BMW 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

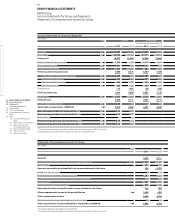

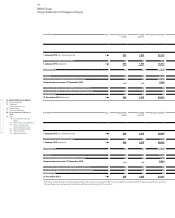

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

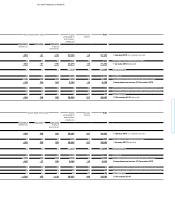

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

BMW Group

Notes to the Group Financial Statements

Accounting Principles and Policies

Basis of preparation

The consolidated financial statements of Bayerische

Motoren Werke Aktiengesellschaft (BMW Group Finan-

cial Statements or Group Financial Statements) at 31

December 2013 have been drawn up in accordance with

International Financial Reporting Standards (IFRSs)

as endorsed by the EU. The designation “IFRSs” also in-

cludes all valid International Accounting Standards

(IASs). All Interpretations of the IFRS Interpretations

Committee (IFRICs) mandatory for the financial year

2013 are also applied.

The Group Financial Statements comply with § 315a of

the German Commercial Code (HGB). This provision,

in conjunction with the Regulation (EC) No. 1606 / 2002

of the European Parliament and Council of 19 July

2002,

relating to the application of International Finan-

cial Reporting Standards, provides the legal basis for

preparing consolidated financial statements in

accord-

ance with international standards in Germany and applies

to financial years beginning on or after 1 January 2005.

The BMW Group and segment income statements are

presented using the cost of sales method. The Group

and segment balance sheets correspond to the classifi-

cation

provisions contained in IAS 1 (Presentation of

Financial Statements).

In order to improve clarity, various items are aggregated

in the income statement and balance sheet. These items

are disclosed and analysed separately in the notes.

A Statement of Comprehensive Income is presented at

Group level reconciling the net profit to comprehensive

income for the year.

In order to provide a better insight into the net assets,

financial position and performance of the BMW Group

and going beyond the requirements of IFRS 8 (Operating

Segments), the Group Financial Statements also include

balance sheets and income statements for the Automo-

tive, Motorcycles, Financial Services and Other Entities

segments. The Group Cash Flow Statement is supple-

mented by statements of cash flows for the Automotive

and Financial Services segments. This supplementary

information is unaudited.

In order to facilitate the sale of its products, the BMW

Group provides various financial services – mainly loan

and lease financing – to both retail customers and

dealers. The inclusion of the financial services activities

of the Group therefore has an impact on the Group

Financial Statements.

Inter-segment transactions – relating primarily to inter-

nal sales of products, the provision of funds and the

related interest – are eliminated in the “Eliminations”

column. Further information regarding the allocation

of activities of the BMW Group to segments and a de-

scription of the segments is provided in note 49.

In conjunction with the refinancing of financial ser-

vices business, a significant volume of receivables

arising from retail customer and dealer financing is

sold. Similarly, rights and obligations relating to leases

are sold. The sale of receivables is a well-established

instrument used by industrial companies. These trans-

actions usually take the form of asset-backed financing

transactions involving the sale of a portfolio of receiv-

ables to a trust which, in turn, issues marketable

se-

curities to refinance the purchase price. The BMW Group

continues to “service” the receivables and receives an

appropriate fee for these services. In accordance with

IAS 27 (Consolidated and Separate Financial

State-

ments) and Interpretation SIC-12 (Consolidation –

Spe-

cial Purpose Entities) such assets remain in the Group

Financial Statements although they have been legally

sold. Gains and losses relating to the sale of such assets

are not recognised until the assets are removed from

the Group balance sheet on transfer of the related sig-

nificant risks and rewards. The balance sheet volume of

the assets sold at 31 December 2013 totalled € 10.1 bil-

lion (2012: € 9.4 billion).

In addition to credit financing and leasing contracts,

the Financial Services segment also brokers insurance

business via cooperation arrangements entered into

with local insurance companies. These activities are not

material to the BMW Group as a whole.

The Group currency is the euro. All amounts are

dis-

closed in millions of euros (€ million) unless stated other-

wise.

Bayerische Motoren Werke Aktiengesellschaft has its

seat in Munich, Petuelring 130, and is registered in the

Commercial Register of the District Court of Munich

under the number HRB 42243.

1