BMW 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

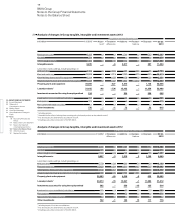

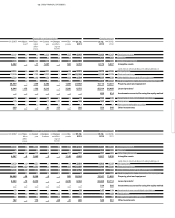

121 GROUP FINANCIAL STATEMENTS

BMW Group

Notes to the Group Financial Statements

Notes to the Statement of Comprehensive Income

20

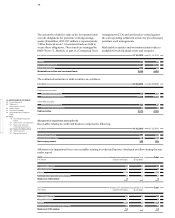

Disclosures relating to total comprehensive income

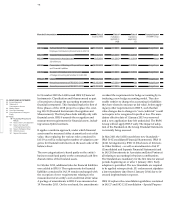

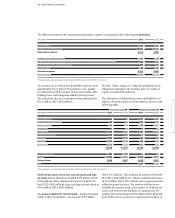

Other comprehensive income for the period after tax comprises the following:

Deferred taxes on components of other comprehensive income are as follows:

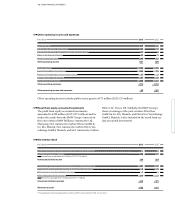

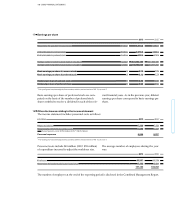

The total expense recognised in 2013 for the share-based

remuneration component of Board of Management

members and department heads was € 989,912 (2012:

€ 542,162).

The fair value of the two programmes at the date of grant

of the share-based remuneration components was

€ 1,453,500 (2012: € 1,379,723), based on a total of 19,196

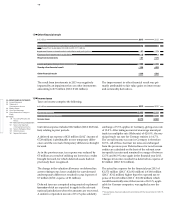

The result from equity accounted investments is reported

in the Statement of Changes in Equity in the line item

“Exchange differences on translating foreign operations”

with a negative amount of € 10 million (2012: negative

shares (2012: 22,915 shares) of BMW AG common stock

or a corresponding cash-based settlement measured at

the relevant market share price prevailing on the grant

date.

Further details on the remuneration of the Board of

Management are provided in the 2013 Compensation Re-

port, which is part of the Combined Management Report.

amount of € 5 million) and in the line item “Financial in-

struments used for hedging purposes” with a positive

amount of € 2 million (2012: positive amount of € 87 mil-

lion).

in € million 2013 2012*

Before Deferred After Before Deferred After

tax taxes tax tax taxes tax

Remeasurement of the net defined benefit liability for pension plans 1,308 – 372 936 – 1,914 538 – 1,376

Available-for-sale securities 8 19 27 214 – 45 169

Financial instruments used for hedging purposes 1,357 – 425 932 1,302 – 437 865

Other comprehensive income for the period from

equity accounted investments – 7 – 1 – 8 111 – 29 82

Exchange differences on translating foreign operations – 635 – – 635 – 123 – – 123

Other comprehensive income 2,031 -779 1,252 – 410 27 – 383

* Prior year figures have been adjusted in accordance with the revised version of IAS 19, see note 7.

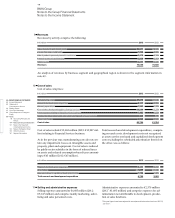

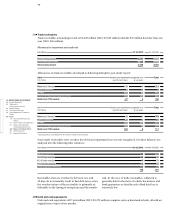

in € million 20131 20121, 2

Remeasurement of the net defined benefit liability for pension plans 1,308 – 1,914

Deferred taxes – 372 538

Items not expected to be reclassified to the income statement

in the future 936 – 1,376

Available-for-sale securities 8 214

thereof gains / losses arising in the period under report 48 174

thereof reclassifications to the income statement – 40 40

Financial instruments used for hedging purposes 1,357 1,302

thereof gains / losses arising in the period under report 1,536 770

thereof reclassifications to the income statement – 179 532

Other comprehensive income from equity accounted investments – 7 111

Deferred taxes – 407 – 511

Currency translation foreign operations – 635 – 123

Items expected to be reclassified to the income statement

in the future 316 993

Other comprehensive income for the period after tax 1,252 – 383

1 Presentation adjusted in accordance with revised IAS 1.

2 Prior year figures have been adjusted in accordance with the revised version of IAS 19, see note 7.