BMW 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25 COMBINED MANAGEMENT REPORT

Currency markets

At an annual average rate of US dollar 1.32 to the euro

in 2013, the US dollar exchange rate was slightly higher

than one year earlier and fluctuated within a relatively

narrow corridor over the twelve-month period. The euro

also appreciated slightly against the British pound

with

an annual average rate of British pound 0.85 to the

euro. Even though the European Central Bank (ECB)

loosened monetary policy still further during the fourth

quarter of 2013 by reducing the reference interest rate

to 0.25 %, the perception on the markets is nonetheless

that the ECB is following a more restrictive course

than

the Reserve Bank in the USA and the Bank of Eng-

land in the UK. Since the exchange rate of the Chinese

renminbi remains more or less coupled to that of the US

dollar, its value against the euro fell only marginally in

2013, with an annual average exchange rate of Chinese

renminbi 8.14 to the euro. By contrast, the Japanese yen

and the currencies of numerous emerging economies,

such as India, Brazil and South Africa, lost a good deal of

ground against the euro. The annual average exchange

rate of the Russian rouble was 42.30 to the euro, making

it 6 % weaker than in the previous year.

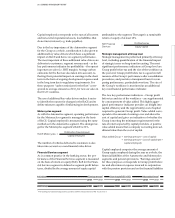

Energy and commodity prices

With the situation in the Middle East still unsettled, the

price of crude oil stagnated at a high level throughout

2013: the annual average price of Brent and WTI crude

oil

was US dollar 108 and US dollar 98 per barrel respec-

tively. For the most part, metal prices fell slightly during

the course of the year, partly reflecting the reduction

of

funds invested in commodities and partly due to the

fact that capacity utilisation rates in the steel and metals

industries were relatively poor, particularly in Europe

under the pervading influence of the euro crisis.

Sector-specific environment

Within an increasingly competitive environment, the

BMW Group was again able to assert its leading position

in the premium market in 2013, benefiting from its

innovative strength on the one hand and from a well-

balanced regional spread of sales on the other. Global

diversification means that downturns in individual

markets can be compensated to a large degree by faster

growth rates in other regions.

Automobile markets

The number of passenger cars and light commercial

vehicles sold worldwide rose by 5.1 % to 76.5 million

units in 2013, primarily on the back of increased de-

mand in the USA and China. The strongest momentum

for growth was generated in China, where the market

grew by 2.5 million to 15.8 million units (+ 19.2 %).

The

next fastest growing market was the USA, where

total sales rose by 1.1 million units to 15.6 million units

(+ 7.6 %).

In Europe, the number of new registrations fell once

again in 2013 (12.2 million units; – 1.8 %). With an

above-average decrease of 4.2 %, new registrations in

Germany – the region’s largest single market – fell to

approximately 2.9 million units. The contraction in

France (– 5.5 %) and Italy (– 7.8 %) was even more

pro-

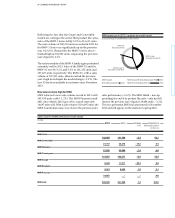

Oil price trend

Price per barrel of Brent Crude

140

120

100

80

60

40

20

09 10 11 12 13

Source: Reuters.

Price in €

Price in US Dollar

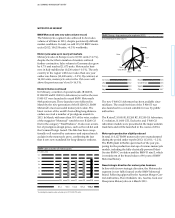

Steel price trend

(Index: January 2009 = 100)

150

140

130

120

110

100

90

80

09 10 11 12 13

Source: Working Group for the Iron and Metal Processing Industry.