BMW 2013 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

Past service cost arises where a BMW Group company

introduces a defined benefit plan or changes the

bene-

fits payable under an existing plan. These costs are

recognised immediately in the income statement.

Simi-

larly, gains and losses arising on the settlement of a

defined benefit plan are recognised immediately in the

income statement.

The defined benefit obligation is calculated on an actu-

arial basis. The actuarial computation requires the use

of estimates and assumptions, which depend on the

economic situation in each particular country. The most

important assumptions applied by the BMW Group are

shown below. The following weighted average values

have been used for Germany, the United Kingdom and

other countries:

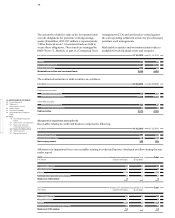

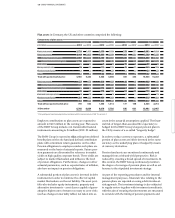

31 December Germany United Kingdom Other

in % 2013 2012 2013 2012 2013 2012

Discount rate 3.50 3.00 4.40 4.25 4.46 3.82

Pension level trend 2.00 2.18 3.32 2.31 0.05 0.09

In Germany, the so-called “pension entitlement trend”

(Fest betragstrend) also represents a significant actuar-

ial assumption for the purposes of determining bene-

fits

payable at retirement and was left unchanged at

2.0 %.

The salary level trend is a less sensitive assump-

tion within the BMW Group. The calculation of the

pension

level trend was reviewed in conjunction with

the application of the revised IAS 19 and brought onto a

standardised footing worldwide. In this context, the

assumption applied in the UK now also takes account

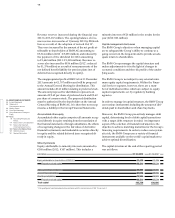

The following mortality tables are applied in countries, in which the BMW Group has significant defined benefit plans:

of restrictions due to caps and floors. For the purposes

of calculating the average rate, countries with pension

payments not linked to inflation or with one-off pay-

ments are also now included. The assumptions applied

in the previous year were adjusted accordingly.

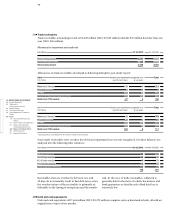

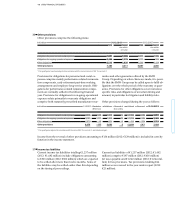

Based on the measurement principles contained in

IAS 19, the following balance sheet carrying amounts

apply to the Group’s pension plans:

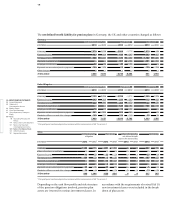

31 December Germany United Kingdom Other Total

in € million 2013 2012 2013 2012* 2013 2012* 2013 2012*

Present value of defined benefit obligations 7,400 7,974 7,409 7,137 949 1,144 15,758 16,255

Fair value of plan assets 6,749 6,064 6,076 5,782 636 601 13,461 12,447

Effect of limiting net defined benefit asset to asset ceiling – – – – 4 4 4 4

Carrying amounts at 31 December 651 1,910 1,333 1,355 317 547 2,301 3,812

thereof pension provision 652 1,910 1,333 1,355 318 548 2,303 3,813

thereof assets – 1 – – – – 1 – 1 – 2 – 1

* Prior year figures have been adjusted in accordance with the revised version of IAS 19, see note 7.

Germany Mortality Table 2005 G issued by Prof. K. Heubeck (with invalidity rates reduced by 50 %)

United Kingdom S1PA tables weighted accordingly, and S1NA tables minus 2 years, both with a minimum long term annual improvement allowance

USA RP2000 Mortality Table Projected with Scale AA