BMW 2013 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

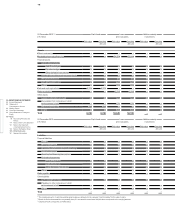

in € million 31. 12. 2013 31. 12. 2012

Euro 14,265 12,736

US Dollar 11,931 10,489

British Pound 3,960 3,814

Chinese Renminbi 1,787 1,179

Japanese Yen 189 435

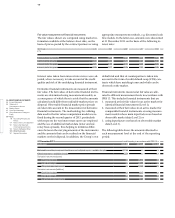

in € million 31. 12. 2013 31. 12. 2012

Euro / Chinese Renminbi 197 246

Euro / US Dollar 65 163

Euro / British Pound 80 65

Euro / Russian Rouble 109 69

Euro / Japanese Yen 15

44 15

exchange rate fluctuations to operating cash flows on

the basis of probability distributions. Volatilities and

correlations serve as input factors to assess the rele-

vant

probability distributions.

The potential negative impact on earnings is computed

for each currency for the following financial year on the

basis of current market prices and exposures to a

con-

fidence level of 95 % and a holding period of up to one

year. Correlations between the various currencies are

Currency risk for the BMW Group is concentrated on

the currencies referred to above.

Interest rate risk

The BMW Group’s financial management system in-

volves the use of standard financial instruments such

as short-term deposits, investments in variable and

fixed-income securities as well as securities funds. The

BMW Group is therefore exposed to risks resulting

from changes in interest rates.

Interest rate risks can be managed by the use of interest

rate derivatives. The interest rate contracts used for

hedging purposes comprise mainly swaps which are

ac-

counted for on the basis of whether they are designated

as a fair value hedge or as a cash flow hedge. A description

of the management of interest rate risks is provided in

the Combined Management Report.

As stated there, the BMW Group applies a group-wide

taken into account when the risks are aggregated, thus

reducing the overall risk.

The following table shows the potential negative impact

for the BMW Group – measured on the basis of the

cash-flow-at-risk approach – attributable to unfavourable

changes in exchange rates. The impact for the principal

currencies, in each case for the following financial year,

is as follows:

These risks arise when funds with differing fixed-rate

periods or differing terms are borrowed and invested.

All items subject to, or bearing, interest are exposed

to interest rate risk. Interest rate risks can affect either

side of the balance sheet.

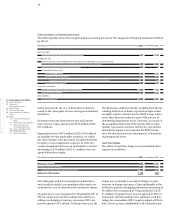

The fair values of the Group’s interest rate portfolios for

the five main currencies were as follows at the end of

the reporting period:

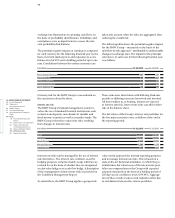

value-at-risk approach for internal reporting purposes

and to manage interest rate risks. This is based on a

state-of-the-art historical simulation, in which the po-

tential future fair value losses of the interest rate port-

folios are compared across the Group with expected

amounts measured on the basis of a holding period of

250 days and a confidence level of 99.98 %. Aggrega-

tion

of these results creates a risk reduction effect due

to correlations between the various port folios.