Capital One 2005 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

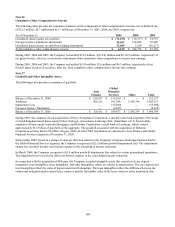

Note 16

C

umulative Other Comprehensive Income

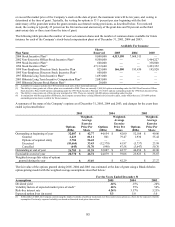

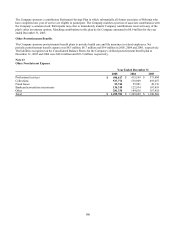

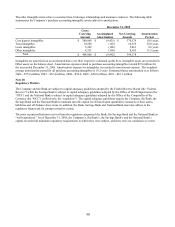

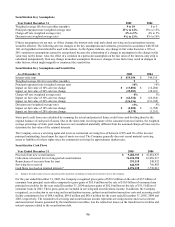

The following table presents the cumulative balances of the components of other comprehensive income, net of deferred tax,

of $22.2 million, $8.7 million and $11.7 million as of December 31, 2005, 2004, and 2003, respectively:

As of December 31

2005 2004 2003

Unrealized (losses) gains on securities $ (71,253) $ (16,377) $ 34,735

Foreign currency translation adjustments 45,693 158,882 93,640

Unrealized gains (losses) on cash flow hedging instruments 31,689 2,254 (45,217)

Total cumulative other comprehensive income $ 6,129 $ 144,759 $ 83,158

During 2005, 2004 and 2003, the Company reclassified $32.2 million, $(118.0) million and $(110.5) million, respectively of

et gains (losses), after tax, on derivative instruments from cumulative other comprehensive income into earnings. n

During 2005, 2004 and 2003, the Company reclassified $(3.0) million, $2.6 million and $8.3 million, respectively of net

(losses) gains on sales of securities, after tax, from cumulative other comprehensive income into earnings.

Note 17

G

oodwill and Other Intangible Assets

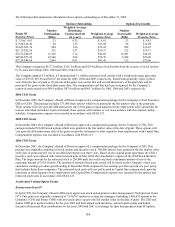

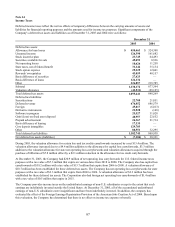

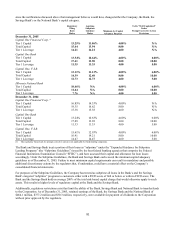

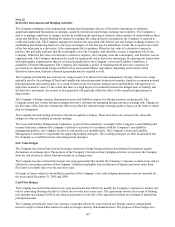

he following table provides a summary of goodwill. T

Auto

Finance

Global

Financial

Services Other Total

Balance at December 31, 2004 $ 218,957 $ 133,200 $ — $ 352,157

Additions 109,235 291,588 3,188,334 3,589,157

Impairment Loss — (25,490) — (25,490)

Foreign Currency Translation — (9,425) — (9,425)

Balance at December 31, 2005 $ 328,192 $ 389,873 $ 3,188,334 $ 3,906,399

During 2005, the company closed acquisitions of Onyx Acceptance Corporation, a specialty auto loan originator; Hfs Group,

a United Kingdom based home equity broker; InsLogic, an insurance brokerage firm; eSmartloan, a U.S. based online

originator of home equity loans and mortgages; and Hibernia Corporation, a retail bank in Louisiana, which created

approximately $3.6 billion of goodwill, in the aggregate. The goodwill associated with the acquisition of Hibernia

Corporation is being held in the Other category while all other 2005 acquisitions are allocated to Auto Finance and Global

inancial Services segments at December 31, 2005. F

In December 2005, based on a change in strategic direction related to the Company’ s insurance brokerage business held in

the Global Financial Services segment, the Company recognized a $25.5 million goodwill impairment loss. The impairment

harge was recorded in other non-interest expense in the consolidated income statement. c

In March 2004, the Company recognized a $3.8 million goodwill impairment loss related to certain international operations.

his impairment was recorded in other non-interest expense in the consolidated income statement. T

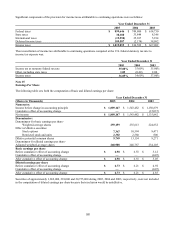

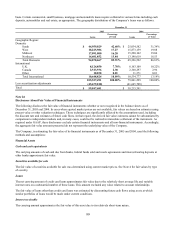

In connection with the acquisition of Hibernia, the Company recorded intangible assets that consisted of core deposit

intangibles, trust intangibles, lease intangibles, and other intangibles, which are subject to amortization. The core deposit and

trust intangibles reflect the value of deposit and trust relationships. The lease intangibles reflect the difference between the

contractual obligation under current lease contracts and the fair market value of the lease contracts at the acquisition date.

89