BMW 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

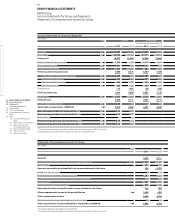

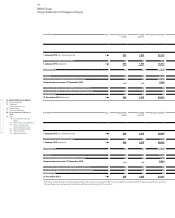

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

Foreign currency translation

The financial statements of consolidated companies

which are drawn up in a foreign currency are translated

using the functional currency concept (IAS 21 The

Effects of Changes in Foreign Exchange Rates) and the

modified closing rate method. The functional currency

of a subsidiary is determined as a general rule on the

basis of the primary economic environment in which it

operates and corresponds therefore usually to the rele-

vant local currency. Income and expenses of foreign

subsidiaries are translated in the Group Financial State-

ments at the average exchange rate for the year, and

assets and liabilities are translated at the closing rate.

Exchange differences arising from the translation of

shareholders’ equity are offset directly against accumu-

lated other equity. Exchange differences arising from

the use of different exchange rates to translate the

in-

come statement are also offset directly against accumu-

lated other equity.

Foreign currency receivables and payables in the single

entity accounts of BMW AG and subsidiaries are

re-

corded, at the date of the transaction, at cost. At the end

of the reporting period, foreign currency receivables

and payables are translated at the closing exchange rate.

The resulting unrealised gains and losses as well as the

subsequent realised gains and losses arising on settle-

ment are recognised in the income statement in ac-

cordance

with the underlying substance of the relevant

transactions.

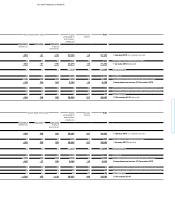

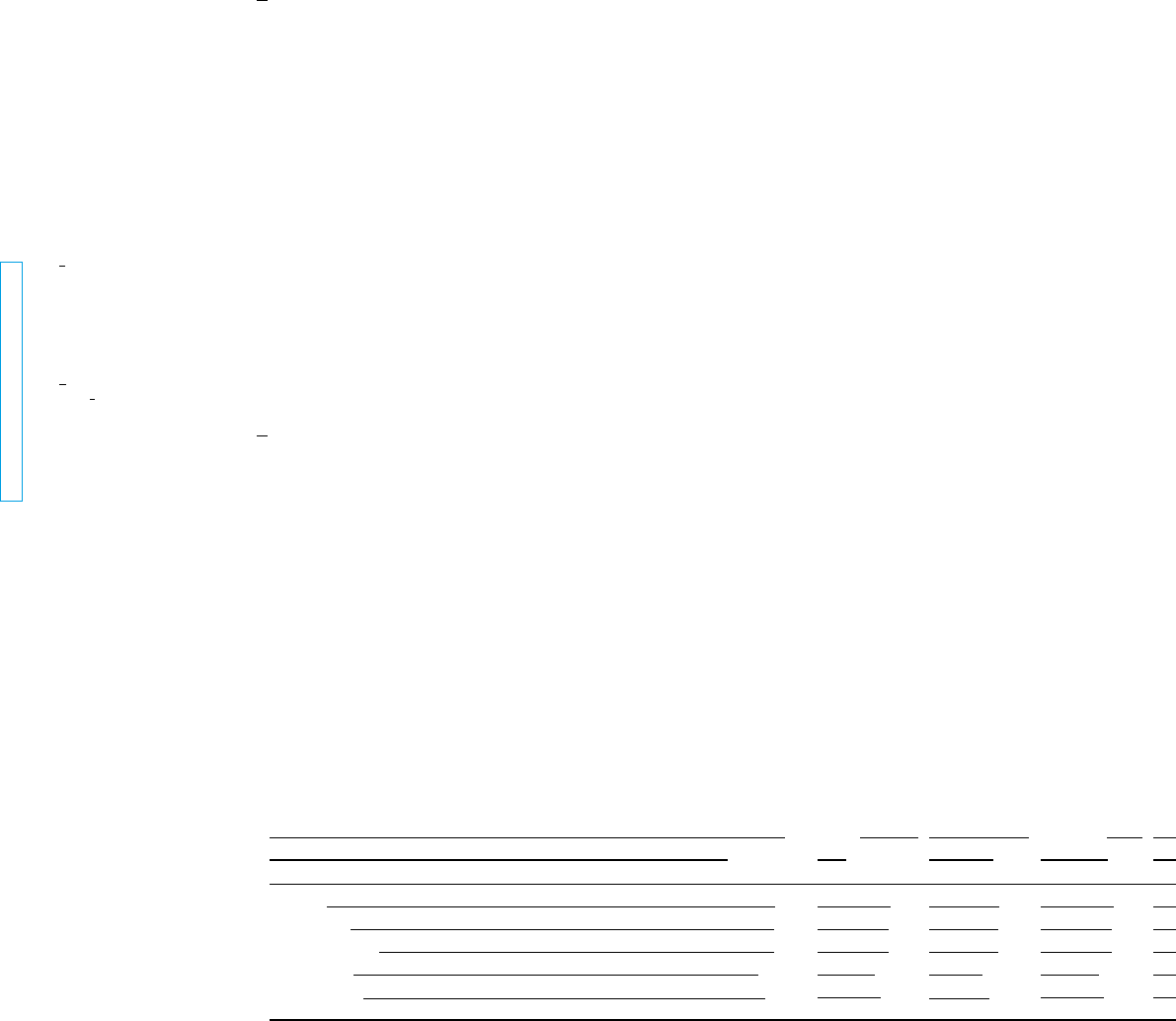

The exchange rates of those currencies which have a

material impact on the Group Financial Statements were

as follows:

4

Closing rate Average rate

31. 12. 2013 31. 12. 2012 2013 2012

US Dollar 1.38 1.32 1.33 1.29

British Pound 0.83 0.81 0.85 0.81

Chinese Renminbi 8.34 8.23 8.16 8.11

Japanese Yen 144.55 114.10 129.70 102.63

Russian Rouble 45.29 40.41 42.34 39.91

Consolidation principles

The equity of subsidiaries is consolidated in accordance

with IFRS 3 (Business Combinations). IFRS 3 requires

that all business combinations are accounted for using

the acquisition method, whereby identifiable assets and

liabilities acquired are measured at their fair value at

acquisition date. An excess of acquisition cost over the

Group’s share of the net fair value of identifiable assets,

liabilities and contingent liabilities is recognised as good-

will as a separate balance sheet line item and allocated

to the relevant cash-generating unit (CGU). Goodwill of

€ 91 million which arose prior to 1 January 1995 remains

netted against reserves.

Receivables, payables, provisions, income and expenses

and profits between consolidated companies (intra-group

profits) are eliminated on consolidation.

Munich, was merged with BMW Finanz Verwaltungs

GmbH, Munich, in the fourth quarter and therefore

ceased to be a consolidated company.

The Group reporting entity also changed by comparison

to the previous year as a result of the first-time

consoli-

dation of twelve special purpose trusts and one special

Under the equity method, investments are measured at

the BMW Group’s share of equity taking account of

fair

value adjustments. Any difference between the cost

of investment and the Group’s share of equity is ac-

counted

for in accordance with the acquisition method.

Investments in other companies are accounted for as a

general rule using the equity method when significant

influence can be exercised (IAS 28 Investments in Asso-

ciates). As a general rule, there is a rebuttable

assump-

tion that the Group has significant influence if it holds

between 20 % and 50 % of the associated company’s and /

or joint venture’s voting power.

purpose securities fund and the deconsolidation of six

special purpose trusts.

The changes to the composition of the Group do not have

a material impact on the results of operations,

financial

position or net assets of the Group.

3