Capital One 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As of December 31, 2005, the Corporation had one effective shelf registration statement under which the Corporation from

time to time may offer and sell senior or subordinated debt securities, preferred stock, common stock, common equity units

and stock purchase contracts. This shelf registration statement was updated in October 2005 to increase capacity to an

aggregate amount not to exceed $2.5 billion.

On May 17, 2005, the Company issued 10.4 million shares of common stock in accordance with the settlement provisions of

the forward purchase contracts related to the mandatory convertible debt securities (the “Upper DECs”) issued in April of

2002. The issuance provided $747.5 million in cash proceeds.

In

May 2005, the Company issued $500.0 million of ten year 5.50% fixed rate senior notes through its shelf registration.

In February 2005, the Company completed a remarketing of approximately $704.5 million aggregate principal amount of its

6.25% senior notes due May 17, 2007. As a result of the remarketing, the annual interest rate on the senior notes was reset to

4.738%. The remarketing was conducted pursuant to the original terms of the Uppers Decs mandatory convertible securities

issued in April of 2002. Subsequently in February 2005, the Company extinguished $585.0 million principal amount of the

remarketed senior notes and issued in its place $300.0 million of seven year 4.80% fixed rate senior notes and $300.0 million

of twelve year 5.25% fixed rate senior notes.

In November 2005, in connection with the Hibernia acquisition, the Company assumed $100.0 million of ten year 5.35%

fixed rate subordinated notes. The Company also assumed $51.5 million aggregate principal amount of 9.0% junior

subordinated debentures due June 30, 2032 and $10.3 million aggregate principal amount of floating rate (LIBOR plus

3.05%, reset quarterly) junior subordinated debentures due June 30, 2033. The debentures were issued by a subsidiary of

Hibernia to Coastal Capital Trust I (“CCTI”) and Coastal Capital Trust II (“CCTII”). CCTI and CCTII are considered

business trusts. The trust preferred securities represent a beneficial interest in the assets of the business trusts.

In connection with the Hibernia acquisition, the Company also assumed Federal Reserve Home Loan Bank (FHLB) advances

which are secured by the Company’ s investment in FHLB stock and by a blanket floating lien on portions of the Company’ s

residential mortgage loan portfolio. FHLB stock totaled $105.2 million at December 31, 2005 and is included in securities

available for sale.

D

eposits

The Company continues to expand its retail deposit gathering efforts through its direct marketing channels. With the

completion of the Hibernia acquisition, retail deposits will also be originated through the existing Hibernia branch network

nd through De Novo branch expansion. a

D

eposits from the direct marketing business continued to grow due to expansion in marketed channels, such as the internet.

With the acquisition of Hibernia, Capital One acquired a new channel for deposit growth. The branch network offers a

broader set of deposit products that include demand deposits, money market deposits, NOW accounts, and certificates of

deposits (“CDs”). Hibernia experienced an increase in incremental deposits since the Gulf Coast Hurricanes due in part to

customers receiving federal funds and insurance payments.

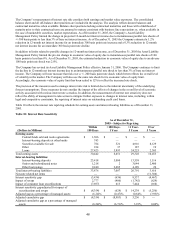

As of December 31, 2005, the Company had $47.9 billion in deposits of which $2.4 billion were held in foreign banking

offices and $11.0 billion represented large domestic denomination certificates of $100 thousand or more.

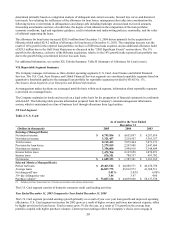

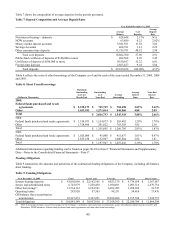

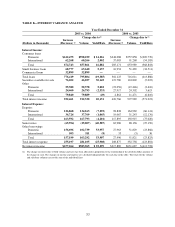

Table 6 shows the maturities of domestic time certificates of deposit in denominations of $100 thousand or greater (large

enomination CDs) as of December 31, 2005. d

T

able 6: Maturities of Large Denomination Certificates—$100,000 or More

December 31, 2005

(Dollars in thousands) Balance Percent

Three months or less $ 1,815,619 16.52%

Over 3 through 6 months 1,163,411 10.59

Over 6 through 12 months 1,798,701 16.37

Over 12 months through 10 years 6,211,723 56.52

Total $ 10,989,454 100.00%

44