Capital One 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

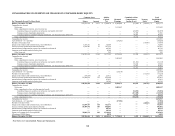

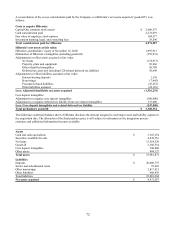

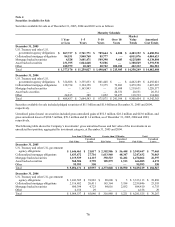

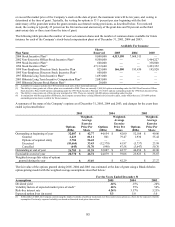

See Note 1, Significant Accounting Policies, for the accounting policies of the reportable segments.

Year Ended December 31, 2005

U.S. Card Auto

Finance

Global

Financial

Services Other Total

Managed Securitization

Adjustments Total

Reported

Net interest income $ 4,793,956 $ 1,149,377 $ 1,680,522 $ 31,599 $ 7,655,454 $ (3,975,212) $ 3,680,242

Non-interest income 3,321,457 19,951 1,022,756 195,234 4,559,398 1,798,707 6,358,105

Provision for loan loss s e

Non-interest expenses 2,279,109 459,513 925,777 3,178 3,667,577 (2,176,505) 1,491,072

3,356,600 506,480 1,496,678 358,515 5,718,273 — 5,718,273

Income tax provision (benefit)

870,351 71,268 94,796 (16,560) 1,019,855 — 1,019,855

Net income (loss) $ 1,609,353 $ 132,067 $ 186,027 $ (118,300) $ 1,809,147 $ — $ 1,809,147

Loans receivable $ 49,463,522 $ 16,372,019 $ 23,386,490 $ 16,305,460 $ 105,527,491 $ (45,679,810) $ 59,847,681

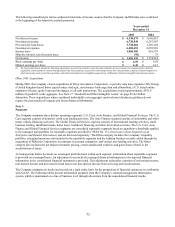

Year Ended December 31, 2004

U.S. Card Auto

Finance

Global

Financial

Services Other Total

Managed Securitization

Adjustments Total

Reported

Net interest income $ 4,655,897 $ 797,936 $ 1,421,508 $ (240,599) $ 6,634,742 $ (3,631,764) $ 3,002,978

Non-interest income 3,219,567 80,712 844,192 80,115 4,224,586

3,177,045 1,675,571 5,900,157

Provision for loan loss s e

Non-interest expenses 2,207,888 279,981 683,612 5,564 (1,956,193) 1,220,852

3,499,918 342,761 1,265,549 213,991 5,322,219 — 5,322,219

Income tax provision (benefit)

780,357 92,126 103,459 (159,360) 816,582 — 816,582

Net income (loss) $ 1,387,301 $ 163,780 $ 213,080 $ (220,679) $ 1,543,482 $ — $ 1,543,482

Loans receivable $ 48,609,571 $ 9,997,497 $ 21,240,325 $ 13,906 $ 79,861,299 $ (41,645,708) $ 38,215,591

Year Ended December 31, 2003

U.S. Card Auto

Finance

Global

Financial

Services Other Total

Managed Securitization

Adjustments Total

Reported

Net interest income $ 4,287,814 $ 727,987 $ 1,072,098 $ (49,985) $ 6,037,914 $ (3,252,825) $ 2,785,089

Non-interest income 3,583,357 101,984 605,821 (90,536) 4,200,626

3,555,024 1,215,298 5,415,924

Provision for loan loss s e

Non-interest expenses 2,647,406 382,952 595,543 (70,877) (2,037,527) 1,517,497

3,348,894 289,414 988,321 253,963 4,880,592 — 4,880,592

Income tax provision (benefit)

693,702 58,314 29,216 (114,150) 667,082 — 667,082

Net income (loss) $ 1,181,169 $ 99,291 $ 64,839 $ (209,457) $ 1,135,842 $ — $ 1,135,842

oans receivable $ 46,278,750 $ 8,466,873 $ 16,507,937 $ (8,764) $ 71,244,796 $ (38,394,527) $ 32,850,269 L

S

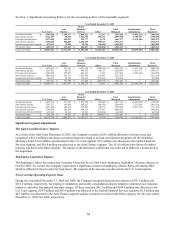

ignificant Segment Adjustments

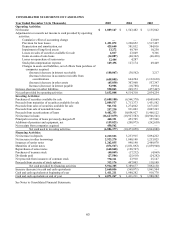

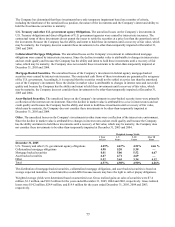

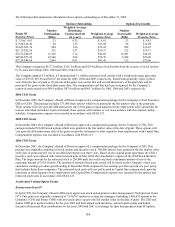

he Gulf Coast Hurricanes’ Impacts T

As a result of the Gulf Coast Hurricanes of 2005, the Company recorded a $28.5 million allowance for loan losses and

recognized a $15.6 million write-down on retained interests related to its loan securitization programs. Of the additional

allowance build, $10.0 million was allocated to the U.S. Card segment, $2.5 million was allocated to the Global Financial

Services segment, and $16.0 million was allocated to the Auto Finance segment. The $15.6 million write-down of retained

interests was held in the Other category. The impact of the hurricanes on Hibernia was reflected in Hibernia’ s results prior to

the acquisition.

Bankruptcy Legislation Impacts

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (“new bankruptcy legislation”) became effective in

October 2005. As a result, the Company experienced a significant increase in bankruptcy related charge-offs during 2005

hich is reflected in the provision for loan losses. The majority of the increase was allocated to the U.S. Card segment. w

N

on-recurring Operating Expense Items

During the year ended December 31, 2005 and 2004, the Company recognized non-interest expense of $76.3 million and

$161.2 million, respectively, for employee termination and facility consolidation charges related to continued cost reduction

initiatives and other less material one-time charges. Of these amounts, $41.7 million and $109.6 million was allocated to the

U.S. Card segment, $24.9 million and $45.4 million was allocated to the Global Financial Services segment, $8.5 million and

$4.5 million was allocated to the Auto Finance segment and the remainder was held in the Other category for the years ended

December 31, 2005 and 2004, respectively.

74