 23,010,284

Net assets acquired $ 4,971,587

72