BMW 2013 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

152

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

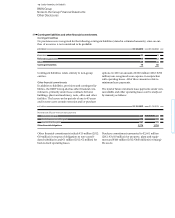

Fair value gains and losses recognised on derivatives

and recorded initially in accumulated other equity are

reclassified to cost of sales when the derivatives mature.

No gains / losses were recognised in “Financial Result” in

2013 in connection with forecasting errors and the re-

sulting over-hedging of currency exposures (2012: net

positive amount of € 1 million). In the previous year, the

impact arose primarily as a result of changes in sales

forecasts in foreign currencies. Gains attributable to the

ineffective portion of hedging instruments amounting to

€ 8 million were recognised in “Financial Result” (2012:

€ – million). No gains / losses were recognised in 2013 in

connection with forecasting errors relating to cash flow

hedges for commodities (2012: negative impact of € 8 mil-

lion). However, losses attributable to the ineffective por-

in € million 2013 2012

Balance at 1 January 202 – 750

Total changes during the year 934 952

thereof reclassified to the income statement – 179 532

Balance at 31 December 1,136 202

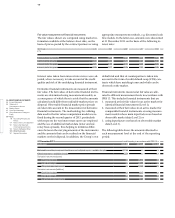

Gains / losses from the use of derivatives relate pri-

marily

to fair value gains or losses arising on stand-alone

derivatives.

Net interest income from interest rate and interest

rate / currency swaps amounted to € 126 million (2012:

€ 111 million).

Impairment losses of € 73 million (2012: € 166 million)

on available-for-sale marketable securities, for which

fair value changes were previously recognised directly

in equity, were recognised as expenses in 2013. Re-

versals of impairment losses on marketable securities

amounting to € 70 million (2012: € – million) were rec-

ognised directly in equity.

The disclosure of interest income resulting from the un-

winding of interest on future expected receipts would

normally only be relevant for the BMW Group where

assets have been discounted as part of the process of

determining impairment losses. However, as a result of

the assumption that most of the income that is subse-

quently recovered is received within one year and the

fact that the impact is not material, the BMW Group

does not discount assets for the purposes of determin-

ing impairment losses.

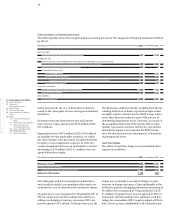

Cash flow hedges

The effect of cash flow hedges on accumulated other

equity was as follows:

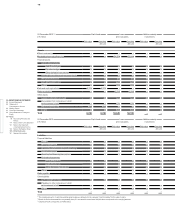

Gains and losses on financial instruments

The following table shows the net gains and losses arising for each of the categories of financial instrument defined

by IAS 39:

in € million 2013 2012

Held for trading

Gains / losses from the use of derivative instruments 571 – 278

Available-for-sale

Gains and losses on sale and fair value measurement of marketable securities held for sale

(including investments in subsidiaries and participations measured at cost) – 57 – 145

Net income from participations and investments 10 5

Accumulated other equity

Balance at 1 January 108 – 61

Total change during the year 27 169

thereof recognised in the income statement during the period under report – 40 40

Balance at 31 December 135 108

Loans and receivables

Impairment losses / reversals of impairment losses – 310 – 440

Other income / expenses 126 – 61

Other liabilities

Income / expenses – 235 – 115