Capital One 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

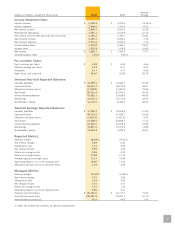

US Card Continues To Deliver Exceptional Results

Our US Card business continued to generate exceptional results. Our profits were up 16% to $1.6 billion, and our

managed charge-off rate was near an industry low at 5% in 2005. The credit card market is intensely competitive and

highly consolidated. In certain market segments, like the prime revolver segment, our competitors are offering 0%

balance transfer “teaser” rates for long periods that are heavily dependent on penalty repricing. We have chosen to

pull back from this segment because we believe that the prevailing pricing practices compromise long-term returns

and customer loyalty for the sake of short-term asset growth.

Instead, we chose to focus on rewards products, like our “No Hassle Rewards” card which allows customers to fly on

any airline, anytime, with no blackout dates. These products consistently drive purchase volume growth and provide

a compelling customer experience. In 2005, purchase volume grew 15% and profits were up 16% in our US Card business.

Even though growth in the US credit card market is modest, this business offers the most attractive risk-adjusted returns

in all of consumer lending. Our US Card business continued to deliver strong results with after-tax returns on managed

loans of 3.4% in 2005. Despite industry challenges, we remain well-positioned to continue to deliver profitable growth.

Our Auto Finance Business Has Strong Earnings Power

Capital One Auto Finance had a great year in 2005. We delivered after-tax profits of $132 million driven by continuing

efficiency gains, strong credit performance, and strong growth in originations. The auto finance market is growing at a

relatively modest rate and, historically, the captive auto lenders have captured a significant share of the market. Despite

these issues, we are positioned to deliver exceptional growth in this business as the market continues to consolidate

and we leverage our proven skills as consolidators. We became the #2 non-captive auto lender in 2005 with a 6.4%

share of non-captive auto loan originations. We continued to ramp up growth with $10.4 billion in auto originations

in 2005, and $16.4 billion in outstandings at year end, excluding Hibernia’s auto finance business. Credit performance

remains rock solid with cumulative net charge-offs in 2005 of 2.7%.

We are growing our auto lending business organically and through acquisitions and partnerships. We have significantly

expanded our dealer network and now have relationships with 73% of all franchised dealers in the United States – up

from 51% last year. We’ve created a national scale auto loan origination and servicing platform with access to customers

through multiple channels across the credit risk spectrum. And we’ve expanded the reach of our direct auto channels

through the internet, cross-sell relationships and partnerships. We see great growth opportunities in auto finance as

we continue to expand geographically, leverage our full credit spectrum capabilities, and generate additional volume

through individual dealers already in our dealer network.

Global Financial Services Is Delivering Growth And Diversification

Our Global Financial Services (GFS) business is the home for emerging growth plays at Capital One. GFS delivered solid

profitability and healthy asset growth in 2005, with $186 million in NIAT and 10% growth in managed loans. GFS results

were powered by strong performance in our U.S. businesses, such as small business loans, home loans, installment loans and

healthcare finance, as well as our international businesses in the United Kingdom and Canada. With $23 billion in outstandings

at the end of 2005, GFS is continuing to provide meaningful diversification of Capital One’s assets and earnings.

The power of

attracting great people

outweighs everything

else we do.

- 3 -

“

”