BMW 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208

|

|

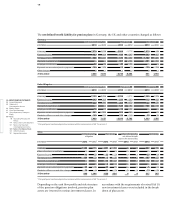

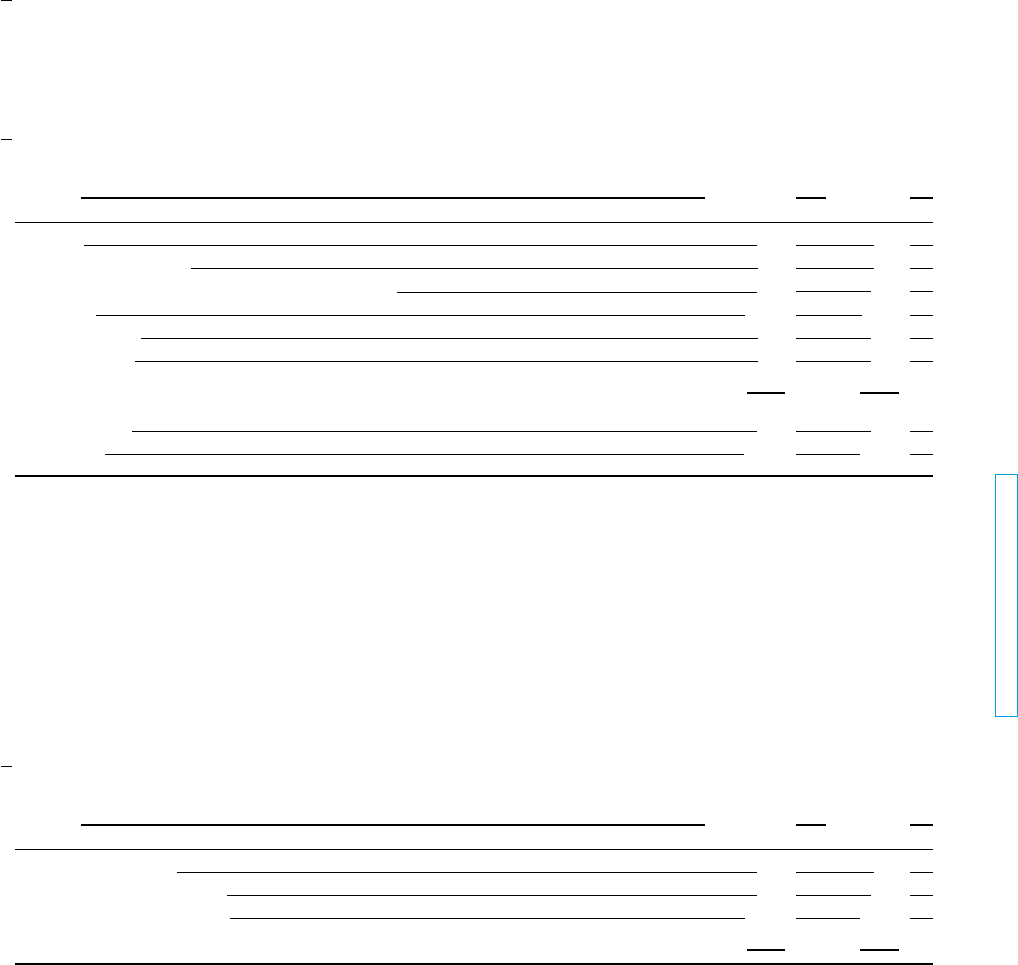

129 GROUP FINANCIAL STATEMENTS

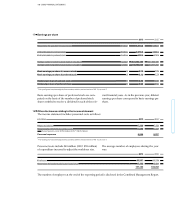

Income tax assets

Income tax assets totalling € 1,151 million (2012:

€ 966 million) include claims amounting to € 530 mil-

lion (2012: € 638 million) which are expected to be

settled after more than twelve months. Some of the

claims may be settled earlier than this depending on

the timing of proceedings.

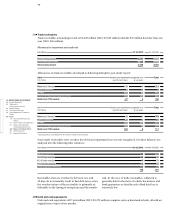

28

in € million 31. 12. 2013 31. 12. 2012*

Other taxes 867 796

Receivables from subsidiaries 779 738

Receivables from other companies in which an investment is held 999 676

Prepayments 1,074 1,043

Collateral receivables 706 555

Sundry other assets 794 659

Other assets 5,219 4,467

thereof non-current 954 803

thereof current 4,265 3,664

29

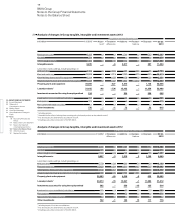

Other assets

Other assets comprise:

Receivables from subsidiaries include trade receivables

of € 102 million (2012: € 189 million) and financial

re-

ceivables of € 677 million (2012: € 549 million). They in-

clude € 253 million (2012: € 178 million) with a remaining

term of more than one year.

Receivables from other companies in which an invest-

ment is held include € 911 million (2012: € 608 million)

due within one year.

Prepayments of € 1,074 million (2012*: € 1,043 million) re-

late mainly to prepaid interest, insurance premiums and

commission paid to dealers. Prepayments of € 565 million

(2012*: € 588 million) have a maturity of less than one year.

Collateral receivables comprise mainly customary collat-

eral (banking deposits) arising on the sale of receivables.

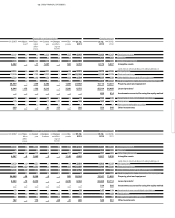

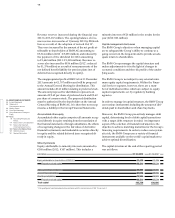

in € million 31. 12. 2013 31. 12. 2012

Raw materials and supplies 843 786

Work in progress, unbilled contracts 850 827

Finished goods and goods for resale 7,892 8,112

Inventories 9,585 9,725

30

Inventories

Inventories comprise the following:

At 31 December 2013, inventories measured at their

net realisable value amounted to € 592 million (2012:

€ 639 million) and are included in total inventories of

€ 9,585 million (2012: € 9,725 million). Write-downs

to

net realisable value amounting to € 28 million (2012:

€ 21 million) were recognised in 2013. Reversals of write-

downs in the year under report amounted to € 4 million

(2012: € – million).

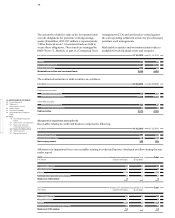

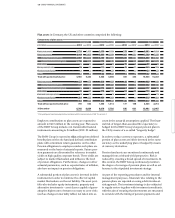

* Prior year figures have been adjusted in accordance with the revised version of IAS 19,

see note 7.