BMW 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

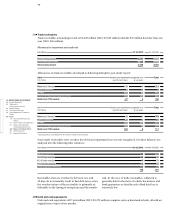

31

32

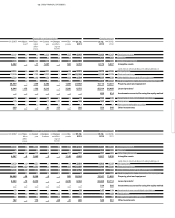

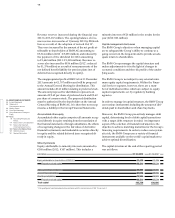

Trade receivables

Trade receivables amounting in total to € 2,449 million (2012: € 2,543 million) include € 47 million due later than one

year (2012: € 46 million).

in € million 31. 12. 2013 31. 12. 2012

Gross carrying amount 2,555 2,654

Allowance for impairment – 106 – 111

Net carrying amount 2,449 2,543

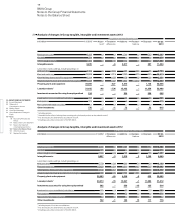

2013 Allowance for impairment recognised on a Total

in € million specific item basis group basis

Balance at 1 January 105 6 111

Allocated / reversed 2 4 6

Utilised – 8 – – 8

Exchange rate impact and other changes – 2 – 1 – 3

Balance at 31 December 97 9 106

2012 Allowance for impairment recognised on a Total

in € million specific item basis group basis

Balance at 1 January* 95 7 102

Allocated / reversed 20 1 21

Utilised – 6 – 2 – 8

Exchange rate impact and other changes – 4 – – 4

Balance at 31 December 105 6 111

* Including entities consolidated for the first time during the financial year.

Allowances on trade receivables developed as following during the year under report:

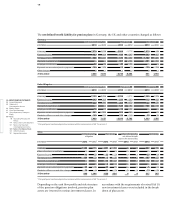

Allowance for impairment and credit risk

in € million 31. 12. 2013 31. 12. 2012

1 – 30 days overdue 80 139

31 – 60 days overdue 30 55

61 – 90 days overdue 8 22

91 – 120 days overdue 13 15

More than 120 days overdue 17 16

148 247

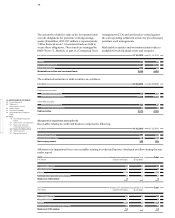

Receivables that are overdue by between one and

30 days do not normally result in bad debt losses since

the overdue nature of the receivables is primarily at-

tributable to the timing of receipts around the month-

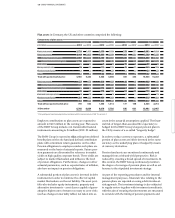

Cash and cash equivalents

Cash and cash equivalents of € 7,664 million (2012: € 8,370 million) comprise cash on hand and at bank, all with an

original term of up to three months.

Some trade receivables were overdue for which an impairment loss was not recognised. Overdue balances are

analysed into the following time windows:

end. In the case of trade receivables, collateral is

generally held in the form of vehicle documents and

bank guarantees so that the risk of bad debt loss is

extremely low.