Capital One 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

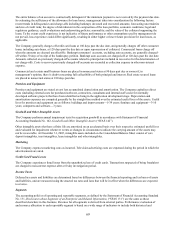

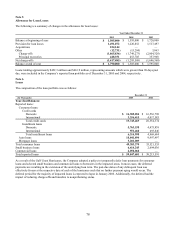

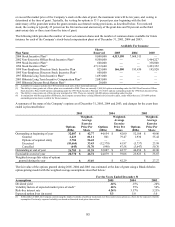

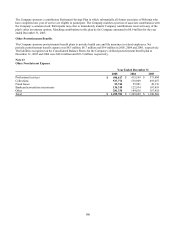

Note 5

A

llowance for Loan Losses

he following is a summary of changes in the allowance for loan losses: T

Year Ended December 31

2005 2004 2003

Balance at beginning of year $ 1,505,000

$ 1,595,000 $ 1,720,000

Provision for loan losses 1,491,072

1,220,852 1,517,497

Acquisitions 224,144

— —

Other (12,731) (15,284) 3,863

Charge-offs (1,865,836) (1,749,273) (2,004,328)

Principal recoveries 448,351

453,705 357,968

Net charge-offs (1,417,485) (1,295,568) (1,646,360)

Balance at end of year $ 1,790,000

$ 1,505,000 $ 1,595,000

Loans totaling approximately $422.3 million and $416.9 million, representing amounts which were greater than 90 days past

ue, were included in the Company’ s reported loan portfolio as of December 31, 2005 and 2004, respectively. d

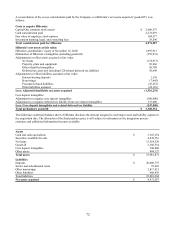

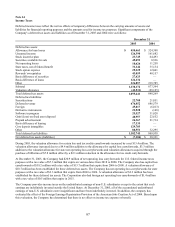

Note 6

Loans

The composition of the loan portfolio was as follows:

December 31

(In Thousands) 2005 2004

Year-End Balances:

Reported loans:

Consumer loans:

Credit cards

$ 16,389,054

$ 16,536,789 Domestic

International 3,356,415 4,017,585

Total credit cards 19,745,469 20,554,374

Installment loans

Domestic 5,763,538 4,475,838

International 551,460 493,846

Total installment loans 6,314,998 4,969,684

Auto loans 18,041,894 9,997,497

Mortgage loans 5,281,009 —

Total consumer loans 49,383,370 35,521,555

Small business loans 6,414,243 2,694,036

Commercial loans 4,050,068 —

Total reported loans $ 59,847,681 $ 38,215,591

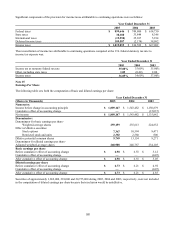

As a result of the Gulf Coast Hurricanes, the Company adopted a policy to temporarily defer loan payments for consumer

loans and selected small business and commercial loans to borrowers in the impacted areas. In most cases, the deferred

payments are resulting in the extension of the underlying loan term. The past-due status of any delinquent loan was

effectively frozen at the respective date of each of the hurricanes such that no further payment aging would occur. The

deferral period for the majority of impacted loans is expected to lapse in January 2006. Additionally, the deferral had the

impact of reducing charge-offs and transfers to nonperforming status.

78