BMW 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

141 GROUP FINANCIAL STATEMENTS

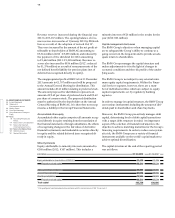

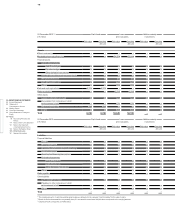

in € million

1. 1. 2013 *

Translation

Additions

Reversal of

Utilised Reversed 31. 12. 2013

differences

discounting

Obligations for personnel and social expenses 1,616 – 12 1,310 – – 1,194 – 23 1,697

Obligations for ongoing operational expenses 3,181 – 117 1,486 13 – 1,010 – 85 3,468

Other obligations 1,879 – 48 854 – 8 – 450 – 209 2,018

Other provisions 6,676 – 177 3,650 5 – 2,654 – 317 7,183

* Prior year figures adjusted in accordance with the revised IAS 19, see note 7, and include mergers.

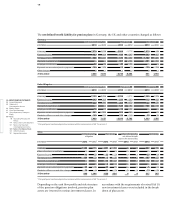

in € million 31. 12. 2013 31. 12. 2012*

Total thereof Total thereof

due within due within

one year one year

Obligations for personnel and social expenses 1,697 1,299 1,611 1,198

Obligations for ongoing operational expenses 3,468 1,076 3,177 924

Other obligations 2,018 1,036 1,899 1,124

Other provisions 7,183 3,411 6,687 3,246

* Prior year figures have been adjusted in accordance with the revised version of IAS 19, see note 7.

36

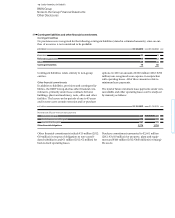

Other provisions

Other provisions comprise the following items:

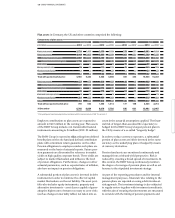

Provisions for obligations for personnel and social ex-

penses comprise mainly performance-related remunera-

tion components, early retirement part-time working

arrangements and employee long-service awards. Obli-

gations for performance-related remuneration compo-

nents are normally settled in the following financial

year. Provisions for obligations for on-going operational

expenses relate primarily to warranty obligations and

comprise both statutorily prescribed manufacturer war-

ranties and other guaranties offered by the BMW

Group. Depending on when claims are made, it is possi-

ble that the BMW Group may be called upon to fulfil ob-

ligations over the whole period of the warranty or guar-

antee. Provisions for other obligations cover numerous

specific risks and obligations of uncertain timing and

amount, in particular for litigation and liability risks.

Other provisions changed during the year as follows:

Income from the reversal of other provisions amounting to € 134 million (2012: € 129 million) is included in costs by

function in the income statement.

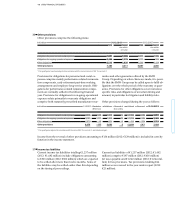

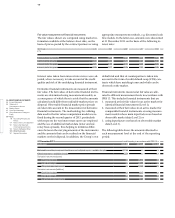

37

Income tax liabilities

Current income tax liabilities totalling € 1,237 million

(2012: € 1,482 million) include obligations amounting

to € 823 million (2012: € 806 million) which are expected

to be settled after more than twelve months. Some of

the liabilities may be settled earlier than this depending

on the timing of proceedings.

Current tax liabilities of € 1,237 million (2012: € 1,482

million) comprise € 197 million (2012: € 438 million)

for taxes payable and € 1,040 million (2012: € 1,044 mil-

lion) for tax provisions. Tax provisions totalling € 44

million were reversed in the year under report (2012:

€ 23 million).