BMW 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

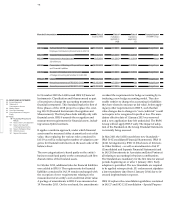

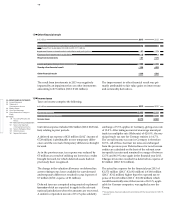

The calculation of pension provisions requires assump-

tions to be made with regard to discount factors, salary

trends, employee fluctuation and the life expectancy

of

employees. As in previous years, discount factors are

determined by reference to market yields at the end of

the reporting period on high quality corporate bonds.

The salary level trend refers to the expected rate of

salary increase which is estimated annually depending

on inflation and the career development of employees

within the Group. Further information is provided in

note 35.

Adjustments as a result of IAS 19 (revised 2011)

In June 2011 the IASB published amendments to IAS 19

(

Employee Benefits), in particular in relation to post

-

retirement benefits and pensions. The revised Standard

was endorsed by the EU in June 2012. The revised version

of IAS 19 is mandatory for annual periods beginning on

or after 1 January 2013.

As a result of the revised Standard, the BMW Group

has made amendments mainly in connection with the

measurement of obligations for pensions and pre-retire-

ment part-time working arrangements.

The change in the measurement of pension obligations

relates primarily to the treatment of other expected

administrative costs, which may no longer be included

in the measurement of the obligation. In addition, more

extensive disclosure requirements now apply.

The requirement to recognise past service cost imme-

diately

as expense (rather than spread such costs over

the term) also results in an adjustment to pension provi-

sions.

The adjustments to the provision for pre-retirement

part-

time working arrangements result from a change in

the measurement of top-up amounts, which are now

required, in accordance with revised IAS 19.8, to be

recognised as other long-term employee benefits. Under

the new rules, the expense for top-up amounts is re-

quired to be recognised in instalments with effect from

7

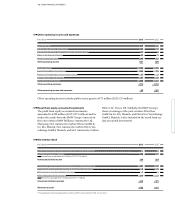

The calculation of deferred tax assets requires assump-

tions to be made with regard to the level of future taxa-

ble income and the timing of recovery of deferred tax

assets. These assumptions take account of forecast op-

erating results and the impact on earnings of the rever-

sal of taxable temporary differences. Since future

busi-

ness developments cannot be predicted with certainty

and to some extent cannot be influenced by the BMW

Group, the measurement of deferred tax assets is sub-

ject

to uncertainty. Further information is provided in

note 16.

the contract date up to the end of working phase of such

arrangements and then released over the period of the

work-free phase (rather than recognising the full amount

as a provision at the start of the working phase).

The revised version of IAS 19 also changes the presen-

tation of financial result in the income statement. As

a result of the fact that net interest is now required to

be computed on the basis of the net defined benefit

liability for pension plans, the expense arising from

unwinding the interest on pension obligations is now

offset against interest income from plan assets. The

statement of total comprehensive income now includes

the line item “Remeasurement of the net defined bene-

fit

liability for pension plans”. In previous financial

statements (up to the Group Financial Statements for

the year ended 31 December 2012), the corresponding

amounts were designated as actuarial gains and losses

on defined benefit pension benefits, similar obligations

and plan assets.

The removal of the corridor method and other amend-

ments to IAS 19 do not have any impact on the BMW

Group.

The new rules are required to be applied retrospectively.

For this reason, the opening balance sheet at 1 January

2012, the comparative figures and the opening balance

sheet at 1 January 2013 were adjusted and made com-

parable.