Capital One 2005 Annual Report Download - page 103

Download and view the complete annual report

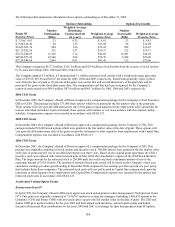

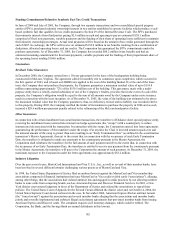

Please find page 103 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Separately, a number of entities, each purporting to represent a class of retail merchants, have also filed antitrust lawsuits (the

“Interchange lawsuits”) against the associations and several member banks, including the Corporation and its subsidiaries,

alleging among other things, that the associations and member banks conspired to fix the level of interchange fees. The

complaints request civil monetary damages, which could be trebled. In October 2005, the Interchange lawsuits were

onsolidated before the United States District Court for the Eastern District of New York. c

We believe that we have meritorious defenses with respect to these cases and intend to defend these cases vigorously. At the

present time, management is not in a position to determine whether the resolution of these cases will have a material adverse

effect on either the consolidated financial position of the Corporation or the Corporation’ s results of operations in any future

reporting period.

In addition, several merchants filed class action antitrust lawsuits, which were subsequently consolidated, against the

associations relating to certain debit card products. In April 2003, the associations agreed to settle the lawsuit in exchange for

payments to plaintiffs and for changes in policies and interchange rates for debit cards. Certain merchant plaintiffs have opted

out of the settlements and have commenced separate lawsuits. Additionally, consumer class action lawsuits with claims

mirroring the merchants’ allegations have been filed in several courts. Finally, the associations, as well as certain member

banks, continue to face additional lawsuits regarding policies, practices, products and fees.

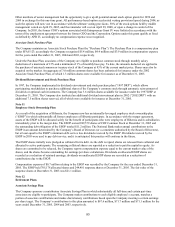

With the exception of the Interchange lawsuits and the Amex lawsuit, the Corporation and its subsidiaries are not parties to

the lawsuits against the associations described above and therefore will not be directly liable for any amount related to any

possible or known settlements of such lawsuits. However, the Corporation’ s subsidiary banks are member banks of

MasterCard and Visa and thus may be affected by settlements or lawsuits relating to these issues, including changes in

interchange payments. In addition, it is possible that the scope of these lawsuits may expand and that other member banks,

including the Corporation’ s subsidiary banks, may be brought into the lawsuits or future lawsuits. The associations are also

subject to additional litigation, including suits regarding foreign exchange fees. As a result of such litigation, the associations

are expected to continue to evolve as corporate entities, including by changing their governance structures, as previously

announced by the associations.

Given the complexity of the issues raised by these lawsuits and the uncertainty regarding: (i) the outcome of these suits,

(ii) the likelihood and amount of any possible judgments, (iii) the likelihood, amount and validity of any claim against the

associations’ member banks, including the banks and the Corporation, and (iv) changes in industry structure that may result

from the suits and (v) the effects of these suits, in turn, on competition in the industry, member banks, and interchange and

association fees, we cannot determine at this time the long-term effects of these suits on us.

Other Pending and Threatened Litigation

In addition, the Company also commonly is subject to various pending and threatened legal actions relating to the conduct of

its normal business activities. In the opinion of management, the ultimate aggregate liability, if any, arising out of any such

pending or threatened legal actions will not be material to the consolidated financial position or results of operations of the

Company.

Tax issues for years 1995-1999 are pending in the U.S. Tax court. The ultimate resolution of these issues is not expected to

ave a materially adverse effect upon the Corporation’ s operations or financial condition. h

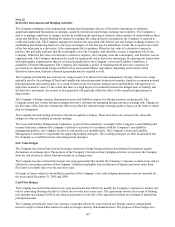

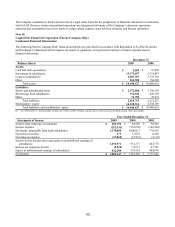

Note 20

Related Party Transactions

In the ordinary course of business, executive officers and directors of the Company may have consumer loans issued by the

Company. Pursuant to the Company’ s policy, such loans are issued on the same terms as those prevailing at the time for

comparable loans to unrelated persons and do not involve more than the normal risk of collectibility.

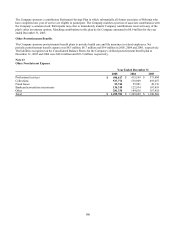

Note 21

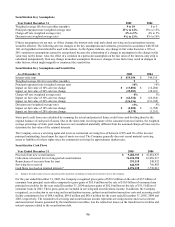

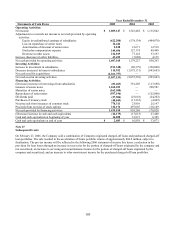

Off-Balance Sheet Securitizations

Off-balance sheet securitizations involve the transfer of pools of consumer loan receivables by the Company to one or more

third-party trusts or qualified special purpose entities in transactions that are accounted for as sales in accordance with SFAS

140. Certain undivided interests in the pool of consumer loan receivables are sold to investors as asset-backed securities in

public underwritten offerings or private placement transactions. The proceeds from off-balance sheet securitizations are

distributed by the trusts to the Company as consideration for the consumer loan receivables transferred. Each new off-balance

sheet securitization results in the removal of consumer loan principal receivables equal to the sold undivided interests in the

pool from the Company’ s consolidated balance sheet (“off-balance sheet loans”), the recognition of certain retained residual

94