Capital One 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A

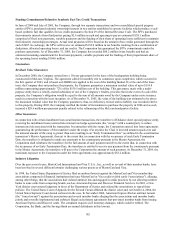

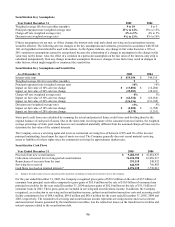

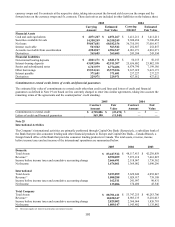

ccounts receivable from securitizations

he carrying amount approximates fair value. T

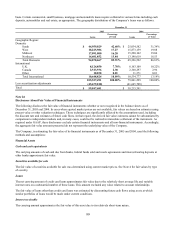

Derivatives

The carrying amount of derivatives approximates fair value and was estimated using present value valuation techniques. This

value generally reflects the estimated amounts that the Company would have received to terminate the interest rate swaps,

currency swaps and forward foreign currency exchange (“f/x”) contracts at the respective dates, taking into account the

forward yield curve on the swaps and the forward rates on the currency swaps and f/x contracts. These derivatives are

included in other assets on the balance sheet.

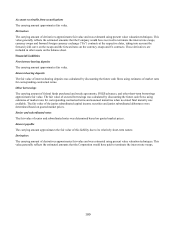

Financial Liabilities

Non-interest bearing deposits

he carrying amount approximates fair value. T

terest-bearing deposits In

The fair value of interest-bearing deposits was calculated by discounting the future cash flows using estimates of market rates

for corresponding contractual terms.

Other borrowings

The carrying amount of federal funds purchased and resale agreements, FHLB advances, and other short-term borrowings

approximates fair value. The fair value of secured borrowings was calculated by discounting the future cash flows using

estimates of market rates for corresponding contractual terms and assumed maturities when no stated final maturity was

available. The fair value of the junior subordinated capital income securities and junior subordinated debentures were

determined based on quoted market prices.

S

enior and subordinated notes

he fair value of senior and subordinated notes was determined based on quoted market prices. T

In

terest payable

The carrying amount approximates the fair value of this liability due to its relatively short-term nature.

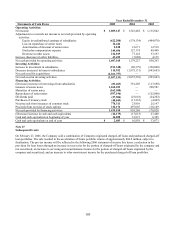

Derivatives

The carrying amount of derivatives approximates fair value and was estimated using present value valuation techniques. This

value generally reflects the estimated amounts that the Corporation would have paid to terminate the interest rate swaps,

100