BMW 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127 GROUP FINANCIAL STATEMENTS

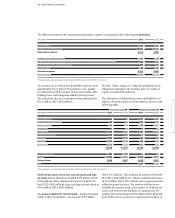

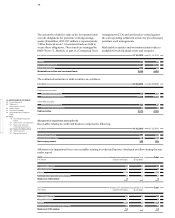

Allowances for impairment on receivables from sales financing developed as follows during the year under report:

2013 Allowance for impairment recognised on a Total

in € million specific item basis group basis

Balance at 1 January 1,268 411 1,679

Allocated / reversed 194 104 298

Utilised – 302 – 15 – 317

Exchange rate impact and other changes – 61 – 19 – 80

Balance at 31 December 1,099 481 1,580

2012 Allowance for impairment recognised on a Total

in € million specific item basis group basis

Balance at 1 January* 1,355 262 1,617

Allocated / reversed 298 113 411

Utilised – 314 – 21 – 335

Exchange rate impact and other changes – 71 57 – 14

Balance at 31 December 1,268 411 1,679

* Including entities consolidated for the first time during the financial year.

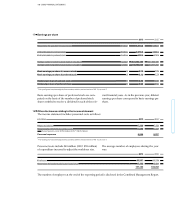

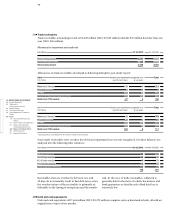

At the end of the reporting period, impairment allow-

ances

of € 481 million (2012: € 411 million) were recog-

nised o

n a group basis on gross receivables from sales

financing totalling € 30,155 million (2012: € 30,813 mil-

lion). Impairment allowances of € 1,099 million (2012:

€ 1,268 million) were recognised at 31 December 2013

on a specific item basis on gross receivables from sales

financing totalling € 12,211 million (2012: € 11,149 mil-

lion).

Receivables from sales financing which were not over-

due at the end of the reporting period amounted to

€ 13,331 million (2012: € 12,631 million). No impairment

losses were recognised for these balances.

The estimated fair value of collateral received for re-

ceivables

on which impairment losses were recognised

totalled € 23,689 million (2012: € 21,649 million) at the

end of the reporting period. This collateral related

pri-

marily to vehicles. The carrying amount of assets held

as collateral and taken back as a result of payment de-

fault amounted to € 30 million (2012: € 37 million).

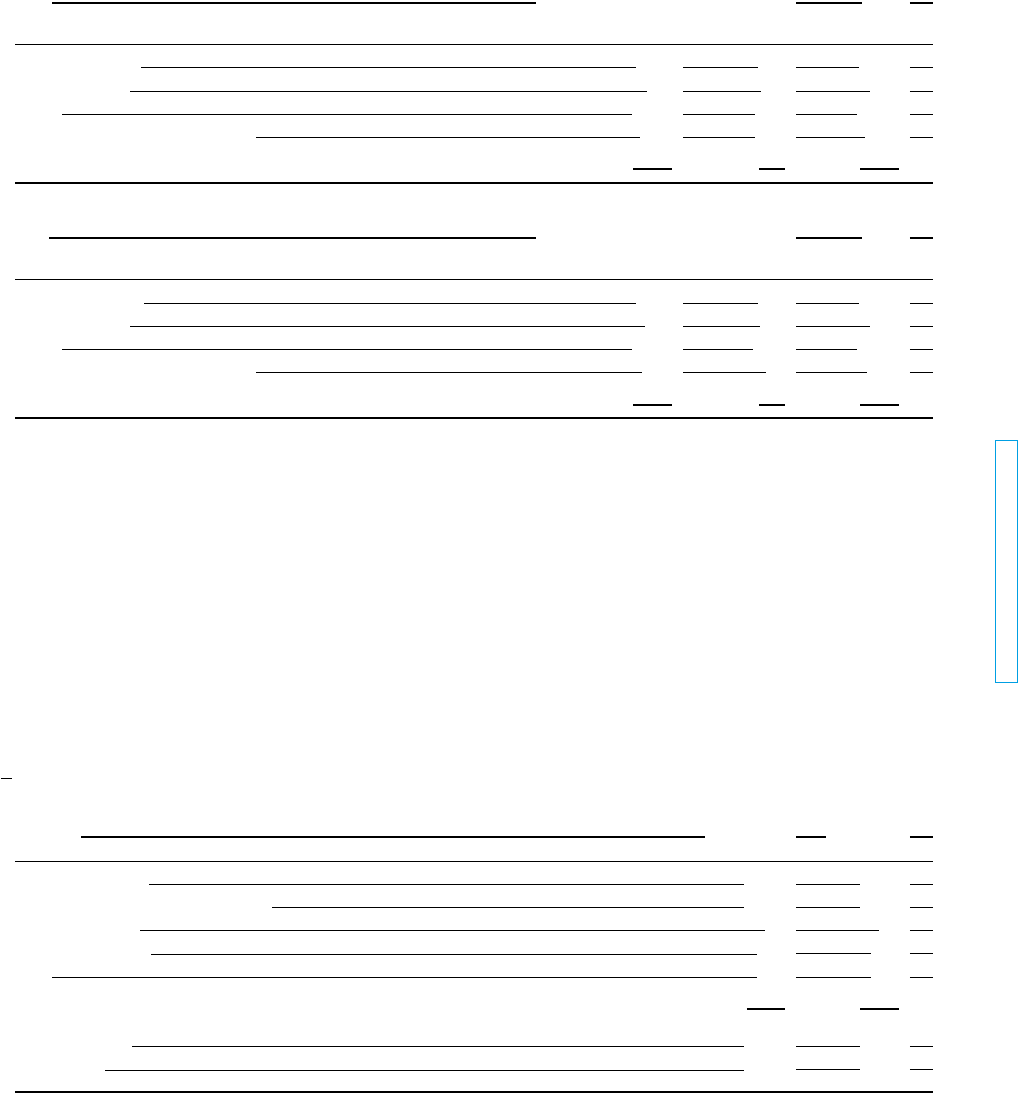

in € million 31. 12. 2013 31. 12. 2012

Derivative instruments 4,013 2,992

Marketable securities and investment funds 3,060 2,655

Loans to third parties 32 44

Credit card receivables 222 234

Other 825 835

Financial assets 8,152 6,760

thereof non-current 2,593 2,148

thereof current 5,559 4,612

27

Financial assets

Financial assets comprise:

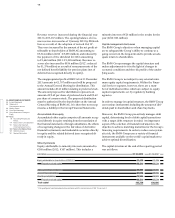

The increase in derivative instruments was primarily

attributable to positive market price developments of

currency derivatives.

The rise in marketable securities and investment funds

mainly reflects an increase in the BMW Group’s strategic

liquidity reserve.