Capital One 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

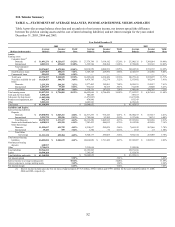

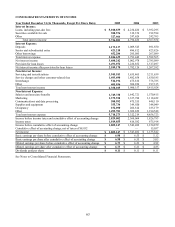

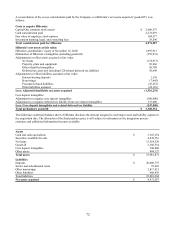

Item 8. Financial Statements and Supplementary Data

CONSOLIDATED BALANCE SHEETS

December 31 (In Thousands, Except Share and Per Share Data)

2005 2004

Assets:

Cash and due from banks $ 2,022,175 $ 327,517

Federal funds sold and resale agreements 1,305,537 773,695

Interest-bearing deposits at other banks 743,555 309,999

Cash and cash equivalents 4,071,267 1,411,211

Securities available for sale 14,350,249 9,300,454

Loans 59,847,681 38,215,591

Less: Allowance for loan losses (1,790,000) (1,505,000)

Net loans 58,057,681 36,710,591

Accounts receivable from securitizations 4,904,547 4,081,271

Premises and equipment, net 1,191,406 817,704

Interest receivable 563,542 252,857

Goodwill 3,906,399 352,157

Other 1,656,320 821,010

Total assets $ 88,701,411 $ 53,747,255

Liabilities:

Non-interest bearing deposits $ 4,841,171 $ 50,155

Interest-bearing deposits 43,092,096 25,636,802

Total deposits 47,933,267 25,686,957

Senior and subordinated notes 6,743,979 6,874,790

Other borrowings 15,534,161 9,637,019

Interest payable 371,681 237,227

Other 3,989,409 2,923,073

Total liabilities 74,572,497 45,359,066

Stockholders’ Equity:

Preferred stock, par value $.01 per share; authorized 50,000,000 shares, none issued or

outstanding — —

Common stock, par value $.01 per share; authorized 1,000,000,000 shares, 302,786,444

and 248,354,259 issued as of December 31, 2005 and 2004, respectively 3,028 2,484

Paid-in capital, net 6,848,544 2,711,327

Retained earnings 7,378,015 5,596,372

Cumulative other comprehensive income 6,129 144,759

Less: Treasury stock, at cost; 2,025,160 and 1,520,962 shares as of December 31,

2005 and 2004, respectively (106,802) (66,753)

Total stockholders’ equity 14,128,914 8,388,189

Total liabilities and stockholders’ equity $ 88,701,411 $ 53,747,255

See Notes to Consolidated Financial Statements.

62