Capital One 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

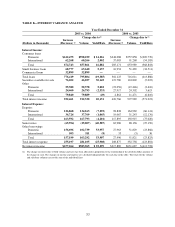

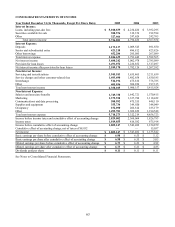

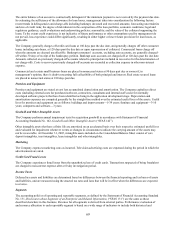

CONSOLIDATED STATEMENTS OF INCOME

Year Ended December 31 (In Thousands, Except Per Share Data)

2005

2004 2003

Interest Income:

Loans, including past-due fees $ 5,010,839 $ 4,234,420 $ 3,932,295

Securities available for sale 388,576

312,374 192,594

Other 327,466

247,626 242,765

Total interest income 5,726,881

4,794,420 4,367,654

Interest Expense:

Deposits 1,173,137

1,009,545 891,650

Senior and subordinated notes 421,218

486,812 423,826

Other borrowings 452,284

295,085 267,089

Total interest expense 2,046,639

1,791,442 1,582,565

Net interest income 3,680,242

3,002,978 2,785,089

Provision for loan losses 1,491,072

1,220,852 1,517,497

Net interest income after provision for loan losses 2,189,170

1,782,126 1,267,592

Non-Interest Income:

Servicing and securitizations 3,945,183

3,635,465 3,211,639

Service charges and other customer-related fees 1,493,690

1,482,658 1,630,185

Interchange 514,196

475,810 376,785

Other 405,036

306,224 197,315

Total non-interest income 6,358,105

5,900,157 5,415,924

Non-Interest Expense:

Salaries and associate benefits 1,749,738

1,642,721 1,570,415

Marketing 1,379,938

1,337,780 1,118,422

Communications and data processing 580,992

475,355 448,110

Supplies and equipment 355,734

349,920 344,049

Occupancy 152,090

206,614 185,179

Other 1,499,781

1,309,829 1,190,548

Total non-interest expense 5,718,273

5,322,219 4,856,723

Income before income taxes and cumulative effect of accounting change 2,829,002

2,360,064 1,826,793

Income taxes 1,019,855

816,582 675,914

Income before cumulative effect of accounting change 1,809,147

1,543,482 1,150,879

Cumulative effect of accounting change, net of taxes of $8,832 —

— 15,037

Net income $ 1,809,147 $ 1,543,482 $ 1,135,842

Basic earnings per share before cumulative effect of accounting change $ 6.98

$ 6.55 $ 5.12

Basic earnings per share after cumulative effect of accounting change $ 6.98

$ 6.55 $ 5.05

Diluted earnings per share before cumulative effect of accounting change $ 6.73

$ 6.21 $ 4.92

Diluted earnings per share after cumulative effect of accounting change $ 6.73

$ 6.21 $ 4.85

Dividends paid per share $ 0.11

$ 0.11 $ 0.11

See Notes to Consolidated Financial Statements.

63