BMW 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

18 COMBINED MANAGEMENT REPORT

18

General Information on the BMW Group

18 Business Model

20 Management System

23 Research and Development

24 Report on Economic Position

24 Overall Assessment by Management

24 General and Sector-specific

Environment

27

Financial and Non-financial

Performance Indicators

29 Review of Operations

47 Results of Operations, Financial

Position and Net Assets

62 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

63 Outlook

68 Risks Report

77 Report on Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Consolidated Financial Reporting Process

82 Disclosures Relevant for Takeovers

and Explanatory Comments

85

BMW Stock and Capital Markets

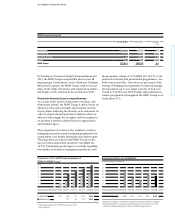

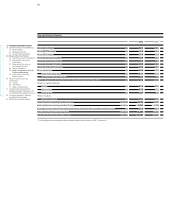

Revenues in the Africa, Asia and Oceania region to-

talled € 25,916 million (2012: € 25,420 million) and were

up by 2.0 % compared to the previous year. These fig-

ures include China, where revenues grew by 6.2 % due

to higher volumes within a sound economic environ-

ment. Revenues generated in Germany and in the Rest

of Europe were respectively 3.2 % and 1.8 % lower than

one year earlier. Revenues in the Americas region were

also 2.9 % below their previous year’s high level, affected

both by the depreciation of the US dollar and the steep

rise in new leasing business (the latter resulting in a

higher level of inter-segment eliminations).

Group cost of sales were 0.9 % lower than in the pre-

vious year and comprise mainly manufacturing costs

(2013: € 36,572 million; 2012: € 37,648 million), cost

of sales directly attributable to financial services (2013:

€ 14,044 million; 2012: € 13,370 million) and research

and development expenses (2013: € 4,117 million; 2012:

€ 3,993 million). In addition to changes in these items,

cost of sales for the year was also affected by the loss in

value of a number of major currencies and by inter-

segment

eliminations.

Gross profit fell by 1.4 % to € 15,274 million, resulting in

a gross profit margin of 20.1 % (2012: 20.2 %).

The gross profit margin recorded by the Automotive

segment was 18.2 % (2012: 19.5 %), while that of the

Motorcycles segment was 16.7 % (2012: 17.0 %). In the

Financial Services segment, the gross profit margin

remained stable at 13.1 %.

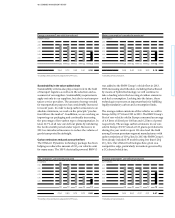

Compared to the previous year, research and

develop-

ment expenses increased by € 124 million to € 4,117

mil-

lion, mirroring increased expenditure on new vehicle

projects and technologies. As a percentage of revenues,

the research and development ratio increased by 0.2 per-

centage

points to 5.4 %. Research and development

ex-

pense

includes amortisation of capitalised development

costs amounting to € 1,069 million (2012: € 1,130 million).

Total research and development expenditure amounted

to € 4,792 million (2012: € 3,952 million). This figure com-

prises

research costs, non-capitalised development

costs and capitalised development costs (excluding

scheduled amortisation). The research and development

expenditure ratio was therefore 6.3 % (2012: 5.1 %).

The proportion of development costs recognised as

assets was 36.4 % (2012: 27.6 %).

Compared to the previous year, selling and administra-

tive expenses increased by € 223 million to € 7,255 mil-

lion, with the rise in administrative expenses mainly

attributable to the higher workforce size and to group-

wide IT restructuring. Overall, selling and administra-

tive expenses were equivalent to 9.5 % (2012: 9.2 %) of

revenues. Depreciation and amortisation on property,

plant and equipment and intangible assets recorded in

cost of sales and in selling and administrative expenses

amounted to € 3,739 million (2012: € 3,541 million).

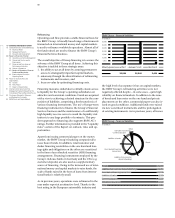

Other operating income and expenses improved from a

net expense of € 187 million to one of € 33 million. The

main reason for the improvement was that the previous

year’s figures had included one-time losses recognised

in advance of the planned sale of the Husqvarna Group.

The profit before financial result (EBIT) came in at

€ 7,986 million (2012: € 8,275 million).

The financial result for the twelve-month period was a

net expense of € 73 million, an improvement of € 399 mil-

lion over the previous year. The result from equity ac-

counted investments, which improved by € 127 million,

comprised the Group’s share of results from interests

in

the joint venture BMW Brilliance Automotive Ltd.,

Shenyang, the joint ventures with the SGL Carbon

Group, and the two DriveNow entities. Other financial

result benefited from the better outcome of changes in

the market values of interest rate and commodity de-

rivatives.

Compared to the previous year, write-downs

on available-for-sale

marketable securities had a lower

impact on the financial

result.

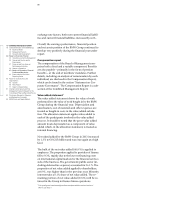

Including all these factors, the profit before tax rose to

€ 7,913 million (2012: € 7,803 million). The pre-tax return

on sales was 10.4 % (2012:

10.2 %).

Income tax expense amounted to € 2,573 million (2012:

€ 2,692 million), resulting in an effective tax rate of

32.5 % (2012: 34.5 %). Lower non-recoverable with-

holding taxes, the changed regional earnings mix and

intergroup pricing issues contributed to the decrease

in the income tax expense for the year.