Capital One 2005 Annual Report Download - page 31

Download and view the complete annual report

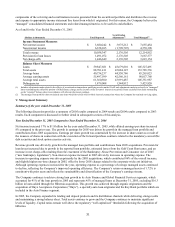

Please find page 31 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.changes can reduce the overall yield on our portfolio if we do not adequately provide for them in our interest rate hedging

strategies. When interest rates rise, there are fewer low-rate alternatives available to customers. Consequently, credit card

balances may rise (or fall more slowly) and pre-payment rates on installment lending products may fall. In this circumstance,

we may have to raise additional funds at higher interest rates. In our credit card business, we could, subject to legal and

competitive constraints, mitigate this risk by increasing the interest rates we charge, although such changes may increase

opportunities for our competitors to offer attractive products to our customers and consequently increase customer attrition

from our portfolio. We could also mitigate this risk through hedging strategies, if available, if we are unable to do so, we

could suffer adverse impacts on overall portfolio yield. Rising interest rates across the industry may also lead to higher

delinquencies as customers face increasing interest payments both on our products and on other loans they may hold. See

pages 47-48 in Item 7 “Management’ s Discussion and Analysis of Financial Condition and Results of Operations—Interest

Rate Risk Management” contained in the Annual Report on Form 10-K for the year ended December 31, 2005.

We Face the Risk of a Complex and Changing Regulatory and Legal Environment

We operate in a heavily regulated industry and are therefore subject to a wide array of banking, consumer lending and deposit

laws and regulations that apply to almost every element of our business. Failure to comply with these laws and regulations

could result in financial, structural and operational penalties, including receivership. In addition, efforts to comply with these

laws and regulations may increase our costs and/or limit our ability to pursue certain business opportunities. See “Supervision

and Regulation” above. Federal and state laws and regulations, as well as laws and regulations to which we are subject in

foreign jurisdictions in which we conduct business, significantly limit the types of activities in which we may engage. For

example, federal and state consumer protection laws and regulations, and laws and regulations of foreign jurisdictions where

we conduct business, limit the manner in which we may offer and extend credit. From time to time, the U.S. Congress, the

states and foreign governments consider changing these laws and may enact new laws or amend existing laws and regulatory

authorities may issue new regulations. Such new laws or regulations could limit the amount of interest or fees we can charge,

restrict our ability to collect on account balances, or materially affect us or the banking or credit card industries in some other

manner. Additional federal, state and foreign consumer protection legislation also could seek to expand the privacy

protections afforded to customers of financial institutions and restrict our ability to share or receive customer information.

In addition, banking regulators possess broad discretion to issue or revise regulations, or to issue guidance, which may

significantly impact us. For example, the Federal Trade Commission has issued, and will continue to issue, a variety of

regulations under the FACT Act of 2003, the Federal Reserve has announced proposed rule-making, and has issued some

final rules, and in the UK the Office of Fair Trading is conducting an industry investigation on the calculation of default

charges, all of which may impact us. Additionally, the new bankruptcy reform legislation will put additional requirements on

the Company regarding disclosures on the effects on consumers of making only minimum payments on their accounts. We

cannot, however, predict whether and how any new guidelines issued or other regulatory actions taken by the banking or

other regulators will be applied to the Bank, the National Bank or the Savings Bank, in what manner such regulations might

be applied, or the resulting effect on us, the Bank, the National Bank or the Savings Bank. There can be no assurance that this

kind of regulatory action will not have a negative impact on us and/or our financial results.

The Credit Card Industry Faces Increased Litigation Risks Relating to Industry Structure

We face possible risks from the outcomes of certain credit card industry litigation. In 1998, the United States Department of

Justice filed an antitrust lawsuit against the MasterCard and Visa membership associations composed of financial institutions

that issue MasterCard or Visa credit or debit cards (“associations”), alleging, among other things, that the associations had

violated antitrust law and engaged in unfair practices by not allowing member banks to issue cards from competing brands,

such as American Express and Discover Financial Services. In 2001, a New York district court entered judgment in favor of

the Department of Justice and ordered the associations to repeal these policies. The United States Court of Appeals for the

Second Circuit affirmed the district court and, on October 4, 2004, the United States Supreme Court denied certiorari in the

case. In November 2004, American Express filed an antitrust lawsuit (the “Amex lawsuit”) against the associations and

several member banks alleging that the associations and member banks jointly and severally implemented and enforced

illegal exclusionary agreements that prevented member banks from issuing American Express and Discover cards. The

complaint requests civil monetary damages, which could be trebled. The Corporation, the Bank, and the Savings Bank are

amed defendants in this lawsuit. n

Separately, a number of entities, each purporting to represent a class of retail merchants, have also filed antitrust lawsuits (the

“Interchange lawsuits”) against the associations and several member banks, including the Corporation and its subsidiaries,

alleging among other things, that the associations and member banks conspired to fix the level of interchange fees. The

complaints request civil monetary damages, which could be trebled. In October 2005, the Interchange lawsuits were

consolidated before the United States District Court for the Eastern District of New York.

22