Capital One 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

a pre-tax gain of $41.1 million. The respective gains were recorded in non-interest income and reported in the Global

inancial Services segment. F

The Global Financial Services segment’ s net charge-off rate was, down 44 basis points for 2004 when compared with the

prior year. Net charge-offs increased $99.1 million, or 19% during 2004 while average Global Financial Services segment

loans grew $4.7 billion, or 34%. The decrease in the net charge-off rate was driven primarily by a bias toward originating

higher credit quality loans within the Global Financial Services segment, improved collection experience and an overall

provement in economic conditions. im

The 30-plus day delinquency rate for the Global Financial Services segment was, up 11 basis points at December 31, 2004.

Global Financial Services delinquencies increased primarily as a result of an expansion of the international loan portfolio

uring 2004. d

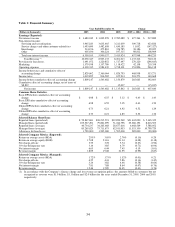

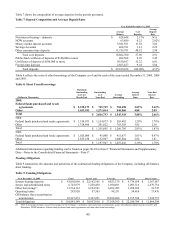

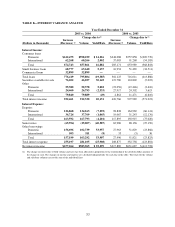

VIII. Funding

Funding Availability

The Company has established access to a variety of funding sources. Table 5 illustrates the Company’ s unsecured funding

urces and its two auto securitization warehouses. so

T

able 5: Funding Availability

(Dollars or dollar equivalents in millions)

Effective/

Issue Date Availability (1)(5) Outstanding

Final

Maturity(4)

Senior and Subordinated Global Bank Note Program(2) 1/03 $ 1,800 $ 4,160 —

Senior Domestic Bank Note Program(3) 4/97 — $ 212 —

Credit Facility 6/04 $ 750 — 6/07

Capital One Auto Loan Facility I — $ 3,969 $ 381 —

Capital One Auto Loan Facility II 3/05 $ 151 $ 599 —

Corporation Shelf Registration 10/05 $ 2,500 N/A —

(1) All funding sources are non-revolving except for the Credit Facility and the Capital One Auto Loan Facilities. Funding availability under the credit facilities is

subject to compliance with certain representations, warranties and covenants. Funding availability under all other sources is subject to market conditions.

(2) The notes issued under the Senior and Subordinated Global Bank Note Program may have original terms of thirty days to thirty years from their date of issuance.

This program was updated in June 2005.

(3) The notes issued under the Senior Domestic Bank Note Program have original terms of one to ten years. The Senior Domestic Bank Note Program is no longer

available for issuances.

(4) Maturity date refers to the date the facility terminates, where applicable.

(5

) Availability does not include unused conduit capacity related to securitization structures of $5.9 billion at December 31, 2005.

The Senior and Subordinated Global Bank Note Program gives the Bank the ability to issue securities to both U.S. and non-

.S. lenders and to raise funds in U.S. and foreign currencies, subject to conditions customary in transactions of this nature. U

Prior to the establishment of the Senior and Subordinated Global Bank Note Program, the Bank issued senior unsecured debt

through an $8.0 billion Senior Domestic Bank Note Program. The Bank did not renew the Senior Domestic Bank Note

rogram for future issuances following the establishment of the Senior and Subordinated Global Bank Note Program. P

In June 2004, the Company terminated its Domestic Revolving and Multicurrency Credit Facilities and replaced them with a

new revolving credit facility (“Credit Facility”) providing for an aggregate of $750.0 million in unsecured borrowings from

various lending institutions to be used for general corporate purposes. The Credit Facility is available to the Corporation, the

Bank, the Savings Bank, and Capital One Bank (Europe), plc, subject to covenants and conditions customary in transactions

of this type. The Corporation’ s availability has been increased to $500.0 million under the Credit Facility. All borrowings

under the Credit Facility are based upon varying terms of London Interbank Offering Rate (“LIBOR”).

In April 2002, COAF entered into a revolving warehouse credit facility collateralized by a security interest in certain auto

loan assets (the “Capital One Auto Loan Facility I”). As of December 31, 2005, the Capital One Auto Loan Facility I had the

capacity to issue up to $4.4 billion in secured notes. The Capital One Auto Loan Facility I has multiple participants each with

separate renewal dates. The facility does not have a final maturity date. Instead, each participant may elect to renew the

ommitment for another set period of time. Interest on the facility is based on commercial paper rates. c

In March 2005, COAF entered into a revolving warehouse credit facility collateralized by a security interest in certain auto

loan assets (the “Capital One Auto Loan Facility II”). As of December 31, 2005, the Capital One Auto Loan Facility II had

the capacity to issue up to $750.0 million in secured notes. The Capital One Auto Loan Facility II has a renewal date of

March 27, 2006. The facility does not have a final maturity date. Instead, the participant may elect to renew the commitment

for another set period of time. Interest on the facility is based on commercial paper rates.

43