BMW 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

154

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

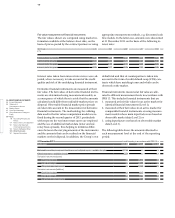

The cash flows shown comprise principal repayments

and the related interest. The amounts disclosed for de-

rivatives comprise only cash flows relating to derivatives

that have a negative fair value at the balance sheet date.

At 31 December 2013 irrevocable credit commitments

to dealers which had not been called upon at the end of

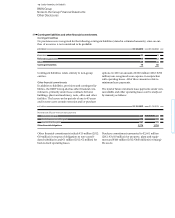

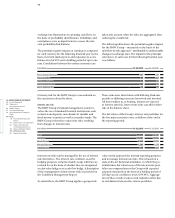

31 December 2012 Maturity Maturity Maturity Total

in € million within between one later than

one year and five years five years

Bonds – 8,482 – 18,375 – 5,071 – 31,928

Liabilities to banks – 4,866 – 4,469 – 678 – 10,013

Liabilities from customer deposits (banking) – 10,139 – 3,028 – – 13,167

Commercial paper – 4,578 – – – 4,578

Asset backed financing transactions – 2,170 – 7,346 – 137 – 9,653

Derivative instruments – 1,146 – 1,085 – 1 – 2,232

Trade payables – 6,424 – 9 – – 6,433

Other financial liabilities* – 86 – 248 – 424 – 758

Total – 37,891 – 34,560 – 6,311 – 78,762

* Previous year’s figures adjusted.

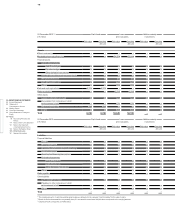

31 December 2013 Maturity Maturity Maturity Total

in € million within between one later than

one year and five years five years

Bonds – 7,933 – 21,434 – 3,043 – 32,410

Liabilities to banks – 4,686 – 4,328 – 126 – 9,140

Liabilities from customer deposits (banking) – 9,405 – 3,243 – – 12,648

Commercial paper – 6,294 – – – 6,294

Asset backed financing transactions – 2,814 – 7,614 – 32 – 10,460

Derivative instruments – 426 – 659 – 80 – 1,165

Trade payables – 7,283 – 195 – – 7,478

Other financial liabilities – 210 – 361 – 367 – 938

Total – 39,051 – 37,834 – 3,648 – 80,533

tion prevailing in the relevant market. The assets in-

volved are generally vehicles which can be converted

into cash at any time via the dealer organisation.

Impairment losses are recorded as soon as credit risks

are identified on individual financial assets, using a

methodology specifically designed by the BMW Group.

More detailed information regarding this methodology

is provided in the section on accounting policies (note 5).

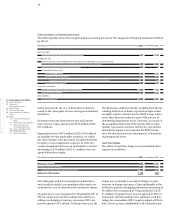

Creditworthiness testing is an important aspect of the

BMW Group’s credit risk management. Every borrower’s

creditworthiness is tested for all credit financing and lease

contracts entered into by the BMW Group. In the case

of retail customers, creditworthiness is assessed using vali-

dated

scoring systems integrated into the purchasing

process. In the area of dealer financing, creditworthiness

is assessed by means of ongoing credit monitoring and

an internal rating system that takes account not only of

the tangible situation of the borrower but also of qualita-

tive factors such as past reliability in business relations.

The credit risk relating to derivative financial instruments

is minimised by the fact that the Group only enters into

such contracts with parties of first-class credit standing.

The general credit risk on derivative financial instru-

ments utilised by the BMW Group is therefore not con-

sidered

to be significant.

A concentration of credit risk with particular borrowers

or groups of borrowers has not been identified in con-

junction with financial instruments.

Further disclosures relating to credit risk – in particu-

lar with regard to the amounts of impairment losses

recognised – are provided in the explanatory notes to

the relevant categories of receivables in notes 26, 27

and 31.

Liquidity risk

The following table shows the maturity structure of ex-

pected contractual cash flows (undiscounted) for finan-

cial liabilities: