BMW 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69 COMBINED MANAGEMENT REPORT

Group risk management is geared towards meeting

the following three criteria: effectiveness, usefulness

and completeness. One of the principal focuses in

2013 was to ensure completeness. In this context, risk

catalogues containing lists of potential risks were

drawn up in collaboration with the Network Repre-

sentatives in order to facilitate the identification of

risks within each area of responsibility and / or each

sub-network, thus making a meaningful contribution

to ensuring completeness and highlighting any over-

arching risk profiles. The various risk catalogues have

been integrated in a newly developed IT tool, which

enables optimal recording and reporting of the risks

and countermeasures relevant for each network. The

new tool also helps to promote reciprocal networking

and cooperation, ensuring the seamless coordination

of the Group risk management system with the Com-

pliance Committee, the Internal Control System and

the Group Internal Audit.

Risk management process

The risk management process is applied throughout

the Group and comprises the early identification and

penetration of risks, comprehensive analysis and risk

measurement, the coordinated use of suitable manage-

ment tools and also the monitoring and evaluation

of measures in the short and medium term of up to two

years.

Risks reported to the centralised risk management from

the network are firstly presented for review to the Risk

Management Steering Committee, for which Group

Controlling is responsible. After review, the risks are

reported to the Board of Management and to the Super-

visory Board. Significant and going-concern-related

risks are classified on the basis of the potential scale of

impact on the Group’s results of operation, financial

position and net assets. The level of risk is quantified,

taking into account the probability of occurrence and

risk mitigation measures.

The risk management system is tested regularly by the

Internal Audit. By sharing experiences with other com-

panies on an ongoing basis, the BMW Group ensures

that new insights are incorporated in the risk manage-

ment system, thus ensuring continual improvement.

Regular basic and further training as well as information

events throughout the BMW Group, and in particular

within the risk management network, are invaluable

ways

of preparing people for new or additional chal-

lenges with regard to the processes in which they are in-

volved.

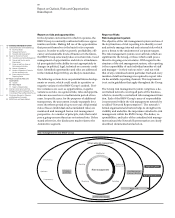

As a supplement to comprehensive risk management,

managing the business on a sustainable basis also repre-

sents one of the Group’s core corporate principles.

Risks and opportunities related to sustainability issues

are discussed by the Sustainability Committee.

Strate-

gic options and measures open to the BMW Group

are put

forward to the Sustainability Board, to which all

members of the Board of Management belong. Risk

aspects discussed at this level are integrated in the work

of the group-wide risk network. The composition of

the

Risk Management Steering Committee on the one

hand and the Sustainability Committee on the other

ensures that risk and sustainability management are

closely coordinated.

Risk measurement

In order to determine which risks can be considered to

be significant in relation to the results of operations,

financial position and net assets of the BMW Group,

to

identify changes in key performance indicators and

to measure their potential earnings impact, all identified

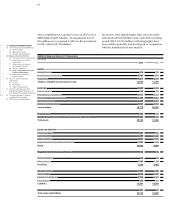

risks are classified on the basis of the following table.

The amount of the risks takes account of both its impact

(net of appropriate countermeasures) and the likelihood

of occurrence in each case.

The overall earnings impact based on the assumption

that the risk will actually take place is sub-divided into

the following categories.

Risks

Political and global economic risks

As one of the world’s leading providers of premium

products and services, the BMW Group faces a variety

of major challenges. The world is changing at great

speed, and in a great number of countries individual

mobility remains a key issue in terms of political regu-

lation

and national industrial policy. Changing values

in society are constantly calling for new solutions in

the

field of mobility. Unpredictable disturbances in eco-

nomic interdependencies, together with ever-increasing

competition, may give rise to knock-on reactions that

are practically impossible to predict. The sovereign

debt crisis in the euro region and volatile economic con-

Class Risk amount

Low > €0 – 50 million

Medium > €50 – 400 million

High > €400 million

Class Earnings impact

Low > €0 – 500 million

Medium > €500 – 2,000 million

High > €2,000 million