BMW 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79 COMBINED MANAGEMENT REPORT

performance culture and the development of the skill-

sets of both staff and managers alike throughout the

or-

ganisation could also have a positive impact on revenues

and profitability. Compared to the outlook, the BMW

Group’s earnings performance is unlikely to benefit

from

efficiency improvements to a significantly greater ex-

tent

than that incorporated in the outlook.

Further opportunities may arise due to other technical

innovations relating to products and processes and as

a result of organisational changes. In the field of light-

weight construction, carbon is being put to use in high

volumes for the first time in the automobile industry in

the construction of the BMW i3. The potential for effi-

ciency improvements in this area is quite considerable,

including the increased use of this material in other vehi-

cle projects

, as a result of which the competitiveness of

the products involved – both in terms of consumption

and driving dynamics – could be improved to a signifi-

cantly greater extent than originally planned. The op-

portunities presented by these new developments are

primarily relevant for the medium to long term and will

not have a material short-term impact on the BMW

Group’s earnings performance.

The BMW Group focuses its selling capacities primarily

on markets with the greatest sales volume and revenue

potential and fastest growth rates. Investment in exist-

ing and new marketing concepts is firmly aimed at in-

tensifying relationships with customers. A good exam-

ple is the new marketing concept for BMW i products

and services, which will be offered in selected markets

in the future via an innovative multi-channel model.

There will be no let-up in the active search for new op-

portunities

to create even greater added value for cus-

tomers than currently expected, whilst at the same time

looking for ways to boost sales volumes and achieve

better selling prices.

Developments in the field of digital communication are

also opening up opportunities for marketing the BMW

Group’s various brands. Consumers can meanwhile

be reached on a more targeted and individual basis,

thus helping to strengthen long-term relationships and

brand loyalty. The BMW Group keeps track of the latest

developments and trends in communication technology,

including the use of social media and networks, in order

to extend customer reach. The BMW Group’s brands

are present on numerous platforms, such as Facebook,

YouTube and Twitter. Thanks to its intensive efforts in

this area, the BMW Group is registering faster growth

rates on the various platforms than its competitors,

measured in terms of the number of fans and visits.

The decisive advantage of digital communication is that

the brands are able to engage in a direct dialogue with

customers and thus create a more intense brand expe-

rience. The BMW Group considers that these opportu-

nities

will not have a material impact compared to the

assumptions made in the outlook.

Pension benefits represent an important component of

the BMW Group’s overall remuneration package, mak-

ing it easier to recruit qualified staff and to gain them

for the enterprise on a long-term basis. Pension liabili-

ties are matched in part by corresponding pension plan

assets. Within a favourable capital market environment,

the return generated by pension assets may exceed

expectations and reduce the deficit of the relevant pen-

sion plans. This, in turn, could have a materially favour-

able impact on the net assets position and earnings per-

formance of the BMW Group. Pension plan assets also

help to reduce the interest and inflation risks attached

to pension liabilities.

Financial opportunities arising from currencies

and raw materials

The ability to compete on global markets is also

signifi-

cantly influenced by changes in exchange rates and raw

materials prices. Favourable developments in exchange

rates (in particular for China and the USA) and in raw

materials prices could have a positive impact on the

finan cial result of the BMW Group. Developments on

the financial markets are closely monitored, in order to

identify and make the best use of any opportunities

that may arise. Financial opportunities are managed by

employing the same processes and methodologies used

to manage financial risks. The principal objective of

these management processes is to reduce risk by improv-

ing

forecasting reliability. Currency and raw material

price opportunities could have a material impact on the

earnings performance of the BMW Group.

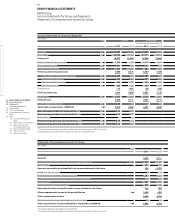

Further information in conjunction with financial in-

struments is provided in note 42 to the Group Financial

Statements.

Opportunities arising in conjunction with the provision

of financial services

The principal risks arising in the Financial Services seg-

ment, namely credit and residual value risks, are closely