BMW 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

24 Report on Economic Position

24 Overall Assessment by Management

24 General and Sector-specific

Environment

27

Financial and Non-financial

Performance Indicators

29 Review of Operations

29 Automotive Segment

35 Motorcycles Segment

36 Financial Services Segment

38 Research and Development

40 Purchasing

41 Sales and Marketing

42 Workforce

44 Sustainability

47 Results of Operations, Financial

Position and Net Assets

56 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Consolidated Financial Reporting Process

82

Disclosures Relevant for Takeovers

and Explanatory Comments

85

BMW Stock and Capital Markets

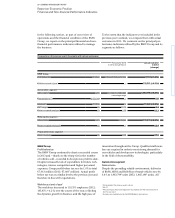

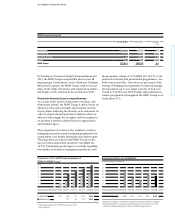

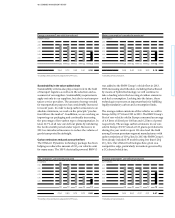

Financial Services segment achieves best figures

to date

The Financial Services segment again benefited from

its attractive product range in 2013 and reported

profitable

growth. The portfolio of leasing and credit

financing contracts in place with retail customers and

dealers grew by 7.4 % to a total of 4,130,002 contracts,

the highest figure ever reported by the segment (2012:

3,846,364 contracts). Business volume in balance sheet

terms grew by 4.2 % to stand at € 84,347 million at the

end of the reporting period (2012: € 80,974 million).

Credit financing and the lease of BMW Group brand

cars and motorcycles to retail customers is the segment’s

largest line of business. In our multi-brand line of busi-

ness, which operates under the brand name “Alphera”,

we also offer financing for vehicles of other manufac-

turers. Moreover, we support our own dealer organisa-

tion by providing financing for dealership vehicle inven-

tories, real estate and equipment. In its international

multi-brand fleet business, which operates under the

brand name “Alphabet”, the BMW Group offers a wide

range of individualised mobility solutions for corpo-

rates, ranging from vehicle financing on the one hand

through to bespoke services and full fleet manage-

ment

on the other. The segment’s range of products is

rounded off by a host of individualised insurance

products and attractive banking services.

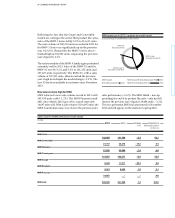

Sharp rise in leasing and new credit business

The segment’s worldwide lease and credit financing busi-

ness

with retail customers continued to grow in 2013.

With a total of 1,471,385 new contracts, the segment set

a new record for the number of new contracts signed

in a year, surpassing the previous year’s figure by 9.7 %

(2012: 1,341,296 contracts).

Lease business and credit financing business contributed

equally to this strong growth, in both cases with an in-

FINANCIAL SERVICES SEGMENT

crease of 9.7 % over the previous year. Leasing accounted

for 33.8 % of new business, credit financing for 66.2 %.

The proportion of new BMW Group cars leased or

financed by the Financial Services segment was 44.0 %,

3.6 percentage points higher than one year earlier.

In the used car financing line of business, 315,919 new

contracts for BMW and MINI brand cars were signed

in 2013, 4.1 % more than in the previous year (2012:

303,490 contracts).

The total volume of all new credit financing and leas-

ing

contracts concluded with retail customers during

the twelve-month period amounted to € 39,241 million,

an increase of 7.0 % over the previous year (2012:

€ 36,664 million).

This surge in new business had a positive impact on the

overall size of the contract portfolio, which grew to a

total of 3,793,768 contracts at the end of the reporting

period (2012: 3,534,620 contracts; + 7.3 %). Growth

was recorded across all regions, with increases in the

Europe / Middle East region (+ 8.8 %), the Americas

region (+ 5.5 %) and for the EU Bank (+ 2.4 %). The most

significant rise was again recorded in the Asia / Pacific

region, where the contract portfolio grew by 23.6 %.

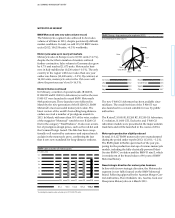

Expansion of BMW Bank successfully completed

The process of turning BMW Bank into a European finan-

cial

institution was successfully completed, following

the formal conversion of the Italian subsidiary to the

status of a BMW Bank branch. This process has entailed

various European financial services entities of the

BMW Group being integrated in BMW Bank GmbH,

either in the form of branches or as subsidiaries. As a

credit institution operating throughout Europe, the

bank is able to enjoy the benefits of greater flexibility

in the areas of liquidity and equity capital management,

thus increasing the overall stability of the segment.

BMW Group new vehicles financed by

Financial Services segment

in %

50

40

30

20

10

09 10 11 12 13

Financing 24.7 24.1 20.0 20.7 22.5

Leasing 24.3 24.1 21.1 19.7 21.5

Contract portfolio of Financial Services segment

in 1,000 units

4,200

4,000

3,800

3,600

3,400

3,200

3,000

09 10 11 12 13

3,086 3,190 3,592 3,846 4,130