BMW 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59 COMBINED MANAGEMENT REPORT

Comments on Financial Statements of BMW AG

Bayerische Motoren Werke Aktiengesellschaft (BMW AG),

which is based in Munich, Germany, is the parent com-

pany of the BMW Group. The comments on the BMW

Group and Automotive segment provided in earlier sec-

tions are also relevant for BMW AG, unless presented

differently in the following section. The Financial

State-

ments of BMW AG are drawn up in accordance with

the provisions of the German Commercial Code (HGB)

and the relevant supplementary provisions contained

in the German Stock Corporation Act (AktG).

The main financial and non-financial performance

in-

dicators relevant for BMW AG are largely identical and

synchronous with those of the Automotive segment

of the BMW Group and are described in detail in the

“Report on Economic Position” section of the Combined

Management Report.

Differences between the accounting policies used in the

BMW AG Financial Statements (prepared in accordance

with HGB) and the BMW Group Financial Statements

(prepared in accordance with IFRSs) arise primarily in

connection with the accounting treatment of intangible

assets, financial instruments and provisions.

Business environment and review of operations

The general and sector-specific environment in which

BMW AG operates is the same as that for the BMW Group

and is described in the “Report on economic position”

section of the Combined Management Report.

BMW AG develops, manufactures and sells cars and

motorcycles as well as spare parts and accessories manu-

factured by itself, foreign subsidiaries and external sup-

pliers. Sales activities are carried out through the Com-

pany’s own branches, subsidiaries, independent dealers

and importers. In 2013, BMW AG was able to increase

its sales volume by 127,745 units to 1,995,903 units. This

figure includes 214,949 units relating to series sets

sup-

plied to the joint venture BMW Brilliance Automotive Ltd.,

Shenyang, an increase of 64,985 units over the previous

year. At 31 December 2013, BMW AG had 77,110 em-

ployees,

2,539 more than one year earlier.

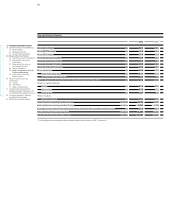

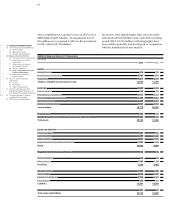

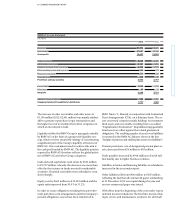

Results of operations, financial position and net assets

Revenues increased by 2.8 % compared to the previous

year. The most significant increase was recorded in Asia.

Sales to Group sales companies accounted for € 46.1 bil-

lion or 76.2 % of total revenues of € 60.5 billion. The

in-

crease in cost of sales was less pronounced than the

increase in revenues, mainly reflecting the lower cost of

materials per unit. As a consequence, gross profit in-

creased

by € 854 million to € 13.4 billion.

Administrative expenses were 25.9 % up on the previous

year due to the restructuring of IT activities at corporate

level and higher expenses for new IT projects.

Research and development expenses were 22.1 % higher

than in the previous year, driven for the main part by

expenses arising in connection with production start-ups

for new models as well as expenditure on alternative

drive technologies and lightweight construction.

The decrease in net other operating income and expenses

was attributable mainly to the fact that taxes arising in

conjunction with profit and loss transfer agreements

were not allocated to the Group entities involved. Work-

ing in the opposite direction within other operating

income and expenses, fine-tuning of the methodology

used to measure warranties resulted in a higher level of

income from reversals of provisions.

The financial result deteriorated by € 229 million, mainly

as a result of the negative impact of the fair value meas-

urement of designated plan assets for pension and other

non-current personnel-related obligations.

The profit from ordinary activities decreased from

€ 4,797 million to € 3,963 million.

The expense for income taxes relates primarily to current

tax for the financial year 2013. In addition, the first-time

application of IDW Position Statement RS HFA 34 means

that income-tax-related expenses are also now included

in the expense for income taxes.

After deducting the expense for taxes, the Company

reports a net profit of € 2,289 million compared to

€ 3,131 million

in the previous year.

Capital expenditure on intangible assets and property,

plant and equipment in the year under report amounted

to € 3,203 million (2012: € 2,776 million), an increase

of 15.4 %. The main focus of capital expenditure was on

product and infrastructure investments in conjunction

with the production start-up of new models as well as

the acquisition of licences. Depreciation and amortisation

amounted to € 1,732 million (2012: € 1,613 million).

Investments went up from € 3,094 million to € 3,377 mil-

lion, mainly as a result of a capital increase at the level

of BMW Automotive Finance (China) Co., Ltd., Beijing,