Capital One 2005 Annual Report Download - page 90

Download and view the complete annual report

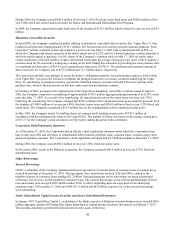

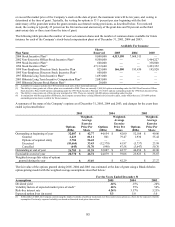

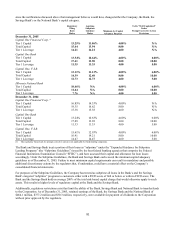

Please find page 90 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During 2004, the Company issued $500.0 million of ten-year 5.125% fixed rate senior bank notes and $500.0 million of five-

year 5.00% fixed rate senior bank notes under the Senior and Subordinated Global Bank Note Program.

In 2004, the Company repurchased senior bank notes in the amount of $124.5 million, which resulted in a pre-tax loss of $4.3

illion. m

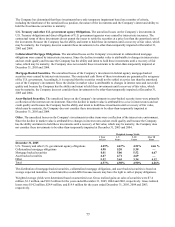

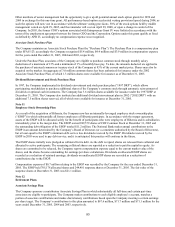

Mandatory Convertible Securities

In April 2002, the Company completed a public offering of mandatory convertible debt securities (the “Upper Decs®”), that

resulted in net proceeds of approximately $725.1 million. The net proceeds were used for general corporate purposes. Each

Upper Dec® initially consisted of and represented (i) a senior note due May 17, 2007 with a principal amount of $50, on

which the Company paid interest quarterly at the initial annual rate of 6.25%, and (ii) a forward purchase contract pursuant to

which the holder agreed to purchase, for $50, shares of the Company’ s common stock on May 17, 2005 (or earlier under

certain conditions), with such number of shares determined based upon the average closing price per share of the Company’ s

common stock for 20 consecutive trading days ending on the third trading day immediately preceding the stock purchase date

at a minimum per share price of $63.91 and a maximum per share price of $78.61. The minimum and maximum amount of

shares issued by the Company was to be 9.5 million and 11.7 million shares, respectively.

The senior notes initially were pledged to secure the holder’ s obligations under the forward purchase contracts. Each holder

of an Upper Dec® was given the election to withdraw the pledged senior notes or treasury securities underlying the Upper

Decs® by substituting, as pledged securities, specifically identified treasury securities that paid $50 on the relevant stock

urchase date, which is the amount due on that date under each forward purchase contract. p

In February of 2005, pursuant to the original terms of the Upper Decs mandatory convertible securities issued in April of

2002, the Company completed a remarketing of approximately $704.5 million aggregate principal amount of its 6.25% senior

notes due May 17, 2007. As a result of the remarketing, the annual interest rate on the senior notes was reset to 4.738%.

Following the remarketing, the Company extinguished $585.0 million of the remarketed senior notes using the proceeds from

the issuance of $300.0 million of seven year 4.80% fixed rate senior notes and $300.0 million of twelve year 5.25% fixed rate

senior notes. The Company recognized a $12.4 million loss on the extinguishment of the remarketed senior notes.

In May 2005, the Company issued 10.4 million shares of common stock resulting in proceeds of $747.5 million in

accordance with the settlement provisions of the Upper DECs. The number of shares was based on the average closing price

f $71.77 for the Company’ s stock calculated over the twenty trading days prior to the settlement. o

C

orporation Shelf Registration Statement

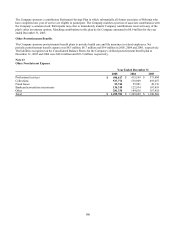

As of December 31, 2005, the Corporation has an effective shelf registration statement under which the Corporation from

time to time may offer and sell senior or subordinated debt securities, preferred stock, common stock, common equity units

nd stock purchase contracts. The Corporation’ s shelf registration statement had $2.5 billion available at December 31, 2005. a

uring 2005, the Company issued $500.0 million of ten year 5.50% fixed rate senior notes. D

In November 2005, as part of the Hibernia acquisition, the Company assumed $100.0 million in ten year 5.35% fixed rate

bordinated notes. su

O

ther Borrowings

S

ecured Borrowings

COAF, a subsidiary of the Company, maintained nineteen agreements to transfer pools of consumer loans accounted for as

secured borrowings at December 31, 2005. The agreements were entered into between 2002 and 2005, relating to the

transfers of pools of consumer loans totaling $21.2 billion. Principal payments on the borrowings are based on principal

collections, net of losses, on the transferred consumer loans. The secured borrowings accrue interest predominantly at fixed

rates and mature between April 2007 and December 2010, or earlier depending upon the repayment of the underlying

consumer loans. At December 31, 2005 and 2004, $11.9 billion and $8.2 billion, respectively, of the secured borrowings

were outstanding.

Junior Subordinated Capital Income Securities and Junior Subordinated Debentures

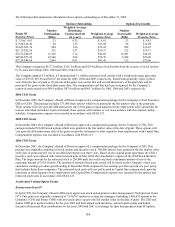

In January 1997, Capital One Capital I, a subsidiary of the Bank created as a Delaware statutory business trust, issued $100.0

million aggregate amount of Floating Rate Junior Subordinated Capital Income Securities that mature on February 1, 2027.

The securities represent a preferred beneficial interest in the assets of the trust.

81