Capital One 2005 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

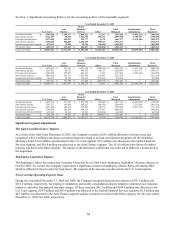

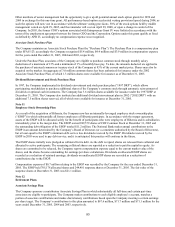

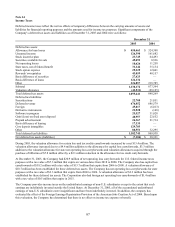

The Company has determined that these investments have only temporary impairment based on a number of criteria,

including the timeframe of the unrealized loss position, the nature of the investments and the Company’ s intent and ability to

old the fixed income securities to maturity. h

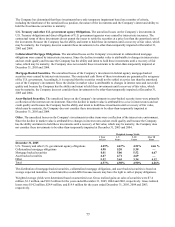

U.S. Treasury and other U.S. government agency Obligations. The unrealized losses on the Company’ s investments in

U.S. Treasury obligations and direct obligations of U.S. government agencies were caused by interest rate increases. The

contractual terms of these investments do not permit the issuer to settle the securities at a price less than the amortized cost of

the investment. Because the Company has the ability and intent to hold these investments until a recovery of fair value, which

may be maturity, the Company does not consider these investments to be other-than-temporarily impaired at December 31,

2005 and 2004.

Collateralized Mortgage Obligations. The unrealized losses on the Company’ s investment in collateralized mortgage

obligations were caused by interest rate increases. Since the decline in market value is attributable to changes in interest rates

and not credit quality and because the Company has the ability and intent to hold these investments until a recovery of fair

value, which may be maturity, the Company does not consider these investments to be other-than-temporarily impaired at

ecember 31, 2005 and 2004. D

Mortgage-Backed Securities. The unrealized losses of the Company’ s investment in federal agency mortgage-backed

securities were caused by interest rate increases. The contractual cash flows of these investments are guaranteed by an agency

of the U.S. government. Accordingly, it is expected that the securities would not be settled at a price less than the amortized

cost of the Company’ s investment. Since the decline in market value is attributable to changes in interest rates and not credit

quality and because the Company has the ability and intent to hold these investments until a recovery of fair value, which

may be maturity, the Company does not consider these investments to be other-than-temporarily impaired at December 31,

005 and 2004. 2

Asset-Backed Securities. The unrealized losses on the Company’ s investments in asset-backed security items were primarily

a reflection of the interest rate environment. Since the decline in market value is attributable to a rise in interest rates and not

credit quality and because the Company has the ability and intent to hold these investments until a recovery of fair value,

which may be maturity, the Company does not consider these investments to be other-than-temporarily impaired at

December 31, 2005 and 2004.

Other. The unrealized losses on the Company’ s investments in other items were a reflection of the interest rate environment.

Since the decline in market value is attributable to changes in interest rates and not credit quality and because the Company

has the ability and intent to hold these investments until a recovery of fair value, which may be maturity, the Company does

not consider these investments to be other-than-temporarily impaired at December 31, 2005 and 2004.

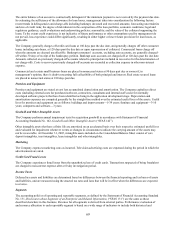

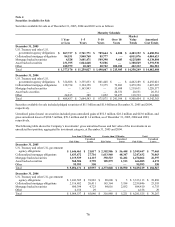

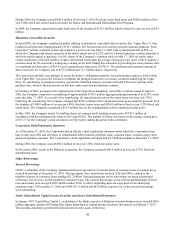

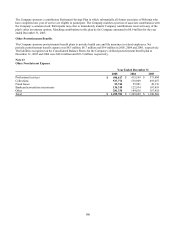

Wei hted Average Yields g

1–5

1 Year

or Less Years 5–10

Years Over 1 0

Years

December 31, 2005

U.S. Treasury and other U.S. government agency obligations 4.29% 4.67% 4.51% 4.46 %

Collateralized mortgage obligations 4.98 5.20 5.38 —

Mortgage backed securities 8.01 5.06 5.52 6.67

Asset backed securities 4.67 4.71 4.69 —

Other 5.52 3.65 3.34 4.12

Total 4.57% 4.98% 4.90% 4.26%

The distribution of mortgage-backed securities, collateralized mortgage obligations, and asset backed securities is based on

average expected maturities. Actual maturities could differ because issuers may have the right to call or prepay obligations.

Weighted average yields were determined based on amortized cost. Gross realized gains on sales of securities were $7.4

million, $1.3 million, and $10.5 million for the years ended December 31, 2005, 2004 and 2003, respectively. Gross realized

losses were $14.2 million, $24.4 million, and $19.9 million for the years ended December 31, 2005, 2004 and 2003,

r spectively. e

77