Capital One 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We believe that we have meritorious defenses with respect to these cases and intend to defend these cases vigorously. At the

present time, management is not in a position to determine whether the resolution of these cases will have a material adverse

effect on either the consolidated financial position of the Corporation or the Corporation’ s results of operations in any future

reporting period.

In addition, several merchants filed class action antitrust lawsuits, which were subsequently consolidated, against the

associations relating to certain debit card products. In April 2003, the associations agreed to settle the lawsuit in exchange for

payments to plaintiffs and for changes in policies and interchange rates for debit cards. Certain merchant plaintiffs have opted

out of the settlements and have commenced separate lawsuits. Additionally, consumer class action lawsuits with claims

mirroring the merchants’ allegations have been filed in several courts. Finally, the associations, as well as certain member

anks, continue to face additional lawsuits regarding policies, practices, products and fees. b

With the exception of the Interchange lawsuits and the Amex lawsuit, the Corporation and its subsidiaries are not parties to

the lawsuits against the associations described above and therefore will not be directly liable for any amount related to any

possible or known settlements of such lawsuits. However, the Corporation’ s subsidiary banks are member banks of

MasterCard and Visa and thus may be affected by settlements or lawsuits relating to these issues, including changes in

interchange payments. In addition, it is possible that the scope of these lawsuits may expand and that other member banks,

including the Corporation’ s subsidiary banks, may be brought into the lawsuits or future lawsuits. The associations are also

subject to additional litigation, including suits regarding foreign exchange fees. As a result of such litigation, the associations

are expected to continue to evolve as corporate entities, including by changing their governance structures, as previously

announced by the associations.

Given the complexity of the issues raised by these lawsuits and the uncertainty regarding: (i) the outcome of these suits,

(ii) the likelihood and amount of any possible judgments, (iii) the likelihood, amount and validity of any claim against the

associations’ member banks, including the banks and the Corporation, and (iv) changes in industry structure that may result

from the suits and (v) the effects of these suits, in turn, on competition in the industry, member banks, and interchange and

association fees, we cannot determine at this time the long-term effects of these suits on us.

We Face the Risk of Fluctuations in Our Expenses and Other Costs that May Hurt Our Financial Results

Our expenses and other costs, such as operating and marketing expenses, directly affect our earnings results. In light of the

extremely competitive environment in which we operate, and because the size and scale of many of our competitors provides

them with increased operational efficiencies, it is important that we are able to successfully manage such expenses. Many

factors can influence the amount of our expenses, as well as how quickly they may increase. For example, further increases in

postal rates or termination of our negotiated service arrangement with the United States Postal Service could raise our costs

for postal service. As our business develops, changes or expands, additional expenses can arise from management of

outsourced services, asset purchases, structural reorganization, a reevaluation of business strategies and/or expenses to

comply with new or changing laws or regulations. Other factors that can affect the amount of our expenses include legal and

administrative cases and proceedings, which can be expensive to pursue or defend.

W

e Face Risks Related to the Impact of the Gulf Coast Hurricanes That May Be Substantial and Cannot Be Predicted

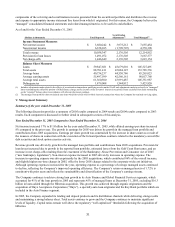

Hibernia is headquartered in New Orleans, Louisiana, and maintains branches in the areas of Louisiana and Texas that

sustained significant damage from the Gulf Coast hurricanes. Hibernia’ s operations in other parts of Louisiana and Texas

ave not been impacted, either significantly or at all, by the hurricanes. h

As a result of the hurricanes, Hibernia is experiencing increased costs, including the costs of rebuilding or repairing branches

and other properties as well as repairing or replacing equipment, some of which are not covered by insurance. Hibernia has

lso announced substantial employee and recovery related costs. a

The Gulf Coast hurricanes have also affected Hibernia’ s consumer, mortgage, auto, commercial and small business loan

portfolios by damaging properties pledged as collateral and by impairing certain borrowers’ ability to repay their loans. In

addition, Hibernia may experience losses from certain customer assistance policies, such as fee waivers, adopted in the wake

of the hurricanes. The hurricanes may continue to affect Hibernia’ s loan originations and loan portfolio quality into the future

and could also adversely impact Hibernia’ s deposit base. More generally, the combined company’ s ability to compete

effectively in the branch banking business in the future, especially with financial institutions whose operations were not

concentrated in the affected area or which may have greater resources than the combined company, will depend primarily on

Hibernia’ s ability to continue normal business operations and experience growth despite the impact of the hurricanes. The

severity and duration of these effects will depend on a variety of factors that are beyond Hibernia’ s control, including the

amount and timing of government, private and philanthropic investment (including deposits) in the region, the pace of

23