BMW 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

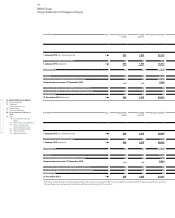

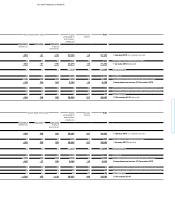

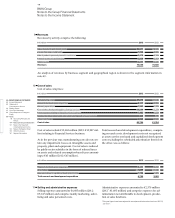

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

and an appropriate proportion of administrative and

social costs.

Borrowing costs are not included in the acquisition or

manufacturing cost of inventories.

Cash and cash equivalents comprise mainly cash on

hand

and cash at bank with an original term of up to three

months.

Assets held for sale and disposal groups held for sale are

presented separately in the balance sheet in accordance

with IFRS 5, if the carrying amount of the relevant

as-

sets will be recovered principally through a sale trans-

action

rather than through continuing use. This situa-

tion only arises if the assets can be sold immediately in

their present condition, the sale is expected to be com-

pleted within one year from the date of classification

and the sale is highly probable. At the date of

classifica-

tion, property, plant and equipment, intangible assets

and disposal groups which are being held for sale are

measured at the lower of their carrying amount and

their

fair value less costs to sell and scheduled deprecia-

tion / amortisation ceases. This does not apply, however,

to items within the disposal group which are not covered

by the measurement rules contained in IFRS 5.

Simul-

taneously, liabilities directly related to the sale are

pre-

sented separately on the equity and liabilities side of the

balance sheet as “Liabilities in conjunction with assets

held for sale”.

Provisions for pensions and similar obligations are rec-

ognised using the projected unit credit method in

ac-

cordance with IAS 19 (Employee Benefits). Under this

method, not only obligations relating to known vested

benefits at the reporting date are recognised, but also

the

effect of future increases in pensions and salaries. This

involves taking account of various input factors which

are evaluated on a prudent basis. The calculation is based

Assumptions, judgements and estimations

The preparation of the Group Financial Statements in

accordance with IFRSs requires management to make

certain assumptions and judgements and to use estima-

tions that can affect the reported amounts of assets and

liabilities, revenues and expenses and contingent liabili-

on an independent actuarial valuation which takes into

account all relevant biometric factors.

Remeasurements of the net defined benefit liability for

pension plans are recognised, net of deferred tax, directly

in equity (revenue

reserves).

Net interest expense on the net defined benefit liability

and / or net interest income on the net defined benefit

asset are presented separately within the financial result.

All other costs relating to allocations to pension

pro-

visions are allocated to costs by function in the income

statement.

Other provisions are recognised when the BMW Group

has a present obligation (legal or constructive) arising

from past events, the settlement of which is probable

and when a reliable estimate can be made of the amount

of the obligation. Measurement of provisions is based

on the best estimate of the expenditure required to

settle

the present obligation at the end of the reporting

period. Non-current provisions with a remaining period

of more than one year are discounted to the present

value of the expenditures expected to settle the obligation

at the end of the reporting period.

Financial liabilities are measured on first-time recogni-

tion at cost which corresponds to the fair value of the

consideration given. Transaction costs are also taken

into account except for financial liabilities allocated to

the category “financial liabilities measured at fair value

through profit or loss”. Subsequent to initial recogni-

tion, liabilities are – with the exception of derivative

financial instruments – measured at amortised cost using

the effective interest method. The BMW Group has no

liabilities which are held for trading. Liabilities from

finance leases are stated at the present value of the fu-

ture

lease payments and disclosed under other finan-

cial liabilities.

ties. Judgements have to be made in particular when as-

sessing whether the risks and rewards incidental to

ownership of a leased asset have been transferred and,

hence, the classification of leasing arrangements.

Major items requiring assumptions and estimations are

described below. The assumptions used are continuously

6