Capital One 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.I. Business Outlook X

This business outlook section summarizes the Company’ s expectations for earnings for 2006, and its primary goals and

strategies for continued growth. The statements contained in this section are based on management’ s current expectations and

do not take into account any acquisitions that might occur during the year. Certain statements are forward looking, and

therefore actual results could differ materially from those in the Company’ s forward looking statements. Factors that could

materially influence results are set forth throughout this section and in Item 1A “Business—Risk Factors.”

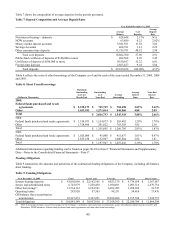

Expected Earnings

The Company expects diluted earnings per share of $7.40 to $7.80, which represents an increase of between 10% and 16%

over its diluted earnings per share of $6.73 in 2005. The company also expects its managed loan growth rate to be between

7% and 9% in 2006.

The Company’ s earnings are a function of its revenues (net interest income and non-interest income), consumer usage,

payment and attrition patterns, the credit quality and growth rate of its earning assets (which affect fees, charge-offs and

provision expense), the growth rate of its branches and deposits, and the Company’ s marketing and operating expenses.

Specific factors likely to affect the Company’ s 2006 earnings are the portion of its loan portfolio it holds in higher credit

quality assets, the level of off-balance sheet securitizations, changes in consumer payment behavior, the amount of and

quality of deposits it generates, the competitive, legal, regulatory and reputational environment, the level of investments,

growth in its businesses, and the health of the economy and its labor markets.

The Company expects to achieve these results based on the continued success of its business strategies and its current

assessment of the competitive, regulatory and funding market environments that it faces (each of which is discussed

elsewhere in this document), as well as the expectation that the geographies in which the Company competes will not

xperience significant consumer credit quality erosion, as might be the case in an economic downturn or recession. e

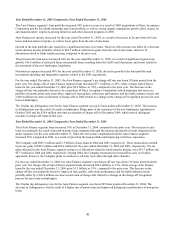

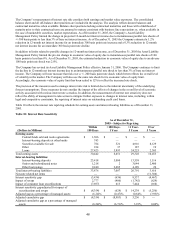

Return on Managed Assets

The Company expects continued stability in its annual return on managed assets, generally consistent with 2004 and 2005

managed ROA of 1.73% and 1.72% respectively. The Company expects a decline in revenue margin, due to its bias towards

lower loss assets, which is expected to be offset primarily by reductions in provision expense and also by reductions in

perating costs as a percent of assets. o

The Company’ s objective is to continue expanding in consumer financial services, which may include expansion into

additional geographic markets, additional bank branches, and other consumer loan products via organic growth and/or

acquisitions of other companies. In each business line, the Company expects to apply its proprietary marketing capabilities to

identify new product and new market opportunities, and to make investment decisions based on the Company’ s extensive

sting and analysis. te

The Company’ s lending and deposit products are subject to intense competitive pressures that management anticipates will

continue to increase as its markets mature, and it could affect the economics of decisions that the Company has made or will

ake in the future in ways that it did not anticipate, test or analyze. m

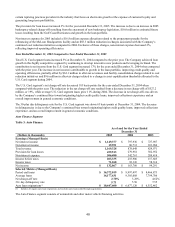

U.S. Card Segment

The Company’ s U.S. Card segment consisted of $49.5 billion of managed U.S. consumer credit card loans as of

December 31, 2005, marketed to consumers. The Company’ s strategy for its U.S. Card segment is to offer compelling, value-

added products to its customers.

The competitive environment is currently intense for credit card products. Industry mail volume has increased substantially in

recent years, resulting in declines in response rates to the Company’ s new customer solicitations over time. Additionally, the

increase in other consumer loan products, such as home equity loans, puts pressure on growth throughout the credit card

industry. These competitive pressures remain significant as a result of, among other things, increasing consolidation within

the industry. The industry’ s response to this competitive pressure has been to increase mail volumes to record levels, and in

some parts of the market, most notably, with respect to the prime revolver customers, offer extremely low up front pricing

that appears to make profitability heavily dependent on penalty repricing well beyond “go to” rates for a substantial

percentage of customers. The Company is choosing to limit its marketing in those selected parts of the market because it

believes the prevailing pricing practices will compromise both economic returns and customer loyalty over the long term.

Instead, the Company is focusing its efforts where it sees better opportunities to deliver profitable growth and create long

term customer loyalty, such as in reward cards. Despite intense competitor pressure, the Company continues to believe that

50