Capital One 2005 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 6 -

DIVERSIFIED BUSINESSES

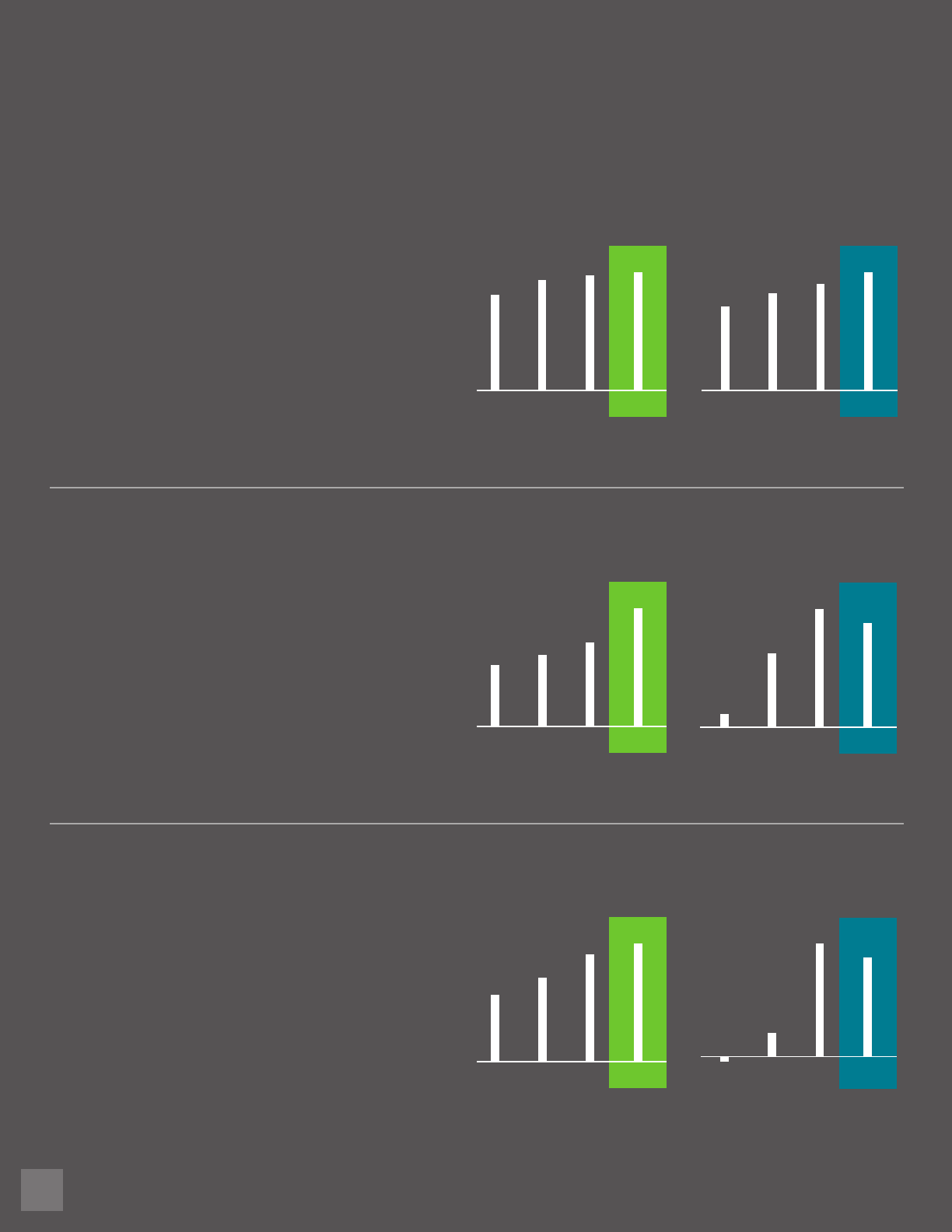

us card

In 2005, we focused on rewards and other segments

where we can deliver consistent returns and customer

value. As a result, our US Card business delivered out-

standing bottom-line returns, strong credit performance

and steady profit growth. Despite intense competition

in a consolidated industry, US Card is well positioned

to continue its success.

auto finance

Our Auto Finance business delivered outstanding

loan growth and strong profitability in 2005. We

also enhanced our national origination and servicing

capabilities. The Auto Finance business is poised for

continuing success as the auto lending market

consolidates.

global financial services

Global Financial Services (GFS) delivered solid

performance in 2005, powered by strong results in

our Small Business, Installment Lending, Home Loans,

and Canadian Credit Card businesses. GFS loan

growth in 2005 further diversified our assets and

built future earnings power.

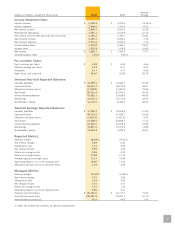

managed loans ($ in billions) net income ($ in millions)

managed loans ($ in billions) net income ($ in millions)

managed loans ($ in billions) net income ($ in millions)

2002

$40.9

2003

$46.3

2004

$48.6

2005

$49.5

2002

$1,000.8

2003

$1,181.2

2004

$1,387.3

2005

$1,609.4

2002

$7.0

2003

$8.5

2004

$10.0

2005

$16.4

2002

$10.3

2003

$99.3

2004

$163.8

2005

$132.1

2002

$11.9

2003

$16.5

2004

$21.2

2005

$23.4

2002

($8.1)

2003

$64.8

2004

$213.1

2005

$186.0